3 Key Risks to Watch Out for When Investing in 2022

December 14, 2021

Since the COVID-19 outbreak, the recent years have been filled with uncertainties and investors looking ahead into 2022 will have enough to worry about before putting their money to work.

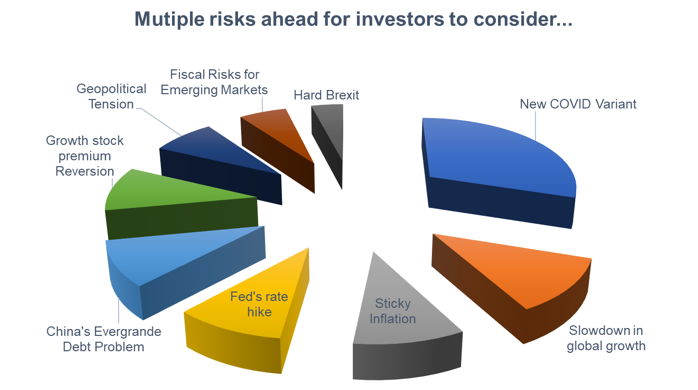

The uncertainties with the new Omicron variant, sticky inflation, Fed’s anticipated rate hikes, China’s Evergrande debt problem, a hard Brexit, fiscal risks for the emerging markets, geopolitical tension and growth stock premium reversion – all of these would have kept investors awake at night.

Source: ProsperUs

Source: ProsperUs

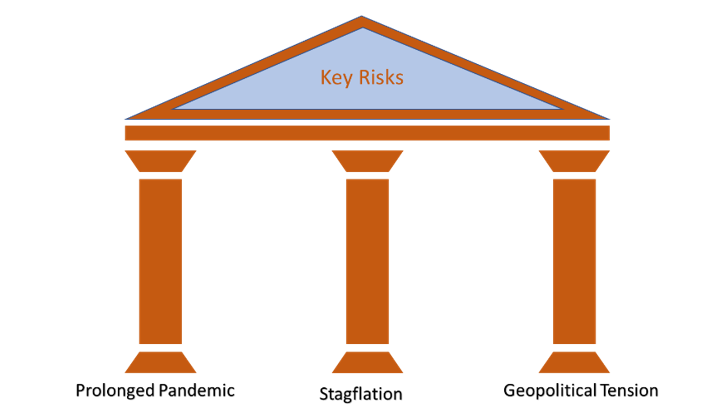

It is next to impossible to keep track of all these developments but here are three key risks that investors should watch out for when planning their investment strategies.

Source: ProsperUs

Source: ProsperUs

1) Prolonged COVID-19 pandemic

The first key risk to watch out for has to be the pandemic, especially after what we’ve seen over the last two years. While most experts believe that we’re at the end game of the pandemic, one thing certain is that the virus is continuing to evolve as seen by the latest Omicron variant. It is said to be more contagious than the Delta variant but possibly less deadly. While that is the outcome most investors would want, it is still too early to suggest that the Omicron variant would mutate to become less life-threatening. The United Kingdom has just reported their first death with Omicron coronavirus variant as I was writing this piece.

On a more positive note, the 1918 flu pandemic, the only historical comparison we have, lasted about 18 months and ended after either everyone had been exposed to the virus or when it became less life-threatening.

The verdict is still out there on this but bear in mind that despite after the discovery of the Delta variant in 2021, the US stock market has maintained its strong momentum. Lockdowns that were imposed globally have led to a surge in online shopping and whether a spending shift to services spending could happen in 2022, depends a lot on whether we’re dealing with a less life-threatening virus or a more contagious and deadly one.

