3 Reasons to Buy This Giant, Defensive Dividend Stock

August 23, 2022

In February this year, I wrote that investors should look for safety by buying into Lockheed Martin Corp (NYSE: LMT) amid rising geopolitical tension.

This is as Russia launched its full-scale invasion of Ukraine on 24 February 2022.

We have now entered into the sixth month of the Russia-Ukraine war and it has become even more apparent that the global geopolitical tension is not going away any time soon.

This has led to rising demand for defense technology, which will benefit Lockheed Martin, or LMT for short. It’s also the world’s largest defense contractor.

There was a bit of concern when LMT reported disappointing earnings in Q2 2022, that came in about half a billion below analysts’ estimates of US$15.5 billion in revenue.

The decline was mainly due to the supply chain disruption that has affected production.

The temporary groundings and inspections of the US-designed F-35 fighter jets’ ejector seat parts has also raised concern on production issues faced by LMT.

However, despite some of these temporary setbacks, here are three reasons why investors should buy LMT – a consistent dividend-paying stock.

1. Demand is not reliant on consumer or business confidence

The US has already entered into a technical recession. With the persistent inflationary pressure and rising interest rate environment, the impact on consumer and business confidence could worsen.

However, defense contractors such as LMT generate most of their revenue from the US government and are not affected by consumer spending in the US.

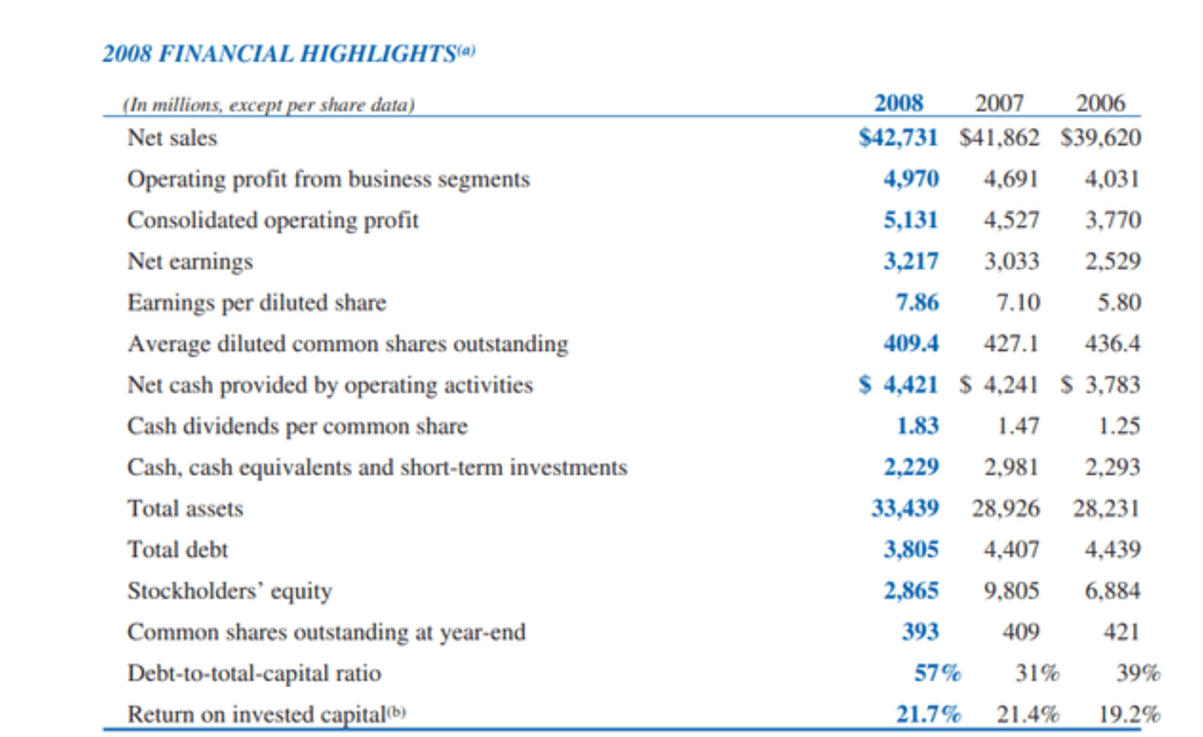

Looking at LMT’s historical earnings, sales and earnings actually improved during the Global Financial Crisis period in 2008 (see below).

Source: LMT’s Annual Report 2008

In terms of share price performance, LMT also outperformed the S&P 500 Index from 2005 to 2010.

Source: SeekingAlpha, ProsperUs

Source: SeekingAlpha, ProsperUs

2. Rising demand amid geopolitical tension

LMT has recently been awarded a US$7.6 billion contract to produce 129 F-35 stealth fighters for the US military and allied forces.

Given the rising geopolitical tension, we have seen more demand for defense technology, which will benefit LMT in the long term.

In December, the US government awarded a US$49 million contract to LMT to design and manufacture a new F-35 variant for an undisclosed allied nation.

Greece has also approached the US to join the F-35 fighter jet co-production programme.

German lawmakers have also passed a €100 billion (US$107 billion) defense budget boost.

This has initiated a major spending spree over several years that is expected to include seven new P-8 Poseidon maritime-surveillance planes, in addition to five copies ordered last year.

The expansion of NATO could also generate additional tailwinds for LMT. Finland and Sweden have officially applied to join NATO in May, which could open up a new market for American defense contractors.

3. Strong dividend track record

Finally, LMT has a strong dividend track record. The firm has been paying dividends since 1996.

Currently, LMT has a forward dividend yield of 2.6% based on its payout ratio of 40.9%.

The defense contractor has also been increasing its dividend over the last 19 consecutive years. Its five-year dividend growth rate is a solid 9.1%.

During H1 FY2022, LMT generated US$2.2 billion in free cash flow and spent US$1.5 billion covering its dividend obligations.

Defense contractor offers safety for investors

I believe there is a need for investors to build a portfolio that is safe and resilient.

In order to do this, there is a need for investors to look at the defense contractor space. LMT is the world’s largest defense contractor, with two-thirds of its revenue generated from the US government’s contracts.

Given its strong dividend track record, leading position in the defense contract industry as well as the rising geopolitical tension, investors should add LMT into their portfolio.

The company’s share price has risen by 13.1% since I first wrote about it back in February of this year.

Disclaimer: ProsperUs Investment Coach Billy Toh doesn’t own shares of any companies mentioned.

Billy Toh

Billy is deeply committed to making investment accessible and understandable to everyone, a principle that drives his engagement with the capital markets and his long-term investment strategies. He is currently the Head of Content & Investment Lead for Prosperus and a SGX Academy Trainer. His extensive experience spans roles as an economist at RHB Investment Bank, focusing on the Thailand and Philippines markets, and as a financial journalist at The Edge Malaysia. Additionally, his background includes valuable time spent in an asset management firm. Outside of finance, Billy enjoys meaningful conversations over coffee, keeps fit as a fitness enthusiast, and has a keen interest in technology.