FAQ

Products and Trading

With a ProsperUs account, you get access to a truly multi-asset platform with a wide choice of markets and instruments to trade on.

The following instruments that are available on the platform:

- Equities and ETFs

- Bonds

- Mutual Funds

- CFDs

- Forex

- Options

- Futures

- Crypto FX

We currently offer 30 exchanges in countries such as US, Hong Kong, China, Singapore, Australia, Canada, Germany, UK, Malaysia, Japan, and European markets. More markets to come in the future!

To trade with ProsperUs, you are required to have available cash in your account before you can execute any trades.

You do not require a CDP account to trade Singapore shares with ProsperUs.

Clients who want access the US market will have to submit the W8-BEN form. This is a requirement by the US Tax Authority for account holders to declare that the beneficiary owner of the amount received from US sources is not an individual residing in the US. The validity of the W-8BEN is 3 years upon approval and will have to be renewed before the expiry date to continue to enjoy US market access.

To find out how to access US market and submit W8-BEN form, please Click here to Access US Market.

If your US market access has not been enabled or you have received a notification upon the completion of your W8-BEN that states “Your declaration was unsuccessful”, please resubmit your declaration.

The definitions below are for guidance only, please check with your tax advisor for further clarifications/advice.

Tax Payer Identification Number (TIN) – An identification number used by the Internal Revenue Service (IRS) in the administration of tax laws. It is issued either by the Social Security Administration (SSA) or by the IRS. A Social Security number (SSN) is issued by the SSA whereas all other TINs are issued by the IRS. Read more here.

For Singapore citizens and permanent residents, your tax identification number is your IC. For non-Singapore citizens and permanent residents, you can find your tax identification number on your tax returns.

P.O. Box – It is a posting box with unique posting number for individual or corporate use. Mail bearing the P.O. Box Number or Locked Bag Number of the Customer’s P.O. Box or Locked Bag will be delivered to such P.O. Box or Locked Bag regardless of the name of the addressee. (If applicable)

“In-care-of” Address – It is an address that a correspondent will receive mail on behalf of the addressee. (If applicable)

For information on W8-BEN, read more here.

These are Specified Investment Products (SIPs). The Monetary Authority of Singapore (MAS) requires us to assess your investment knowledge and experience through Customer Account Review (CAR) and/or Customer Knowledge Assessment (CKA) before you have access to these products.

If you are looking to gain access to these products, refer to ‘CKA/CAR for SIPs’ more information.

When your account goes into a margin call situation, this means your account’s margin utilisation percentage has reached or exceeded 100% and you will receive an on-screen notification on BUILD and/or BOOST. You will be required to deposit additional funds into your account and/or reduce your positions to bring the margin utilisation percentage below 100% within 48 hours from the time the margin call notification was sent.

At the end of the 48 hours, if there was no action taken to top up funds or reduce positions, all your open positions will automatically be liquidated. This 48 hour countdown is a system automated process and will reset as soon as the margin utilisation percentage is back below 100%.

Further, if your account’s margin utilisation percentage reached 200%, all your open positions will also be liquidated regardless of your margin call circumstances. You are strongly recommended to top up more than the required minimum amount to withstand any unforeseen adverse market swings to avoid further or continuous margin calls. Please note there will not be any email notification sent to inform you of your margin call.

For actual closing price to be reflected, you will need to be subscribed to real-time market data. Otherwise, the price reflected on the trading platform is showing delayed pricing.

To subscribe to live or real-time market data for an exchange, fill and submit a market data subscription request to the respective exchange via BOOST. The request will be processed within 2 business days and will be subjected to monthly subscription fees involved.

Learn how to subscribe here.

Certain market data subscriptions are chargeable, you are required to have funded in your account before you subscribe for any subscriptions.