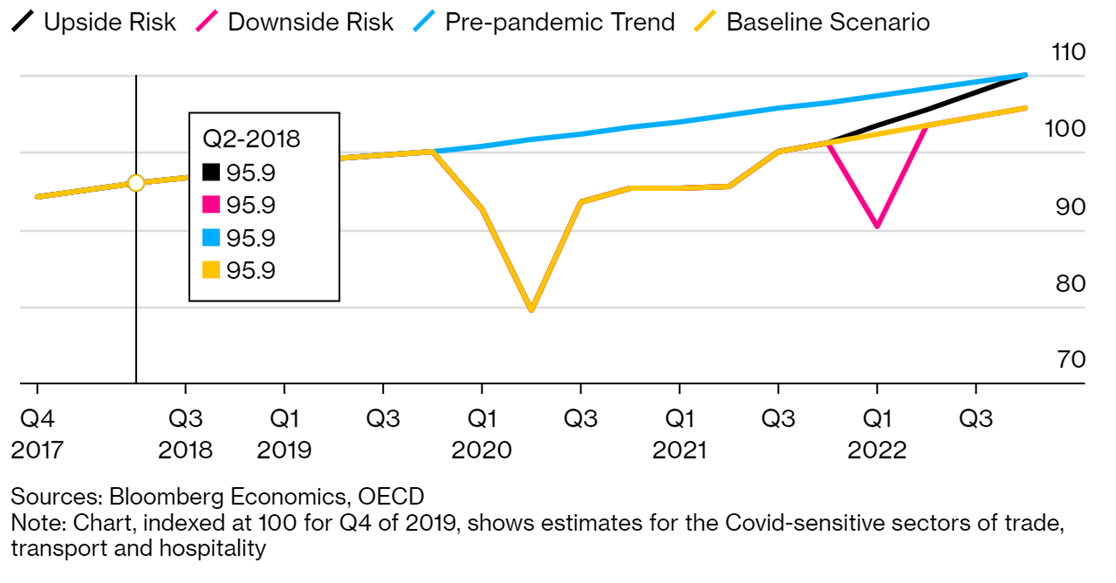

Below is a chart from Bloomberg showing the scenarios for services spending as Omicron spreads:

2) Stagflation

If we look beyond the pandemic, two things that would be on the top of investors’ mind would be inflation and growth. Stagflation, a blend of weak growth and strong inflation, is one risk that investors must pay attention to even if policymakers continue to insist that inflation will soon fade away.

I’ve talked about the importance of asset allocation as well as the winners and losers under a stagflation environment prior to this article. It might help to revisit that piece to help you better understand how one could navigate this risk.

So far, most economists are expecting US inflation to ebb in 2022. However, if wages in US continue to climb while geopolitical tension in oil-producing countries flare up, this could send prices higher. Climate change is another factor that is adding fuel to the fire as food prices may continue to rise.

The Bloomberg Commodity Index shows that the commodity prices have stabilised and this should be a relief but investors should still keep track of the price movements for any indication of another surge in prices.

Source: Bloomberg

Source: Bloomberg

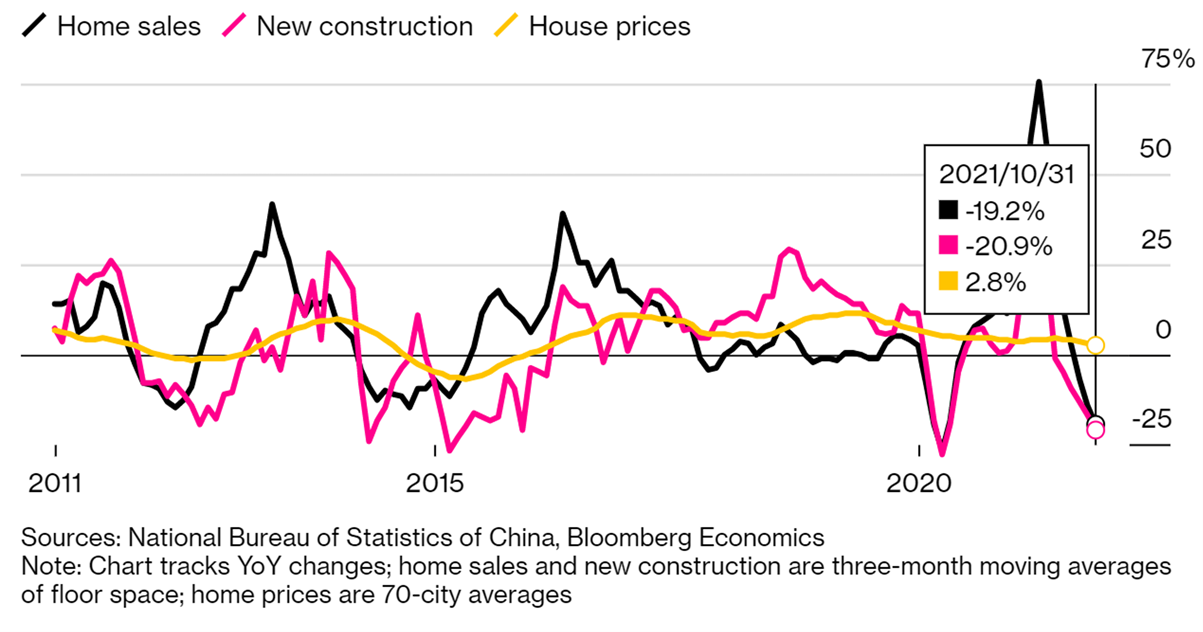

Stagflation has two components to it. Aside from looking into inflation, global growth is another area to look into. At the moment, economists are still expecting a bullish recovery in global growth but a pullback in government spending could slow recoveries. The US Federal Reserve rate hike is also another area to keep an eye on while China’s economy is also affected by various factors such as Beijing’s zero-COVID strategy and the property slump.

