Nio Inc (NYSE: NIO) (SEHK: 9866) (SGX: NIO), a leading Chinese EV maker, stands out with its unique vehicle designs, battery-service offerings, and strong community focus.

They offer not just cars but a lifestyle choice for the eco-friendly, tech-loving consumer.

Today, the EV maker entered into the smartphone industry with the launching of its first Android phone in China, with prices starting at around US$900 and shipping to begin on Sept. 28.

With this in mind, here are 3 reasons why investors should position themselves in the China EV maker.

1. Diversification into the smartphone market

NIO’s entry into the smartphone industry illustrates its forward-thinking strategy and potential for revenue diversification.

They are branching out into the tech sphere with their new smartphone.

According to Nio, they are expecting at least half of its users to buy,

Moreover, by targeting the smartphone’s integration with EVs, NIO aims to enhance the overall driving experience, potentially boosting their vehicle sales by offering a seamless tech-driven journey.

2. Positive gross profit margin projection

While NIO has faced some challenges recently, analysts project an upward trajectory in their gross profit margin.

This has driven optimism among investors as margin expansion is expected despite of price pressure faced by the industry recently.

Additionally, anticipated efficiency improvements in production and the discontinuation of the free battery swap package indicate a focus on enhancing profitability.

3. Broadened EV portfolio to capture market share

NIO remains a strong contender in China’s high-end to premium EV segment.

Their broadened EV product range will likely enable them to recapture a significant market share.

Additionally, with the anticipated debut of the upgraded mid-size coupe SUV EC6 and the expansion of sales channels, there are robust indicators of a brighter future for the company’s vehicle division.

NIO’s growth story remains intact

Investing in NIO means joining a leader in both the EV and tech sectors.

