Previously, I have written about supermarket operator Sheng Siong Group Ltd (SGX: OV8) and since then, its share price has gone up by 3.9%.

Sheng Siong was featured in our 5 Top Singapore Stocks to Buy in June and it has also outperformed Singapore’s Straits Times Index (STI).

Year-to-date, Sheng Siong shares have gained 10.3% while the STI is only up by 4.6%.

During the supermarket operator’s latest earnings results for the first six months ended 30 June 2022 (H1 FY2022), the Group’s revenue was down marginally by 0.7% to S$676.8 million.

However, net profit increased 2.1% year-on-year (yoy) to S$67.5 million.

Here are some key highlights for investors from Sheng Siong’s latest results for H1 FY2022.

1. Another record quarter of gross profit margin

One of the key takeaways from the Group’s latest results is the impressive track record of maintaining its profitability despite rising inflation.

Gross profit margin rose to a record of 30.2% during Q2 FY2022. Management attributed this to the continued improvement of sales mix towards higher margin categories, such as fresh food and private labels.

The key advantage that Sheng Siong has in fresh food pricing stems from its direct sourcing from overseas exporters.

It also has the ability to reduce wastage from repackaging and repricing, while it also benefits from tactical purchasing due to seasonality and dislocation in the supply chain.

The strong gross profit margin reflects the successful pricing strategy of the Group. Incremental costs are being passed on to consumers while the brand retains its perception of “value for money” as compared to supermarket and wet market peers.

