5 Key Highlights from Lendlease REIT’s Q3 FY2023 Earnings

May 10, 2023

In Singapore, the REIT reporting season is coming to an end. But on Tuesday (9 May) Lendlease Global Commercial REIT (SGX: JYEU), or LREIT, reported its latest Q3 FY2023 numbers (for the three months ending 31 March 2023)

The REIT revealed a stable and high committed portfolio occupancy of 99.8% for the period, similar to the previous quarter.

LREIT owns three core assets. Two of them are Jem, an office and retail property in Singapore, and 313@Somerset, a prime retail mall in Singapore. The third one is Sky Complex, three Grade A office buildings in Milan, Italy.

During the business update for Q3 FY2023, LREIT manager emphasised the stability of its portfolio, highlighting the weighted average lease expiry (WALE) of 8.3 years by net lettable area (NLA) and 5.4 years by gross rental income (GRI).

So, for S-REIT investors, here are five key highlights from LREIT’s business updates for investors.

1. Strong retail recovery benefit LREIT

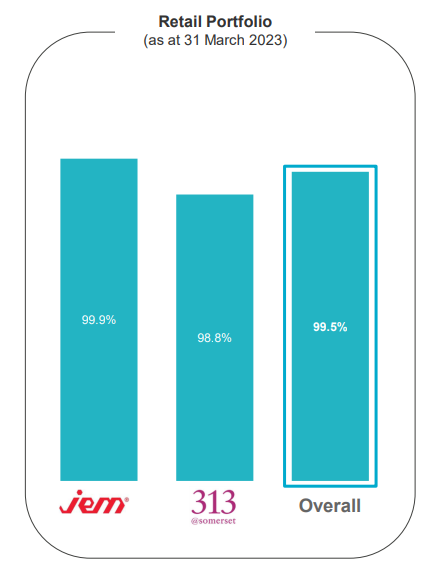

For the retail portfolio, the occupancy rate was an impressive 99.5% as of 31 March 31, 2023, with an encouraging year-to-date retail rental reversion of 3.3%.

Source: LREIT’s Q3 FY2023 Business Update

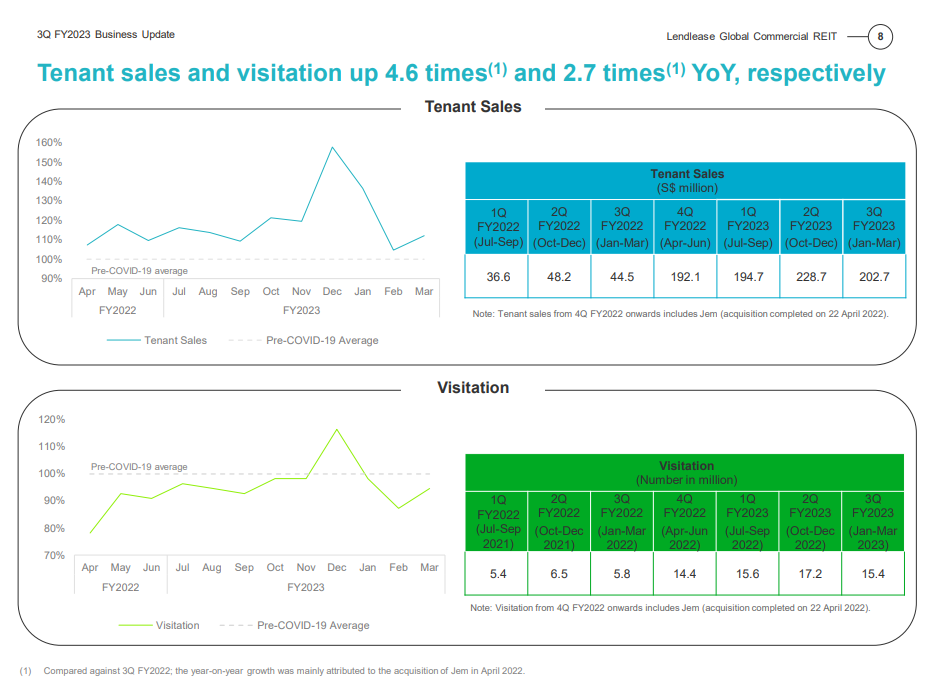

The REIT’s tenant sales were up 4.6 times in Q3 2023, largely propelled by the acquisition of Jem in April 2022.

This led to a 2.7 times increase in visitation year-on-year.

