Are Vitasoy Shares a Buy Now After Hong Kong Controversy?

July 14, 2021

Geopolitical tensions between the US and China have been rising in recent weeks, impacting investors. Just last week, Chinese ride-hailing giant Didi Global Inc (NYSE: DIDI) was reprimanded by China’s cyberspace agency.

This was apparently in response to Chinese concerns over sensitive rider data that could be used by foreign governments (i.e. the US).

However, one arena where the struggle between the two superpowers is playing out is in Hong Kong.

Boycotting brands

In a case that saw a Hong Kong man stab a policeman in the city on 1 July – then kill himself – it turned out the assailant worked for soy milk and beverage specialist Vitasoy International Holdings Ltd (SEHK: 345).

Controversy was sparked when an employee of Vitasoy sent out an internal memo expressing condolences to the man’s family. The company distanced itself from the memo and said it was not approved.

Unsurprisingly, the furore caused a huge backlash online in China, where “Vitasoy boycotts” went viral.

Vitasoy, which gets a large portion of its business from Mainland China, saw its shares decline close to 15% since the beginning of last week.

So, for investors who are interested in this well-known Hong Kong consumer brand, are its shares a buy now?

Business impact

As with any China consumer boycott, it’s hard to tell how much damage will be done to Vitasoy’s business over the medium to long term.

However, what we can do is focus on how much revenue and profits Vitasoy makes from the Mainland China market.

The company actually released its latest full-year earnings for the 12 months ending 31 March 2021, or “FY 2021” in mid-June.

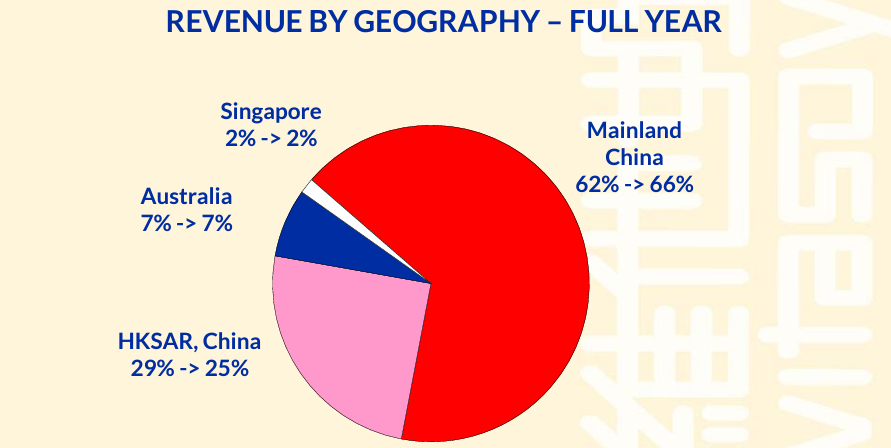

As you can see below, Vitasoy generated two-thirds of its revenue from China in the latest year, up from 62% in the year before.

Source: Vitasoy FY 2021 earnings presentation

Source: Vitasoy FY 2021 earnings presentation

As a percentage of operating profit, though, China’s contribution is lower at 55% of overall operating profit. It goes without saying that that is still significant chunk of its profits.

Vitasoy has also recently opened a new factory in Dongguan, China, to help with local production of its soy milk beverages.

The company has also put a renewed focus on its popular Vita lemon tea drink but with a twist in that it’s now sparkling lemon tea.

Other innovative drink ideas include Vitasoy oat milk – an increasingly popular choice with consumers as evidenced by Oatly Group AB’s (NASDAQ: OTLY) successful IPO earlier this year.

While earnings per share (EPS) in its latest year were basically flat year-on-year at 51.5 Hong Kong cents, Vitasoy does continue to focus on new growth initiatives.

Its business was somewhat protected during Covid-19 by impressive online sales numbers in China.

Wait and see

On the whole, though, when it comes to consumer boycotts in China, the big unknown is; how long will it last?

For investors who are more cautious and want to see how it plays out, looking at Vitasoy’s first-half FY 2022 earnings numbers will give them a better idea as they will have taken into account July to September 2021 sales figures.

On the flip side, if investors feel that the boycott will blow over quickly and Vitasoy’s business remains on a solid footing (which it does) then it could be an opportunity to buy a quality consumer company at a discount.

Disclaimer: ProsperUs Head of Content Tim Phillips doesn’t own shares of any companies mentioned.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.