2 Rock-Solid Stocks That Have Incredible Pricing Power

June 22, 2022

Inflation at a 40-year high. Interest rates raised by a whopping 75 basis points. War in Europe. Soaring food prices. Recession in the US likely this year or next.

For investors right now, the list of negative headlines in markets is endless. Yet that doesn’t mean we should stop investing or thinking about how to best secure our financial future.

Instead, in this environment we need to be invested in companies that can continue to grow their earnings without losing market share.

In other words, we need to buy into the stocks of firms that possess pricing power. Despite all the doom and gloom, there are still companies out there growing their earnings in this inflationary environment.

So, without further ado, here are two rock-solid stocks with top-notch pricing power, and that pay dividends to boot, that investors can consider buying and holding right now.

1. McDonald’s

Who doesn’t love a Big Mac and fries (or a McSpicy chicken burger) every so often? Those are just some of the specialties on offer at McDonald’s Corp‘s (NYSE: MCD) many franchise restaurants globally.

The company has over 38,000 restaurants serving 63 million customers on a daily basis. Over 90% of McDonald’s restaurants are owned and operated by franchisees.

Its latest earnings highlighted just how strong the brand is. McDonald’s saw net profit of US$1.1 billion for the first quarter of 2022, or US$1.48 in earnings per share (EPS).

This was down from US$1.54 billion, or US$2.05 in EPS, from the year-ago period.

However, this was mainly due to McDonald’s setting aside US$500 million during the first quarter, in relation to a potential settlement for an international tax issue.

Excluding that one-off charge, EPS hit US$2.28 and exceeded analysts’ consensus expectations of around US$2.17.

These strong numbers came despite the suspension of operations and the closure of restaurants in both Russia and Ukraine.

Strong sales growth amid price hikes

One of the most encouraging parts of its latest results was the fact that same-store sales growth globally was a robust 11.8% during the period.

This was driven primarily by international operated markets, where comparable sales growth was 20.4% year-on-year – helped by easing Covid-19 restrictions globally and a digital delivery/ordering system that has continued to impress.

While the US saw a more anaemic rate of just 3.5% same-store sales growth, its menu prices were 8% higher during the first three months of this year versus a year ago.

On the cash flow front, McDonald’s is as reliable as ever. In Q1 2022, the company threw off around US$2.13 billion in operating cash flow – broadly flat versus the year-ago period.

Last, but not least, McDonald’s is also a Dividend Aristocrat and has paid a rising dividend every year for the past 46 years.

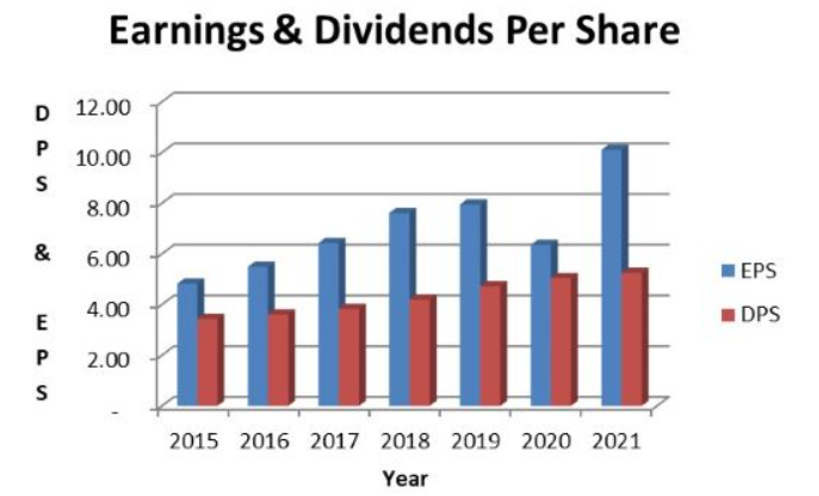

With a solid recent history of earnings and a reasonable payout ratio (see below), the dividend growth streak for McDonald’s should continue.

Source: DividendsDiversify.com

Source: DividendsDiversify.com

Given its latest quarterly dividend per share (DPS) of US$1.38, McDonald’s shares currently offer investors a yield of 2.3%.

2. Microsoft

Moving into more familiar tech terrain, the second rock-solid company with pricing power is cloud and office productivity software giant Microsoft Corporation (NASDAQ: MSFT).

Unlike other tech stocks in the “growth” space, Microsoft is an established and, crucially, highly profitable company.

As I’ve written about previously, the cloud giant has multiple streams of revenue from various business segment and is also a free cash flow machine.

Its EPS growth has been robust enough that its dividend looks certain to be safe even if there’s a big drop-off in earnings (see below).

Source: DividendsDiversify.com

Source: DividendsDiversify.com

More recently, though, Microsoft has pushed through various price hikes for its Office 365 product suite for business users.

The increases will range from US$12 per user per year for Business Basic to US$48 per user per year for its enterprise-level Microsoft 365 E3 offering.

It’s the first substantial price increase since the launch of Office 365 over a decade ago. And it shows that Microsoft is confident that users will continue to pay up for its services.

Why wouldn’t they? Microsoft and 365 Office is so embedded into the lives of white-collar workers that it’s easy to see Microsoft flexing their pricing power as rising costs continue to bite.

Healthy fundamentals

On the business front, everything looks solid, too. Net income came in at a healthy level of US$16.7 billion in its most recent quarter.

Meanwhile, overall revenue growth was 18% year-on-year, an impressive percentage figure given it generated just shy of US$50 billion over the period.

In the cash flow department, Microsoft continued to shine, with free cash flow rising 17% year-on-year to around US$20 billion over the quarter.

While it only yields around 1% at its current price, Microsoft has also consistently returned cash to shareholders via a fast-growing dividend.

Over the past decade, the tech giant has seen the dividend per share (DPS) that it pays out expand at a compound annual growth rate (CAGR) of 12.0%.

Look to companies with pricing power

Amid an uncertain economic environment and high inflation, it’s important that investors focus on quality when buying stocks.

In that regard, focusing on firms that possess pricing power in their industry will leave investors well-placed to ride out any market volatility.

With McDonald’s and Microsoft, investors have arguably two of the best operating businesses in their respective sectors.

Disclaimer: ProsperUs Head of Content & Investment Lead Tim Phillips owns shares of Microsoft Corporation.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.