Singapore’s retail sales, excluding motor vehicles, showed promising growth of 11.7% in February 2023, thanks to an uptick in demand for food, alcohol, apparel, and footwear.

The REIT’s retail portfolio also displayed a robust tenant retention rate of 79.5% by the end of March, based on year-to-date completed lease renewals by NLA.

2. Steady income from its office property

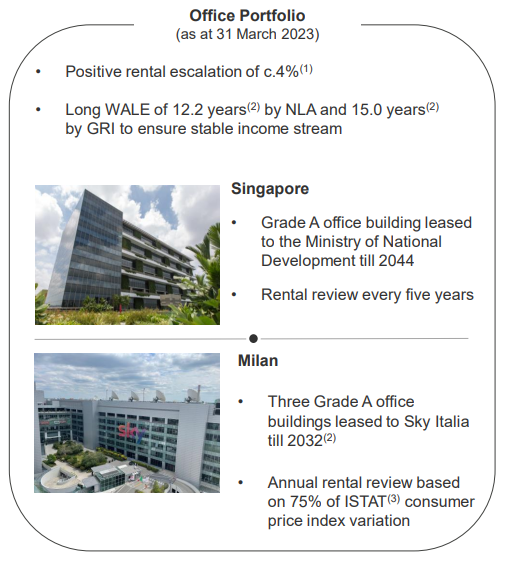

Aside from that, LREIT’s Grade-A office, Sky Complex in Milan, continues to be fully leased to Sky Italia, a subsidiary of Comcast Corp (NASDAQ: CMCSA).

The manager underscored the 4% positive office rental escalation and the long office WALE of 12.2 years by NLA and 15 years by GRI, promising a steady income stream for the REIT’s investors.

![]()

Source: LREIT’s Q3 FY2023 Business Update

3. Rising interest cost hurt margin but no near-term refinancing risk

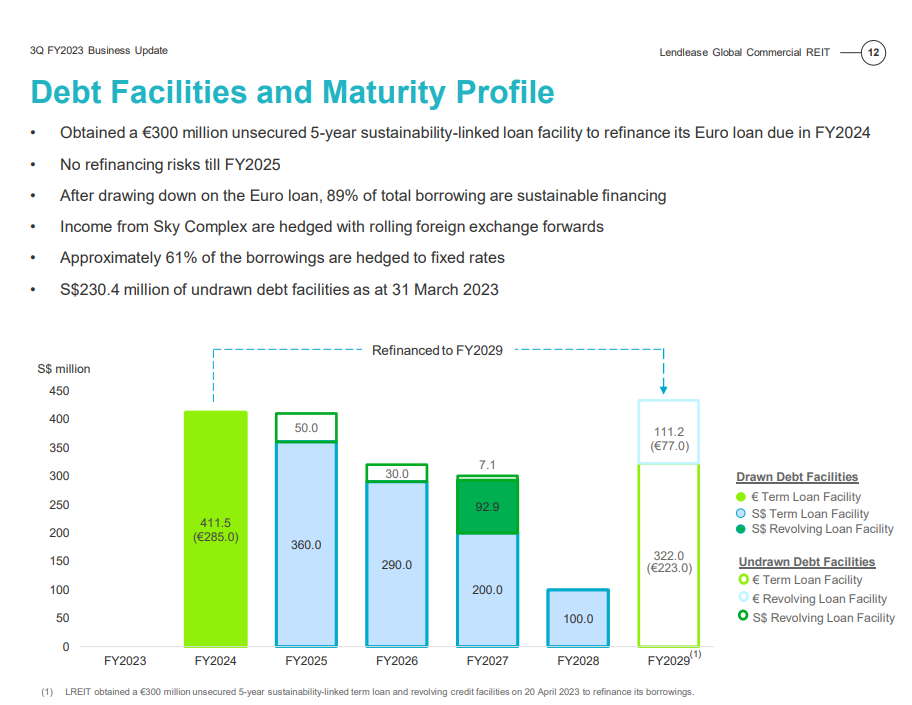

During Q3 FY2023, LREIT’s average cost of debt rose slightly from 2.35% to 2.51% due to higher interest rates on the floating portion of loans.

However, it announced that it had secured a €300m unsecured 5-year sustainability-linked loan facility to refinance its due €285m loan in FY2024.

This will push back refinancing risk until at least FY2025.

Post-refinancing, the proportion of sustainability-linked loans will increase from 62% to 82%.

