When most global economies went into shutdown mode in early 2020, the stock market plummeted. However, as we all know as investors, the rest is history.

There was a huge rebound in the US stock market as the share prices of tech and e-commerce stocks, which were deemed to benefit from the stay-home trend, soared.

One of those companies was online furniture retailer Wayfair Inc (NYSE: W). After hitting the low US$20s at the market bottom in March 2020, Wayfair shares skyrocketed to over US$320 by mid-August last year.

However, many investors are asking whether the company can continue to benefit when the pandemic comes to an end.

Housing proxy

Wayfair had a great statement of intent as it released its first-quarter 2021 results earlier this week. The company posted solid revenue growth of 49% year-on-year as sales hit US$3.48 billion.

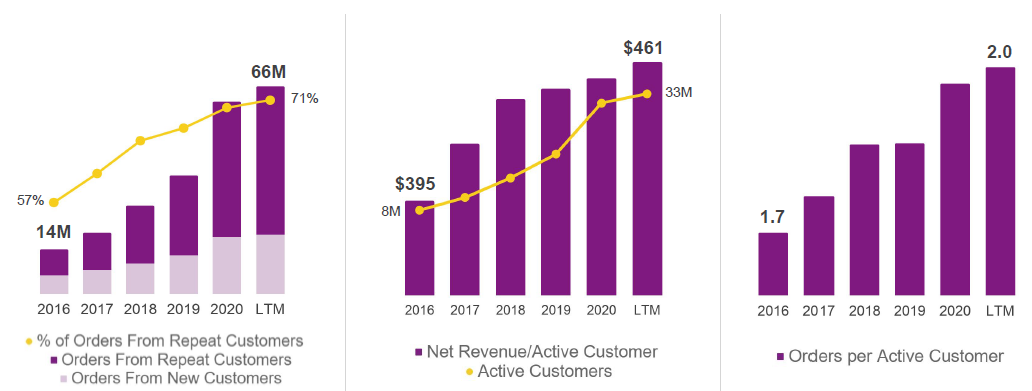

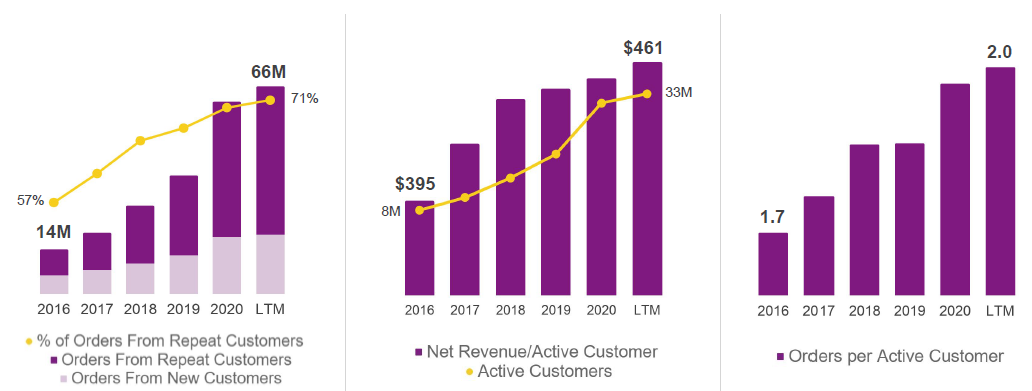

Meanwhile, active customers climbed 57% year-on-year to 33.2 million during the quarter, with repeat customers accounting for over 70% of all orders during the first three months of the year. Revenue per active customer is also rising (see below).

Yet there’s more to it than just the “stay-home” trend for Wayfair. Many investors believe that the company is set to benefit from increased spending on the home, which should outlast the temporary effects of the pandemic boost.

A robust US housing market, plus the trend of more people moving to the suburbs as remote working goes mainstream, means individuals are willing to spend more on their home furnishings.

Having patiently built an international presence in both the UK and Germany in recent years, Wayfair looks likely to continue its success for years to come.

Source: Wayfair Q1 2021 earnings presentation

Source: Wayfair Q1 2021 earnings presentation

Disclaimer: ProsperUs Head of Content Tim Phillips doesn’t own shares of any companies mentioned.

Source: Wayfair Q1 2021 earnings presentation

Source: Wayfair Q1 2021 earnings presentation