2 China Growth Stocks to Buy in September

September 8, 2021

While there’s been a lot of investor panic surrounding the Chinese government’s crackdown on technology giants, that doesn’t mean there aren’t opportunities for long-term investors.

Even though many investors are fearful of what the regulation means for technology companies going forward, China still remains the world’s second-largest economy.

As a result, there are bound to be opportunities for capital appreciation – if you know where to look.

So, for long-term investors who are still interested in having exposure to China’s fast-growing market, here are two Chinese growth stocks to consider buying in September.

1. Trip.com

Formerly known as Ctrip, Trip.com (SEHK: 9961) (NASDAQ: TCOM) is a leading global travel platform but also one of the first online stops for Chinese travellers looking to book trips.

It owns a stable of travel-related sites including Ctrip, Trip.com and Skyscanner.

While it initially listed on the Nasdaq in the US, the company also has a Hong Kong listing (which is the preferable choice for investors given lingering regulatory uncertainty over the future of Chinese ADRs).

Obviously, Trip.com suffered throughout the early stages of the pandemic in 2020 but its business has bounced back strongly along with the Chinese economy and the government’s containment of Covid-19.

In the first quarter of 2021, Trip.com’s revenue did fall around 13% year-on-year to RMB 4.1 billion (US$628 million) given the fall-off in cross-border travel.

However, like the US, China is a massive country and domestic travel has held up surprisingly well.

According to CEO Jane Sun, Trip.com saw a strong rebound in March 2021 as “China domestic travel rebounded quickly” following outbreaks of the virus during the first two months of the year.

Additionally, it was added that “the Company observed an emerging demand for short-haul travel trips, local trips, and domestic boutique and premium accommodations”.

With a healthy gross margin of 75% in its latest quarter, and with the company working on broadening out its travel options for investors, when international travel does resume, Trip.com should be a big winner.

2. Kingdee International Software

Business-to-business (B2B) cloud software operator Kingdee International Software Group Co (SEHK: 268) is one of China’s biggest enterprise-level software providers.

Kingdee has traditionally used a licensing model to sell its software to companies but it has now switched to the more traditional subscription model that a lot of Western Software-as-a-Service (SaaS) companies use.

It offers a suite of cloud solutions including a Finance Cloud, Supply Chain Cloud, Manufacturing Cloud and HR Cloud, among others.

Its customers range from real estate and construction firms to tobacco and equipment production companies

That is going to be hugely beneficial to Kingdee over the long term but, in the short term, revenue is obviously going to have to fall/slow as it transitions to a full subscription model.

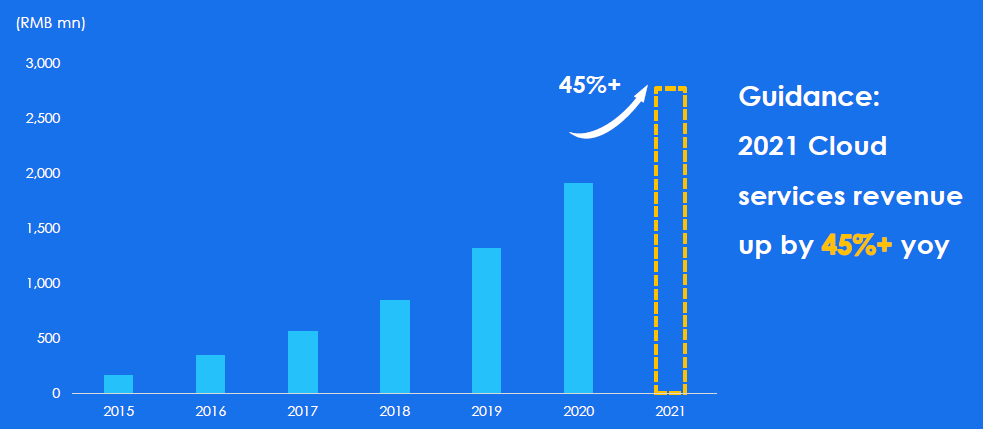

It’s already starting to bear fruit as cloud service revenue growth picks up and the legacy licensing (ERP & Others) business declines (see below).

Source: Kingdee International Software H1 2021 earnings presentation

However, Kingdee is already well on its way to generating a sizeable amount of recurring revenue. In its latest first-half 2021 earnings, the company reported a 71.5% year-on-year increase in subscription annual recurring revenue (ARR) to RMB 1.27 billion.

Like other Saas firms, as it scales meaningfully then profitability should follow. China’s Enterprise Application (EA) SaaS market is expected to see a compound annual growth rate (CAGR) of 31.7% up to 2025.

Given its relatively uncontroversial applications, aimed at improving enterprise productivity and having nothing to do with individual consumers, Kingdee has also clarified that Beijing’s new data security laws won’t impact it.

Find structural winners in China

It’s going to be even more crucial for long-term investors to find the structural winners from the Chinese stock market.

While investing in China’s “Big Tech” stocks might have burned some investors recently, that shouldn’t put us off from identifying which companies will thrive over the long term in China’s massive economy.

Disclaimer: ProsperUs Head of Content Tim Phillips owns shares Kingdee International Software Group Co.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.