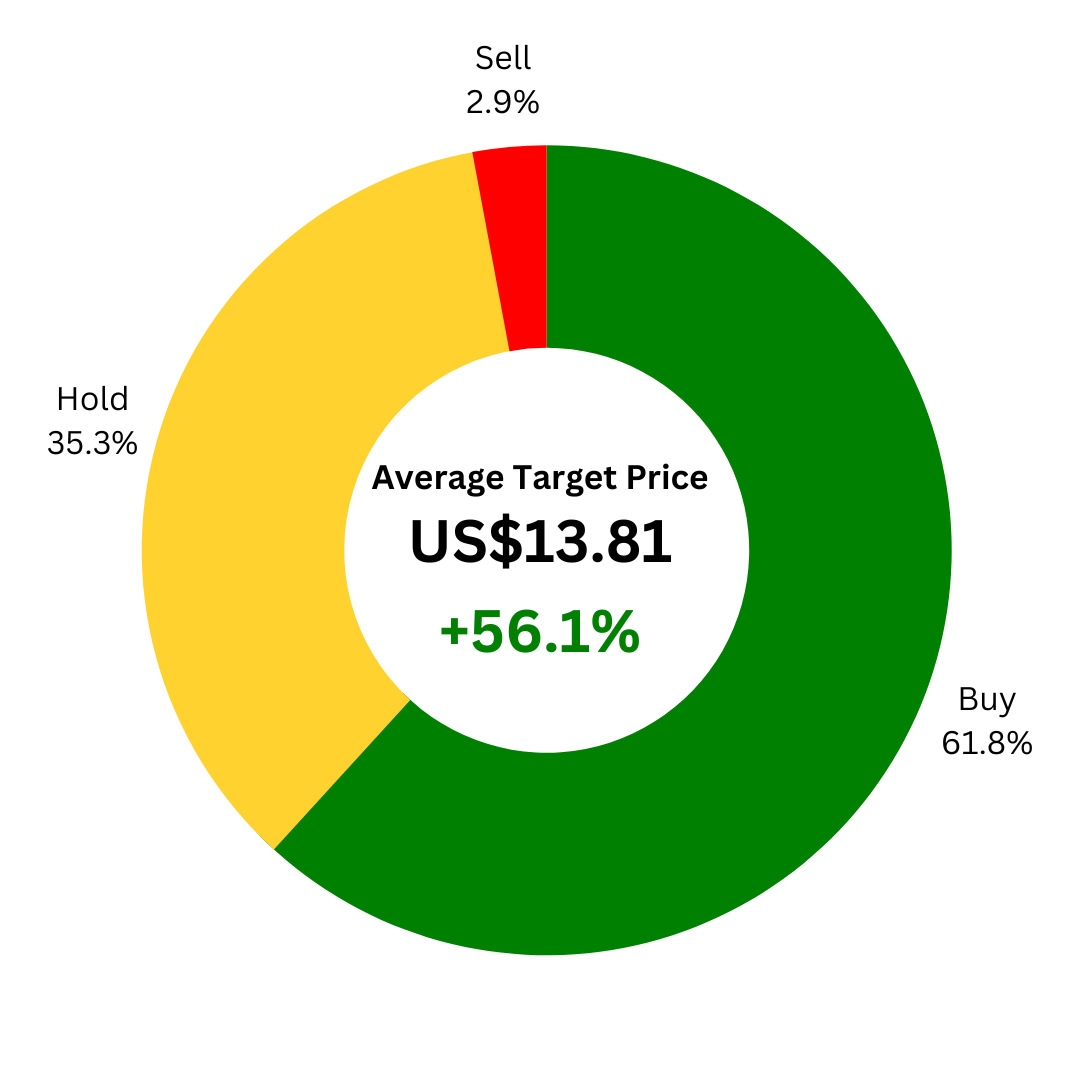

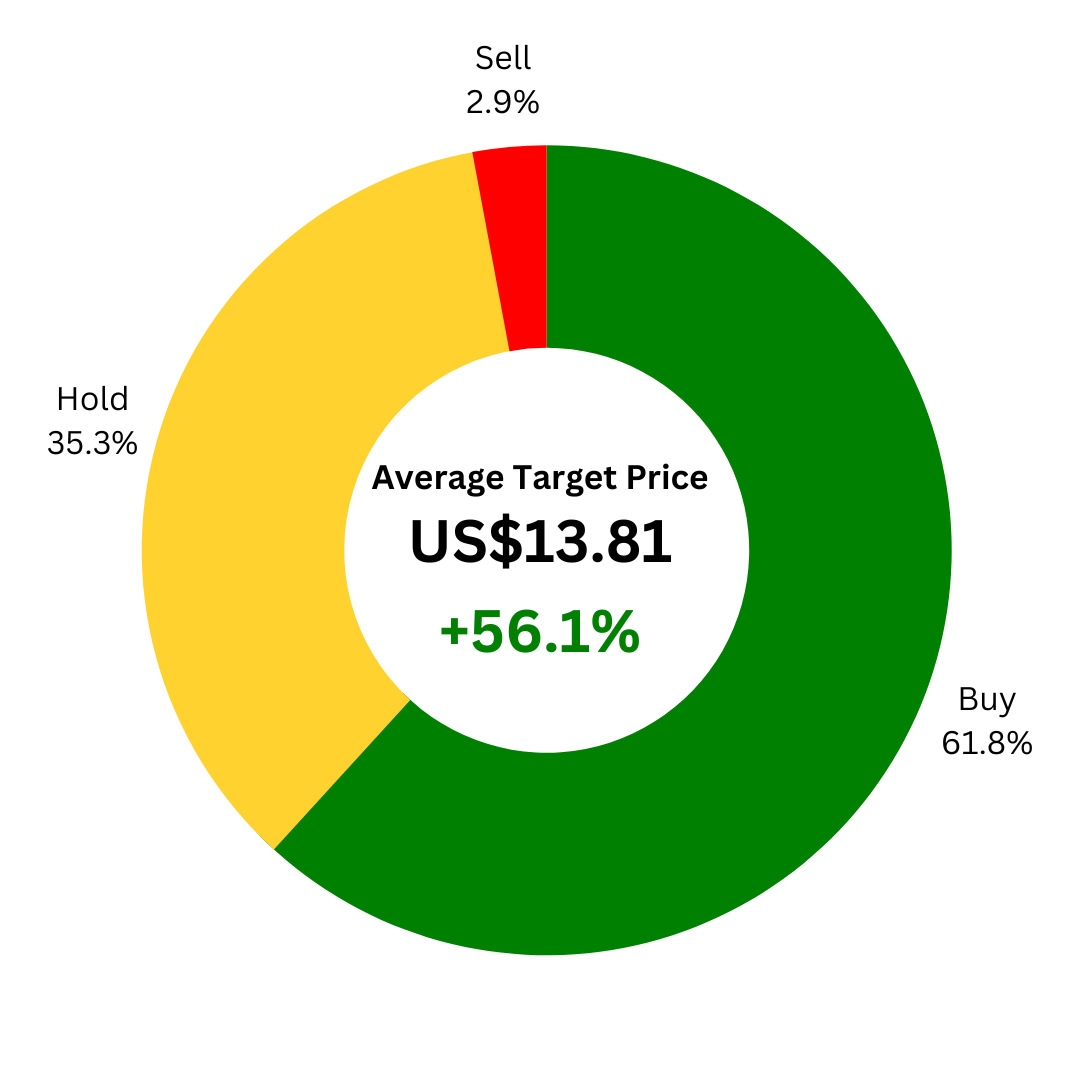

Bloomberg data indicates consensus’ target price of US$13.81, with a potential 56.1% return. Of the analysts, 21 recommend buying, 12 say hold, and 1 suggests selling.

Disclaimer: ProsperUs Head of Content & Investment Lead Billy Toh doesn’t own shares of any companies mentioned.