Here’s Why I Would Avoid Buying HSBC Shares

October 24, 2020

Back in the 1990s and 2000s, HSBC Holdings plc (SEHK: 5) was seen as the ultimate “buy and hold forever” stock by Hong Kong investors. But shares in HSBC last week plunged by nearly 9% to their lowest level since 1995.

In another era, the bank had established itself as one of the few global banking giants in the world. This was done in a space that was normally occupied by the likes of American mega-banks such as Citigroup Inc (NYSE: C).

However, the Global Financial Crisis of 2008 changed all that. The bank’s poor track record of acquisitions in the US, namely the disastrous sub-prime business Household Financial, tarnished its image as the banking system collapsed.

During the depths of the crisis in 2009, former HSBC Chairman Stephen Green admitted as much. “With the benefit of hindsight, this is an acquisition we wish we had not undertaken”.

Stating the obvious, then. Yet that’s little consolation for shareholders, which have had to experience an absolutely miserable decade or so.

HSBC shares started September of 2010 at around HK$80. Today, the share price is in the region of HK$30. All of this amid one of the longest bull markets on record.

There are a few questions for investors to ponder. How did US banks recover so swiftly while the likes of HSBC was left floundering? And where does the “world’s local bank” go next?

Weighed down by global reach

For HSBC, the primary issue with the business is the fact that it’s a global bank that hasn’t changed with the times.

In the 2000s, global banks were all the rage. That has changed. A range of different regulations have come into force since the 2008 when banks were deemed to be unstable and the root cause of the collapse in markets.

The vast majority of these regulatory guidelines since 2008/2009 have been aimed at making banks safer and more boring.

For example, the “Basel IV” measures were aimed at restricting internal risk models for banks that could substantially increase capital requirements for mortgages.

All of this has been a particular drag for banks in Europe, where more corporates rely on banks for capital rising (versus say, the US, where capital can be easily raised on public markets).

This has left the share price of HSBC in the dust versus the leading American banks over the past decade.

Going nowhere: HSBC vs. JPMorgan share price performance

Source: FT.com

Poor cost structure and subsidising losers

Surprise, surprise, this has hurt HSBC given it’s actually a European bank with London headquarters. What shareholders, and investors, should be aware of is that HSBC’s loss-making European business is effectively subsidised by its profitable Asian core operations (focused on Hong Kong and China).

That has been the case for a while and hasn’t changed amid Covid-19. In its latest half-year earnings (for the six months ended 30 June), the bank recorded a loss of US$3.06 billion in Europe while Asia posted a profit before tax of US$7.37 billion.

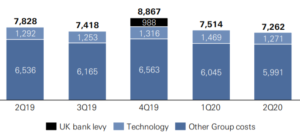

Even worse, HSBC has been weighed down by costs – a problem that it cannot seem to manage. Its global ambitions have turned it into one of the most inefficient banks in the world.

HSBC’s cost efficiency ratio (basically its costs as a percentage of total revenue) was a whopping 61.8% in the first six months of 2020.

For context, JPMorgan Chase & Co (NYSE: JPM), another global giant of banking, had a cost efficiency ratio that was around 51%.

Perhaps even more amusing was the fact that in its European business, HSBC’s cost efficiency ratio was 101.4%. This means the bank paid out more in costs than it made in sales.

It’s a great example of the inefficiencies and bureaucracy that have plagued HSBC for years. Despite management saying it would cut costs and get lean, nothing much has changed recently (see below).

HSBC operating expenses trend (US$ millions)

Source: HSBC 2020 Interim Report

Neither British nor Chinese

One of the bigger problems it has had recently is being caught in the middle of rising geopolitical tensions between China and the UK, particularly over Hong Kong – its main profit centre.

Having been criticised by both sides, the upshot is that the bank has been incapable of pleasing either government, no matter what it does.

That has made it a target of both the British government, for being too soft on China, and the Chinese government, who accuse it of acquiescing too easily to Western governments’ demands.

Given HSBC is betting its future on China and the Pearl River Delta region, this development threatens that potential growth.

However, its geopolitical woes pale in comparison to the many problems that the business itself faces.

A dying business

Investors in HSBC will rightly be angry. Some Hong Kong shareholders have relied heavily on the bank for dividend payments.

Those payouts suspended completely earlier this year after an order from the British regulator for banks to cease dividend payments.

In the end, HSBC’s business operates in a space that is dying; global banking. Unfortunately, the senior management, most of whom are career HSBC people, can’t seem to alter its course.

This is one bank that investors should stay well away from. In 10 years’ time, I believe the bank is either likely to be broken up into different entities or be irrelevant in terms of the banking scene.

Regardless, it will be much smaller and shareholders of HSBC will probably be left to pick up the tab.

This material is categorised as non-independent for the purposes of CGS-CIMB Securities (Singapore) Pte. Ltd. and its affiliates (collectively “CGS-CIMB”) and therefore does not provide an impartial or objective assessment of the subject matter and does not constitute independent research. Consequently, this material has not been prepared in accordance with legal requirements designed to promote the independence of research. Therefore, this material is considered a marketing communication.

This material is general in nature and has been prepared for information purposes only. It is intended for circulation amongst CGS-CIMB’s clients generally and does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this material. The information and opinions in this material are not and should not be construed or considered as an offer, recommendation or solicitation to buy or sell the subject securities, derivative contracts, related investments or other financial instruments or any derivative instrument, or any rights pertaining thereto. CGS-CIMB have not, and will not accept any obligation to check or ensure the adequacy, accuracy, completeness, reliability or fairness of any information and opinion contained in this material. CGS-CIMB shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.