The chart below shows the slowdown in the property and construction sector in China.

3) Geopolitical Tension

The US-China geopolitical tension is another key risk to look into as investors plan ahead. Despite holding a virtual summit in November between US president Joe Biden and China president, Xi Jinping, there was no breakthrough towards better relations. In fact, it was only recently that the White House announced that American officials (not the athletes), would boycott the upcoming Winter Olympics set to commence in Beijing in February 2022. The Biden administration has also called managing American’s relationship with China as “the biggest geopolitical test of the 21st century.”

We also learned an important lesson from Chinese ride-hailing group, Didi Chuxing Technology Co.’s move to delist from the New York Stock Exchange (NYSE) and go public in Hong Kong. This move came after reports that China is planning to ban companies from going public on foreign stock markets via variable interest entities. The stakes are high as Didi’s USD4.4 billion IPO in June was the biggest listing by a Chinese company in NYSE since Alibaba in 2014. At the same time, US Securities and Exchange Commission is set to force Chinese companies to delist if they fail to disclose more information about audit results and government control over their operations.

What is obvious is that the decoupling between the two largest economies in the world can no longer be ignored by investors.

There is also the political turmoil in Europe. While this risk isn’t as severe as the US-China relation situation, it’s something that investors would still want to have an eye on. Add the Russia and Ukraine’s tension into the list and we will have quite a lot of demographics to watch out for. While Russia might not be as dominant on the economic front as it was in the past, the tension could still send oil prices flying.

Bottomline: Pay Attention to the Risks

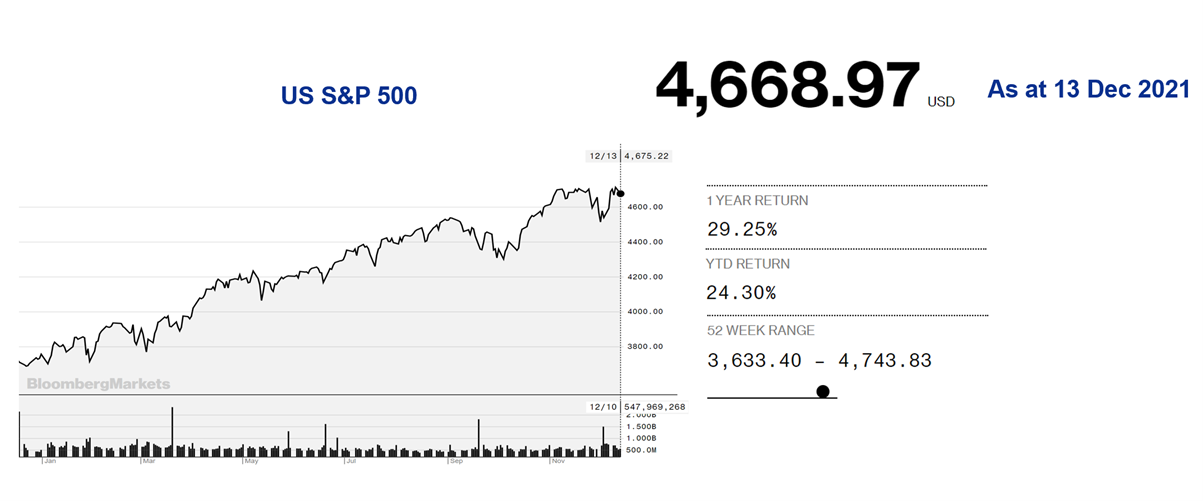

In 2021, the US market has outperformed most major and emerging markets. By any standard, it has been a Slam Dunk year for the S&P 500. Investing will also become more important with the rising inflation as investors want to protect the value of their money. So, it’s natural if you want to jump on board as soon as possible.

Source: Bloomberg, ProsperUs

Source: Bloomberg, ProsperUs

However, if you’re going to start investing, you should understand the risks involved. Every investment strategy comes with their risks and managing those risks is how you can make the most of your money. One possible way is through the art of asset allocation and diversification. I’m not asking you to stop reaching for the higher rewards, I’m asking you to pay attention to the risks involved when you reach out for it.

Billy Toh

Billy is deeply committed to making investment accessible and understandable to everyone, a principle that drives his engagement with the capital markets and his long-term investment strategies. He is currently the Head of Content & Investment Lead for Prosperus and a SGX Academy Trainer. His extensive experience spans roles as an economist at RHB Investment Bank, focusing on the Thailand and Philippines markets, and as a financial journalist at The Edge Malaysia. Additionally, his background includes valuable time spent in an asset management firm. Outside of finance, Billy enjoys meaningful conversations over coffee, keeps fit as a fitness enthusiast, and has a keen interest in technology.