Source: LREIT’s Q3 FY2023 Business Update

4. Attractive distribution yield

The high portfolio occupancy and long WALE of 5.4 years by GRI for LREIT ensures long-term cash flow stability.

With refinancing risk out of the way, LREIT is in a good position to maintain it distribution payout.

This will translate into an attractive dividend yield of around 7%.

Going forward, with the exposure to retail recovery, LREIT is also in a good position to maintain its positive reversion for its retail portfolio.

5. Sustainability at the core of its mission

Investors who are looking for sustainable investments will find LREIT to be a good addition to their portfolio.

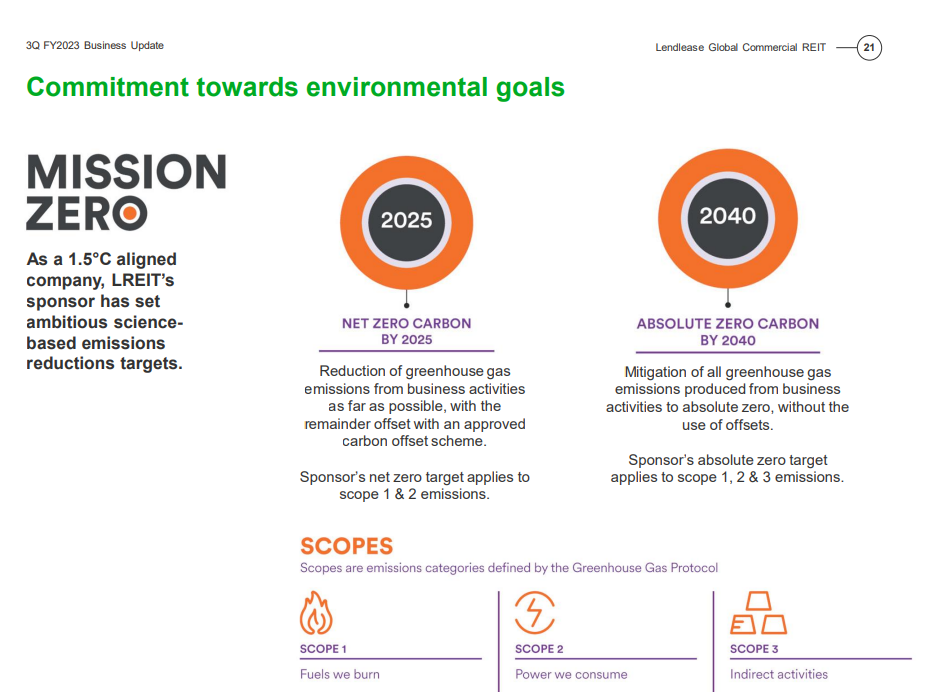

LREIT’s sponsor has set ambitious science-based emissions reduction targets.

It plans to achieve net zero carbon by 2025 and absolute zero carbon by 2040.

Net zero carbon refers to reduction of greenhouse gas emissions from business activities as far as possible, with the remainder offset with an approved carbon offset scheme.

Meanwhile, absolute zero carbon refers to mitigation of all greenhouse gas emissions produced from business activities to absolute zero, without the use of offsets.

Source: LREIT’s Q3 FY2023 Business Update

Invest in LREIT for resilient portfolio and promising prospects

In summary, LREIT’s organic growth potential, combined with its exposure to an ongoing retail recovery, underscores its investment value.

The REIT’s robust performance, driven by high occupancy rates, positive rental reversions, and long-term leases, positions it as a valuable asset for investors seeking stable cash flow.

As the investment landscape continues to evolve, LREIT appears to be a compelling option for those looking to diversify their portfolio with a reliable REIT that offers an attractive dividend yield.

Disclaimer: ProsperUs Investment Coach Billy Toh doesn’t own shares of any companies mentioned.

Billy Toh

Billy is deeply committed to making investment accessible and understandable to everyone, a principle that drives his engagement with the capital markets and his long-term investment strategies. He is currently the Head of Content & Investment Lead for Prosperus and a SGX Academy Trainer. His extensive experience spans roles as an economist at RHB Investment Bank, focusing on the Thailand and Philippines markets, and as a financial journalist at The Edge Malaysia. Additionally, his background includes valuable time spent in an asset management firm. Outside of finance, Billy enjoys meaningful conversations over coffee, keeps fit as a fitness enthusiast, and has a keen interest in technology.