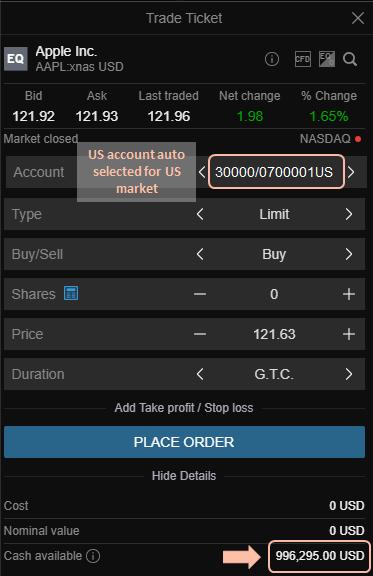

If you have multiple currency accounts e.g. SGD and USD:

When placing a US order, your US currency account is selected by default. Do ensure that you have sufficient cash balance in your currency account before placing an order.

If you do not have sufficient cash balance available in your US currency account, you will incur financing charges. The cash available in your currency account is displayed at the bottom of the trade ticket.

As long as the order is not executed, you may adjust your order accordingly.

Short sell orders will only be applicable for CFDs, Options, Forex, Futures and CryptoFX. We do not offer short selling for equities or any other products.

As long as the order is not executed, you may adjust your order accordingly.

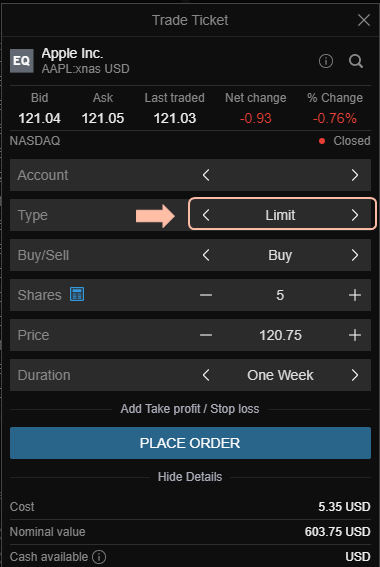

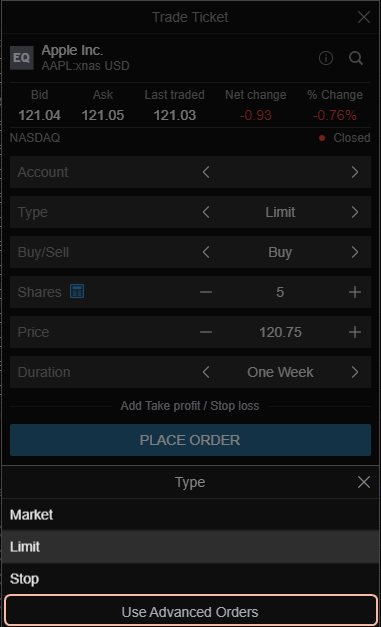

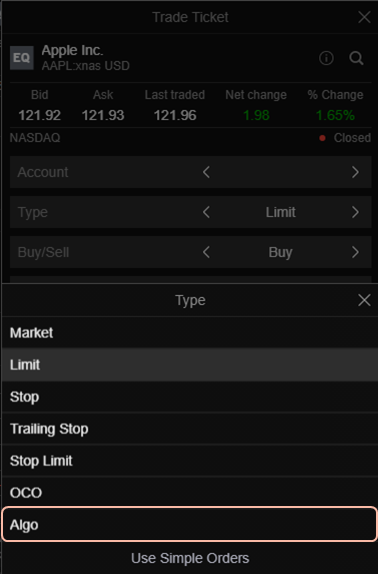

There are simple orders such as Market, Limit, and Stop. We offer advanced orders such as Trailing Stop, Stop Limit, OCO and Algo.

There is a 9% GST charge on all commissions.

The charges are converted to your base currency for settlement. Prevailing FX conversion rates are applicable on any trades executed in another currency that is not your base currency. The rate booked will be displayed upon trade execution. To view more information, select on the ‘Info’ icon (ⓘ) of your position in BUILD or BOOST.

As we are required to comply with SGX regulations on CDP 6.1, SGX market will be available 1-2 business days after you have received an email when your account is ready.

Note: Only applicable for Singaporeans and Singapore Permanent Residents.

The costs involved in a transaction differs depending on the markets. For more information, refer to the individual trading conditions. In BOOST or BUILD, open the instrument’s page, select the ‘Info’ (ⓘ) icon for the breakdown of commission and other charges.