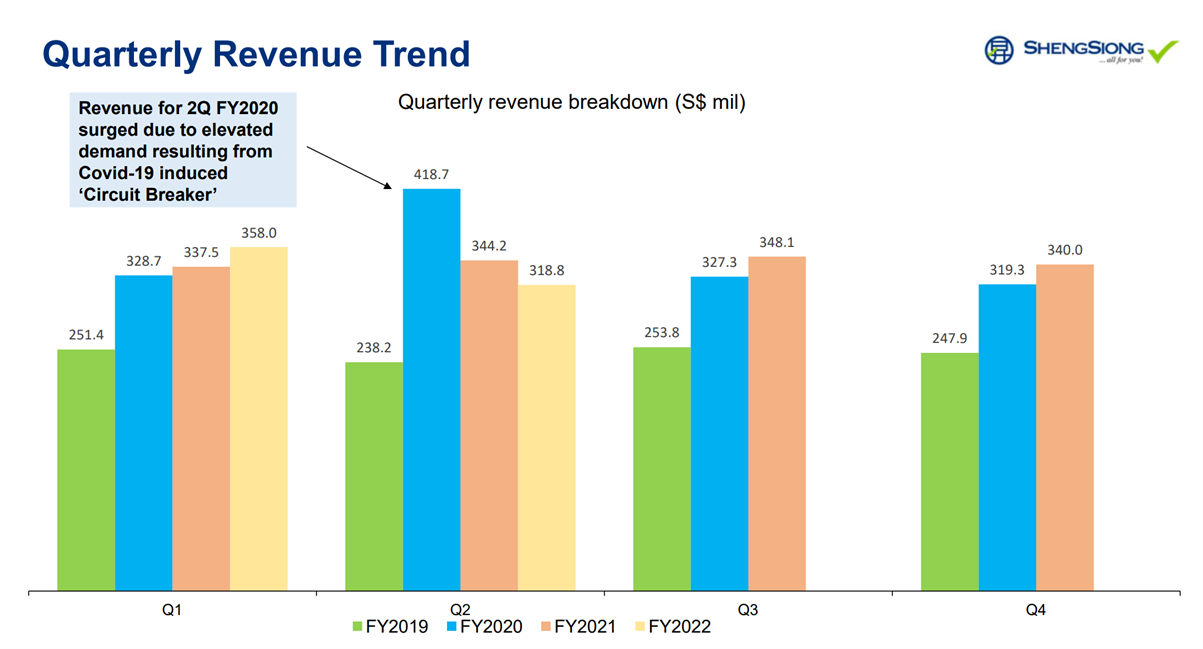

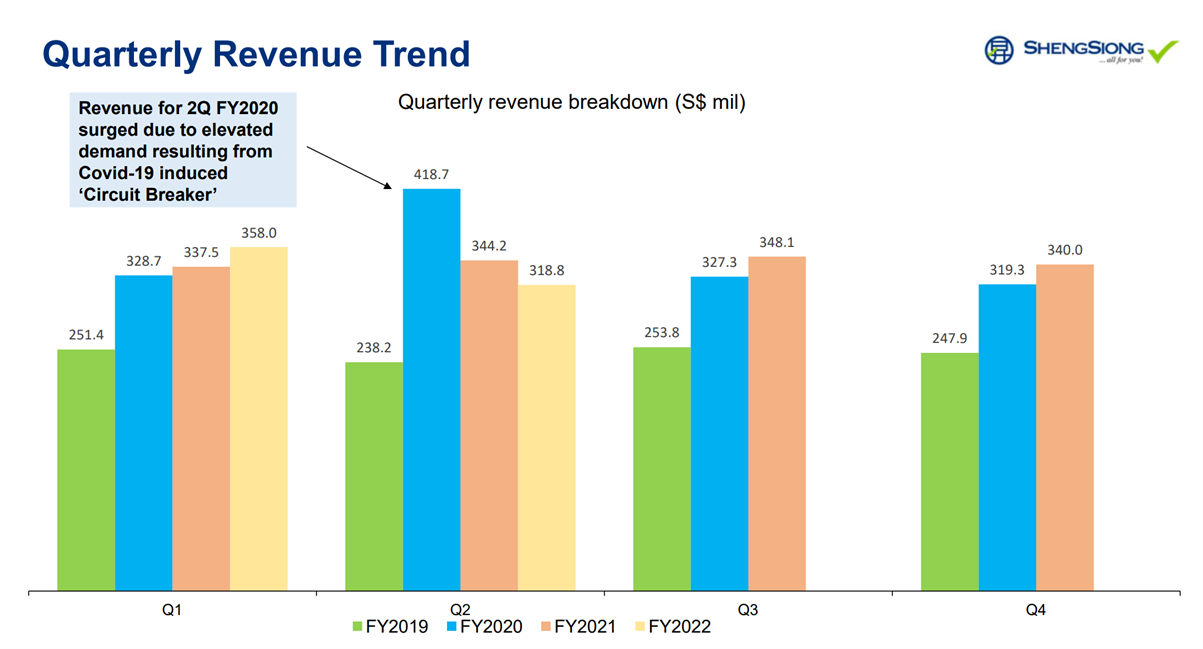

2. Revenue growth normalises

The reopening of the economy has led to a contraction in revenue as grocery demand softened with less at-home dining in the post-pandemic world.

However, given the inflationary pressure and concern over a potential recession, Sheng Siong’s position to target cost-conscious customers will help to mitigate the decline.

Management has also guided that sales revenue will return to a normalised pre-pandemic level.

Comparable same store revenue in Singapore decreased 2.4% yoy but the decline was offset by the new stores that added 0.9% yoy to total revenue.

