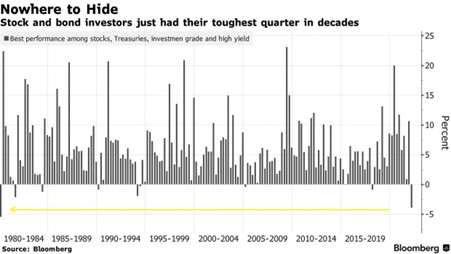

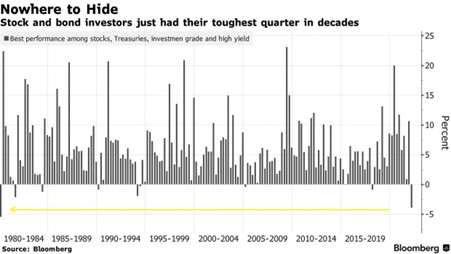

Both stock and bond investors have just gone through the worst quarter in decades.

Across the stock and bond markets, the best-performing US assets were down by 4.9%, in the S&P 500 Index and speculative credit. This was followed by a 5.6% decline in Treasuries and a 7.8% slide in investment grade credit.

This was the worst return for the four categories since 1980. It is not difficult to see why, when we look at the worst crisis since the Cold War as the Russia-Ukraine war drags on.

The inflation and first rate hike by the US Federal Reserve (Fed), as well as the lingering impact of the pandemic, also hurt sentiment.

More than US$3 trillion was erased from the bond and equity markets in the first quarter of this year.

A strong rebound in the second half of March

Despite the negative headlines, investors can take comfort from the strong rebound in the second half of March.

In fact, as my colleague Tim and myself have continued to share over the last few months, the decline in the current market offers an opportunity for investors to gradually build up their portfolio in some of the big names.

In my previous write up on “Chart of The Week: Tech Profit Growth Estimates on the Rise”, I spoke about the need for investors to focus on the long term and that the sell-off in technology stocks provides a good buying opportunity.

Buy safety while accumulating the winners

Over the last two months, I’ve written on a few defense companies that investors can buy into for safety.

The likes of Lockheed Martin Corp (NYSE: LMT), Northrop Grumman Corporation (NYSE: NOC) and BAE Systems PLC (LSE: BA) offer a good defense to a prolonged war between Russia and Ukraine.

The strong dividend track record of these companies is also another advantage for investors during this inflationary environment.

Aside from defense manufacturing companies, other defensive play includes consumer staples that have strong dividend track records, such as The Coca-Cola Company (NYSE: KO).

I also think that the sell-off offers opportunities for us to buy into tech giants. I have written about Meta Platforms Inc (NASDAQ: FB) when it was trading at US$187.61 per share. It has since rebounded by 18.5%.

While the stock market screams panic, long-term investors need to filter the noise and see the opportunities it represents.

Disclaimer: ProsperUs Investment Coach Billy Toh doesn’t own shares of any companies mentioned.