When we think of bank stocks and dividends in Singapore, we automatically gravitate towards the big three local banks, all of which pay dividends.

This week DBS Group Holdings Ltd (SGX: D05), Oversea-Chinese Banking Corp Limited (SGX: O39), also known as OCBC, and United Overseas Bank Ltd (SGX: U11).

For dividend investors looking for passive income, they always seem to be the reliable “stalwarts” when it comes to dividend stocks.

However, last year all three banks saw their dividends capped by the Monetary Authority of Singapore (MAS) at 60% of their 2019 dividend per share (DPS) level.

Leading the pack

For leading local bank DBS, it was another stellar quarter that easily beat analysts’ expectations.

Even better was news that DBS would restore its quarterly dividend to its previous level at 33 Singapore cents after the MAS lifted the dividend cap a few days before bank earnings were announced.

Net profit for DBS in the first half of 2021 hit a new record high of S$3.7 billion, up a robust 54% year-on-year

Although net profit for the second quarter was down 15% sequentially, guidance from DBS CEO Piyush Gupta was positive for the second half of the year.

Underlying expenses are expected to remain stable while expected full-year fee income growth was raised to the mid-teens percentage range, up from double digits.

Focusing on emerging wealth

That’s all boding well for DBS’s business across the region. That’s because the bank’s focus on wealth management continues to pay dividends.

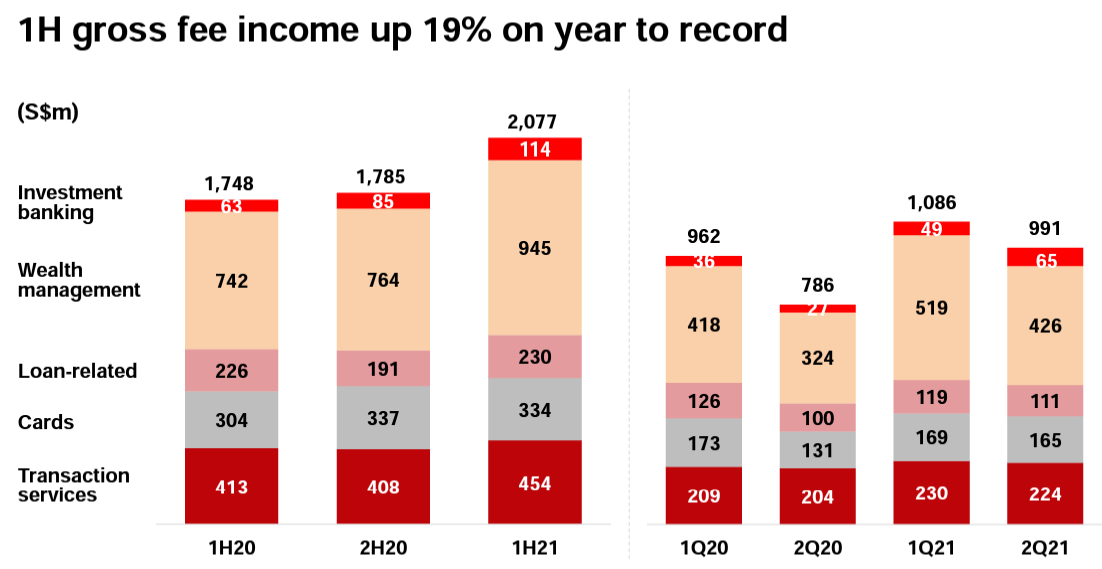

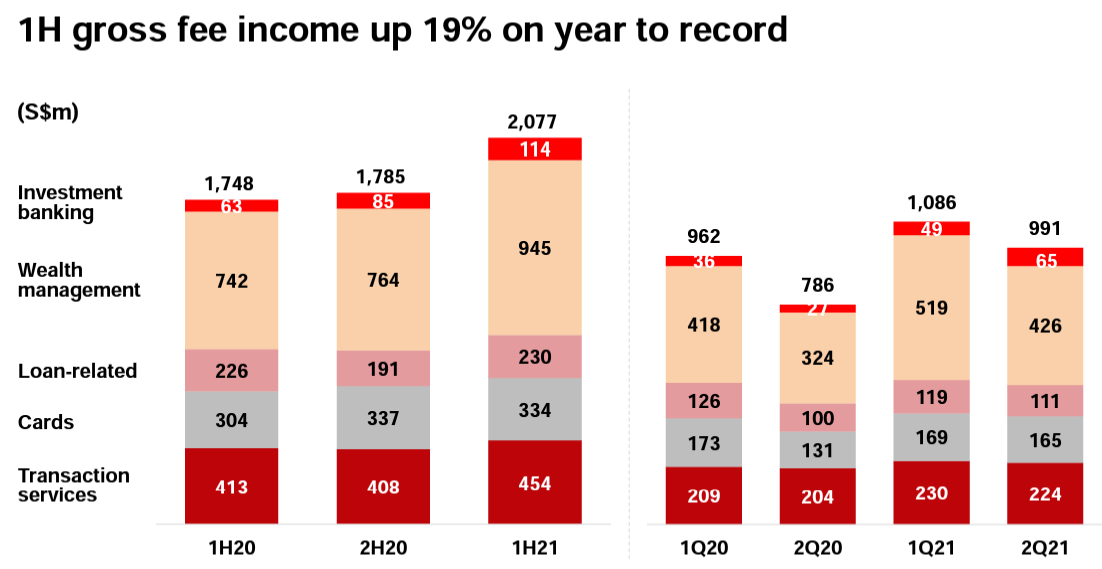

Fee income from wealth management in the first half of 2021 made up nearly 45% of overall gross fee income for the bank (see below).

The gross fee income figure also hit a new record high and although wealth management fee income dropped sequentially in the second quarter, it was still up substantially from the year-ago quarter.

Assets under management (AUM) for its wealth management arm still continued to expand throughout the Covid-19 pandemic and at the end of first half of 2021, the figure sat at S$285 billion.

That AUM figure was up an impressive 8% half-on-half and 13% year-on-year. For long-term investors focused on generating rising dividend streams from one of Singapore’s biggest banks, that’s good news.

Source: DBS Q2 2021 earnings presentation

Source: DBS Q2 2021 earnings presentation

Disclaimer: ProsperUs Head of Content Tim Phillips owns shares of DBS Group Holdings Ltd.

Source: DBS Q2 2021 earnings presentation

Source: DBS Q2 2021 earnings presentation