There have been a lot of uncertainties in the stock market over the last two months. Year-to-date, the US equity benchmark index was down by 17.3%.

According to our Chief Investment Strategist, Say Boon, the decline seen in the stock market could continue in the near-term despite touching the bear market territory.

He cautioned investors on the uncertainty in the stock market and the temptation to buy the dip.

With so much volatility and bearish sentiment in the market, investors can take advantage by trading in the options market.

One of the ways to benefit from the bear market is by deploying the strip straddle strategy using options.

Investors who are not familiar about options can read on how to get started with options that I wrote back in October last year.

What is a Strip Straddle strategy?

The strip straddle strategy is classified as a volatile options trading strategy that is best used when investors are expecting significant movement in prices of a security.

For a long straddle, investors will need to buy at-the-money calls and at-the-money puts. For both the calls and puts, investors will use the same expiration date.

A strip is essentially a long straddle, but it utilizes higher number of puts than calls.

For a start, I think investors can use a 2 to 1 ratio for the puts to call ratio. However, investors can adjust this based on their risk appetite.

When to use a strip straddle strategy?

The strip straddle strategy is specifically designed to be used when the volatile outlook in the market has a bearish sentiment.

Investors are more likely to use this strategy when they expect a big movement in prices of the underlying security. While this strategy can profit from sharp movements in either direction, it will make higher profits from a downward movement.

Examples of strip straddle

To simplify the calculation, we have ignored the commission costs and opted for rounded figures in the below example.

Company A stock is currently trading at US$50 per share.

At-the-money calls (strike price at US$50) are trading at US$2 while at-the-money puts (strike price at US$50) are trading at US$2. Both the options have the same expiry date.

Investor can create a strip straddle at a cost of US$600 with the below:

1) 1 contract of call (containing 100 options) at a cost of US$200

2) 2 contracts of put (containing 200 options) at a cost of US$400

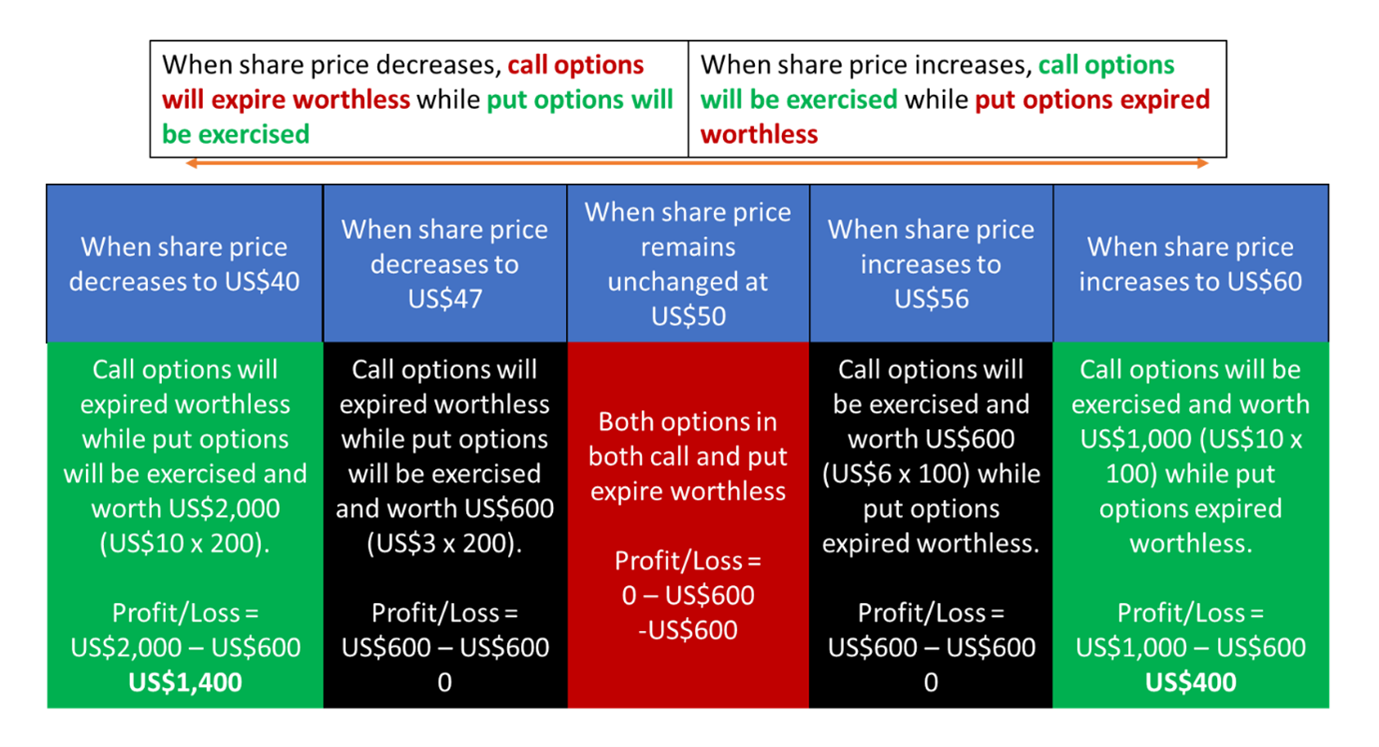

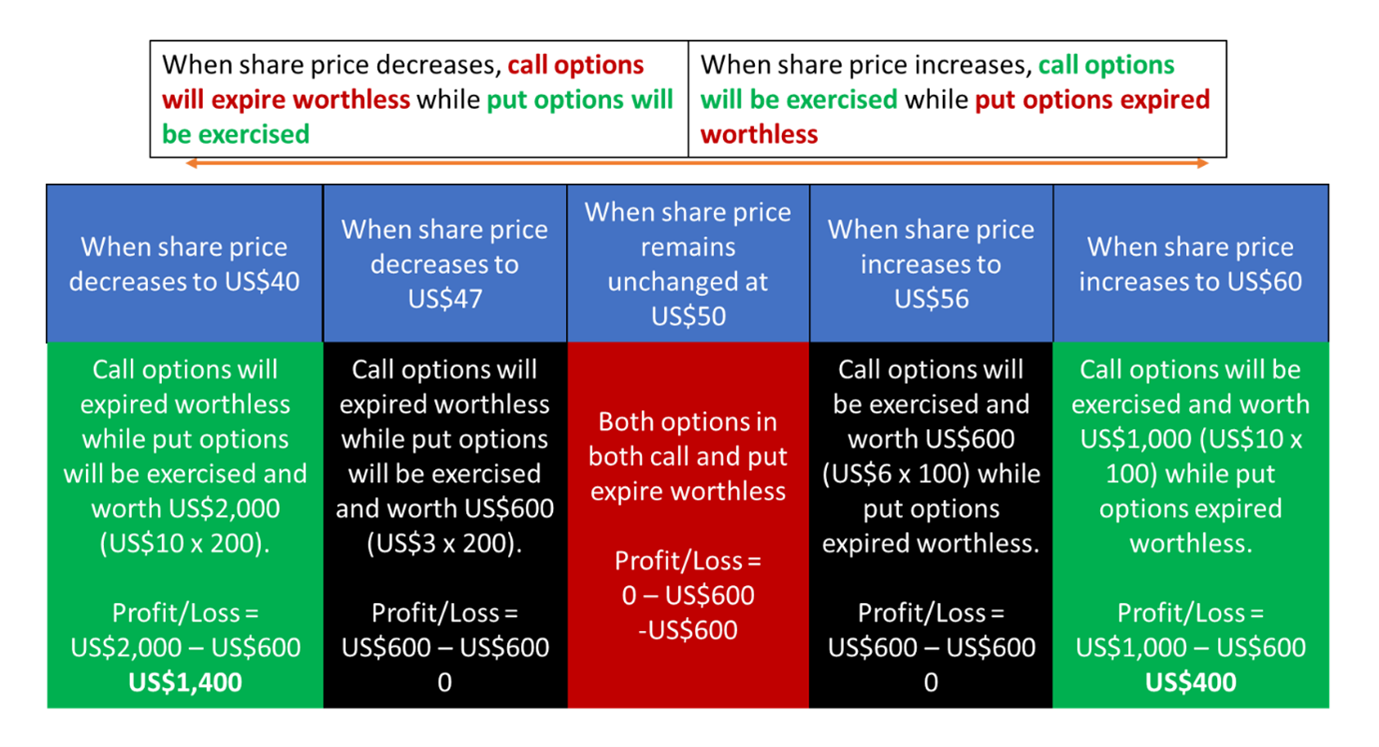

Below is the return scenarios based on how share prices change at expiration date.

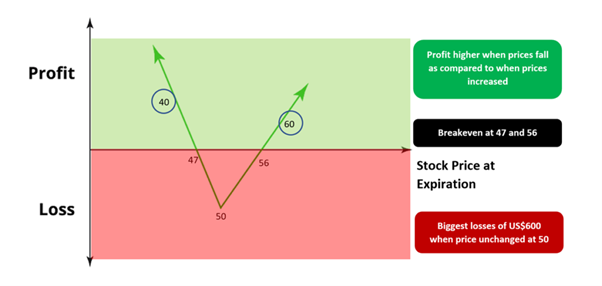

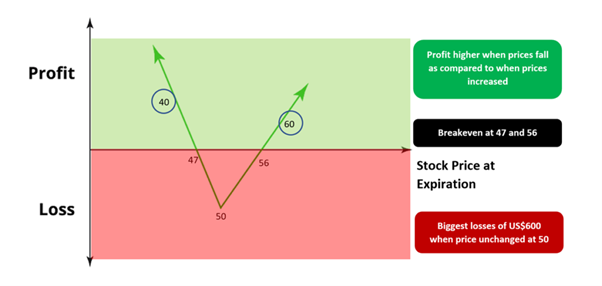

Another way to look at the profit and loss profile of the strip straddle strategy used in options is based on the chart below.

Utilise options strategy to navigate the market volatility

There is still a lot of uncertainty in the stock market but investors can take advantage of options trading strategy to navigate through these volatile times.

While strip straddle is slightly more complicated than other basic trading strategies, it is simple enough for beginners and provide a better alternative for a bear market.

Disclaimer: ProsperUs Investment Coach Billy Toh doesn’t own shares of any companies mentioned.