Datadog Shares Soar 12% on Microsoft Partnership. Is it a Buy?

October 1, 2020

Datadog Inc (NASDAQ: DDOG), cloud-based data and analytics monitoring provider, surged 12.4% higher as the company announced it will feature on Microsoft Corporation’s (NASDAQ: MSFT) Azure platform as a “first class service”.

Tim’s Take:

There are the “Dogs of the Dow” and then there’s Datadog. I know what I’d rather own. Datadog shares have been on a tear in 2020. After yesterday’s pop, shares have nearly tripled since the start of the year.

Datadog does “what it says on the tin”. The company provides wide-ranging monitoring of databases, tools and services – all by leveraging a cloud-based data analytics platform.

Basically allowing IT departments to monitor and address issues related to their cloud computing operations, the services Datadog offer have become invaluable as workforces globally shift to working from home.

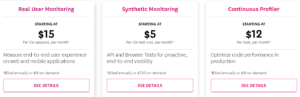

In a similar vein to recent market debutant Snowflake Inc (NYSE: SNOW), Datadog’s revenue model is actually based on a pay-by-use basis (see below) rather than a subscription model – like most Software-as-a-Service (SaaS) companies.

Source: datadoghq.com/pricing

It’s also profitable, having registered GAAP operating income of US$700,000 in its latest quarter and an operating profit margin of 0.5%.

Loyal user base

More impressively, both its operating cash flow and free cash flow are positive. All of this came in a second quarter where it grew revenue by 68% year-on-year to US$140 million.

Clients like the service. Datadog boasts a net retention rate (NRR) of 130%, meaning existing customers are consistently spending more with the firm as it continues to grow its product suite.

The latest partnership with Microsoft Azure has added to the number of strategic wins it’s racked up in recent months. Earlier in September, Datadog achieved AWS Outposts Ready designation, recognising the company’s successful integration with AWS services.

As with all cloud-based firms, valuation would likely be the key stumbling block to further gains. Shares currently trade at 45x price-to-sale (PS) while management did guide for “only” 50% revenue growth in the third quarter.

There’s also the fact that Datadog’s competition is formidable, with the likes of Splunk Inc (NASDAQ: SPLK), Elastic NV (NYSE: ESTC), New Relic Inc (NYSE: NEWR) and recently-listed Sumo Logic Inc (NASDAQ: SUMO) operating in the space.

There is, of course, also the question of whether Datadog can keep up its growth once the Covid-19 pandemic subsides.

Either way, Datadog is likely to remain a leader in the cloud-based data and analytics space for years to come as companies everywhere transition to the cloud.

Disclaimer: ProsperUs Head of Content Tim Phillips owns shares in Datadog Inc.

This material is categorised as non-independent for the purposes of CGS-CIMB Securities (Singapore) Pte. Ltd. and its affiliates (collectively “CGS-CIMB”) and therefore does not provide an impartial or objective assessment of the subject matter and does not constitute independent research. Consequently, this material has not been prepared in accordance with legal requirements designed to promote the independence of research. Therefore, this material is considered a marketing communication.

This material is general in nature and has been prepared for information purposes only. It is intended for circulation amongst CGS-CIMB’s clients generally and does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this material. The information and opinions in this material are not and should not be construed or considered as an offer, recommendation or solicitation to buy or sell the subject securities, derivative contracts, related investments or other financial instruments or any derivative instrument, or any rights pertaining thereto. CGS-CIMB have not, and will not accept any obligation to check or ensure the adequacy, accuracy, completeness, reliability or fairness of any information and opinion contained in this material. CGS-CIMB shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.