You may find relevant content under Investment Insights.

In BUILD or BOOST, in Product Overview, select on the ‘Info’ (ⓘ) icon for details. Alternatively, right-click on the instrument within Watchlist or Screener and select Trading Conditions in the options menu for details.

In BUILD or BOOST, select Account → Performance or Portfolio, a consolidated overview of all your holdings will be displayed.

You can call our Central Execution Desk at +65 6232 5888 should you need to close your existing open positions to minimise exposures and manage your risk. However, you will not be able to initiate new positions. Our dealers will need to verify your identity to carry out trade executions as per regulatory requirement.

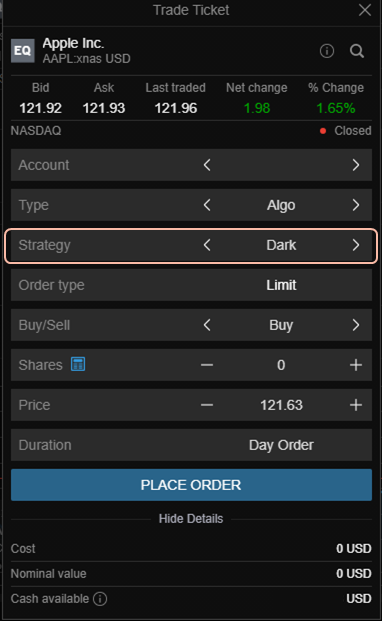

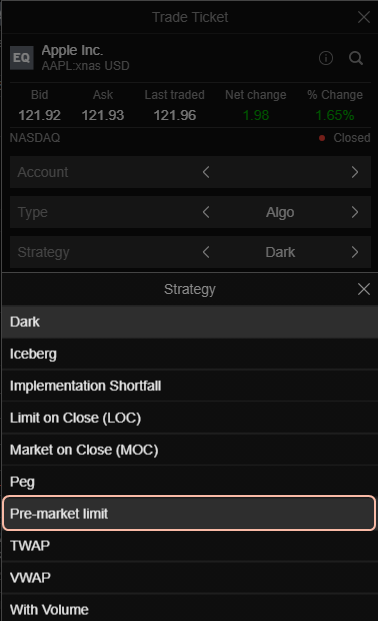

Yes, we do offer pre-marketing trading as part of Algorithmic (Algo) orders strategies for the US market. Pre-market orders are available via the BOOST platform and currently limited to Single Stock CFDs and Stocks only. To place a pre-market trade, you need to open a trade ticket, click on the order type value and click on ‘Use Advanced Orders’. Select ‘Algo’ and choose ‘Pre-Market Limit’ as the Strategy type.

Step 1: Click on order type value and select ‘Use Advanced Orders’ below the dropdown.

Step 2: Select ‘Algo’

Step 3: Scroll through the Strategy type or click ‘Dark’ to display a dropdown and select ‘Pre-Market Limit’

A mutual fund buy order is termed as a Subscription and will be forwarded to the fund manager for execution. It will show up as a position in the Positions screen once order is executed.

The duration would depend on the dealing frequency of the particular fund set by the fund manager and also the daily cut-off time. Please refer to the fund prospectus for the information.

Typically, an order will be reflected as a working order until the latest NAV (Net Asset Value) price is available. An example, if you placed an order today before the daily cut-off time and the order was routed successfully to the fund manager before the cut-off time, the NAV price for today’s trades would be made available tomorrow, as such, your order would still be reflected as working until the next day when NAV price is available.

You are unable to cancel a mutual fund order via BOOST/BUILD. If your wish to cancel your order, kindly inform us at [email protected]. Do note that the ability to cancel the order is subjected to the fund manager and the status of your order.

The prospectus is provided by the fund manager and available to all clients. You can download the prospectus from BUILD under Key Information Document field.

There is a minimum investment amount required by the fund manager and the amount is stated in BUILD as well as in the prospectus. However, there are some mutual funds with no minimum investment amount stated in the trading application and these are funds which the fund manager allows amounts below the minimum stated in the prospectus.