Source: Sheng Siong’s H1 FY2022’s Results Presentation

Source: Sheng Siong’s H1 FY2022’s Results Presentation

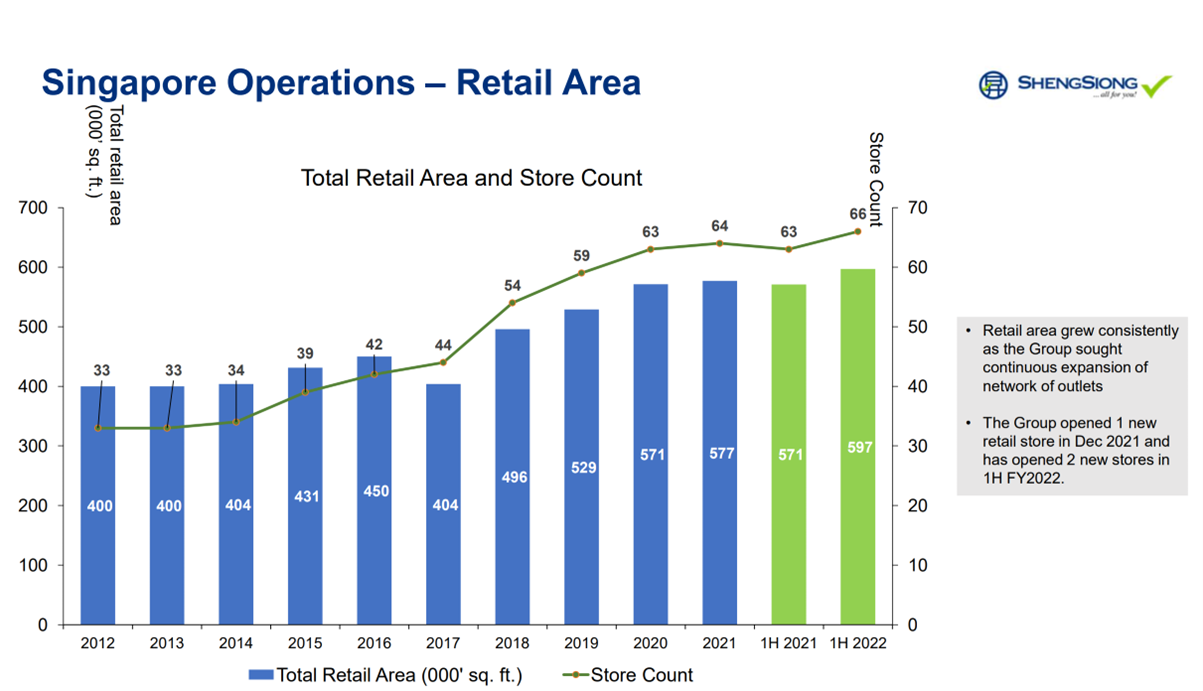

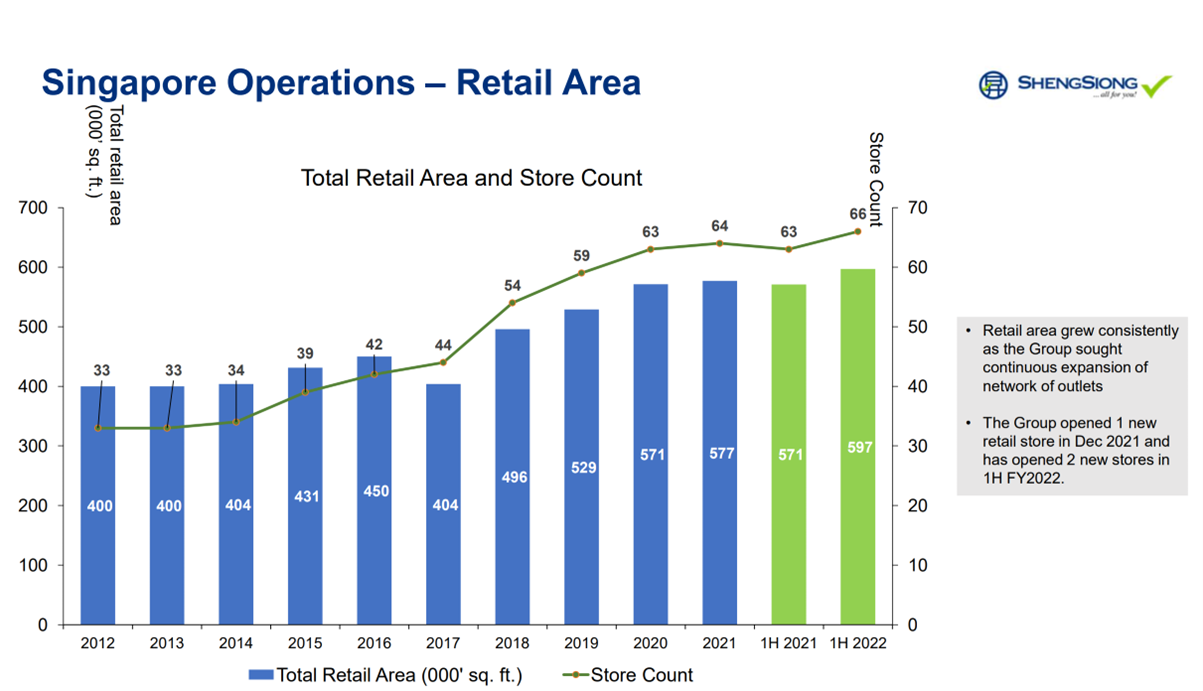

3. More stores to drive growth

During H1 FY2022, Sheng Siong added two new stores, bringing its total store count to 66.

There will be another new store opening during Q3 FY2022.

This is in line with management’s guidance of opening three to five new stores per year over the next three to five years.

Aside from that, the supermarket operator also plans to build on its presence in China, which has remained profitable despite COVID-19 restrictions.

Source: Sheng Siong’s H1 FY2022’s Results Presentation

Source: Sheng Siong’s H1 FY2022’s Results Presentation

Sheng Siong provides good defensive play amid slowdown

The slower revenue growth is expected as the reopening of the economy will cause grocery demand to normalise from the elevated demand during the pandemic era.

However, Sheng Siong is a good defensive play for investors amid the rising inflation and economic slowdown that we’re witnessing.

The strong gross profit margin reflects the Group’s ability to pass on the incremental costs to consumers while maintaining its perception as “value for money”.

Aside from that, the supermarket operator’s long-term growth prospects are also attractive.

Currently, Sheng Siong only has 66 stores and could double its footprint as the largest competitor in Singapore has around 200 stores.

Given management’s guidance for the pace of store openings, I expect the Housing & Development Board (HDB) to release more store leases for bidding over the next two years.

Sheng Siong currently has four outstanding tenders.

Another growth opportunity is Sheng Siong’s expansion plans in Kunming, China, which could be an exciting area for the Group over the long term.

Disclaimer: ProsperUs Investment Coach Billy Toh doesn’t own shares of any companies mentioned.

Source: Sheng Siong’s H1 FY2022’s Results Presentation

Source: Sheng Siong’s H1 FY2022’s Results Presentation Source: Sheng Siong’s H1 FY2022’s Results Presentation

Source: Sheng Siong’s H1 FY2022’s Results Presentation