Singapore Retail REITs: Boosted by Return of International Tourists

March 7, 2023

In Singapore, the tourism industry had been hit hard by the COVID-19 pandemic due to the restrictions on travel and movement.

However, with the reopening of international borders and the economy, Singapore is poised to see the gradual return of international tourists.

In January, international tourist arrivals to Singapore rose to a new post-pandemic high, with over 930,000 visitors.

The Singapore Tourism Board now expects the nation to receive up to 14 million international visitors this year, more than double the 6.3 million recorded in 2022.

Tourism receipts are also expected to grow from around S$14 billion in 2022 to as high as S$21 billion this year.

This bodes well for the retail Singapore REITs (S-REITs), which are expected to benefit from the revival of the tourism industry.

Retail S-REITs’ performance returns to pre-COVID levels

The return of international tourists is good news for retail S-REITs, as it will boost footfall and sales in shopping malls and retail outlets in the city state.

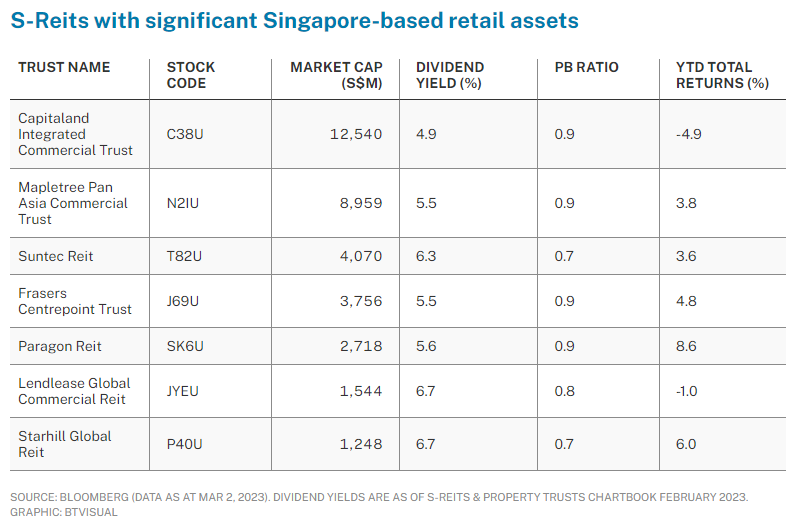

Retail S-REITs such as CapitaLand Integrated Commercial Trust (SGX: C38U), or simply known as CICT, Frasers Centrepoint Trust (SGX: J69U) and Mapletree Pan Asia Commercial Trust (SGX: N2IU) are some of the biggest.

They own the largest and most popular shopping malls in Singapore, and are expected to benefit from the revival of the tourism industry.

CICT reported 25% and 22.5% year-on-year (yoy) expansions in shopper traffic and tenant sales for FY2022, respectively.

Downtown malls saw higher growth, with over 30% increases in both shopper traffic and tenant sales.

CICT noted that operating metrics in its retail portfolio surpassed pre-pandemic figures on the back of healthy market demand.

Retail portfolio occupancy improved to 98.3% as of 31 December, 2022 (vs. 96.8% as of 30 September, 2022) and positive rental reversions were also recorded.

Meanwhile, Mapletree Pan Asia Commercial Trust’s VivoCity Mall reported that its Q3 FY2023 sales continued to exceed pre-COVID levels.

That came as shopper traffic and tenant sales grew 50.5% and 38.5% yoy, respectively. It also recorded positive rental reversions of 7.9%.

Similarly, Frasers Centrepoint Trust reported that shopper traffic and tenant sales in Q1 FY2023 remained robust and grew 38.3% and 13.4% yoy, respectively.

Its retail portfolio committed occupancy rate improved to 98.4% as of 31 December, 2022 on the back of healthy leasing demand.

Other retail S-REITs that have seen a recovery to pre-pandemic levels include Lendlease Global Commercial REIT (SGX: JYEU), Paragon REIT (SGX: SK6U), and Starhill Global REIT (SGX: P40U).

Lendlease Global Commercial Reit’s retail portfolio maintained a portfolio occupancy rate of 99.5% as of 31 December, 2022, with positive rental reversions of around 2%.

The REIT noted that tenant sales and visitation in H1 FY23 surpassed pre-Covid levels and was five times and 2.8 times, respectively, what it was in H1 FY22.

Meanwhile, Paragon Reit’s Paragon Mall saw sales recover to above pre-Covid levels as tenant sales for the January to December 2022 period increased 45% yoy.

Footfall was around 80% of pre-Covid levels. The Clementi Mall remained resilient as tenant sales increased 12% across the same period, with footfall gradually trending upwards post-relaxation of pandemic restrictions.

As for Starhill Global REIT, its Wisma Atria shopping mall saw tenant sales and shopper traffic improve in H1 FY23 by 32.6% and 30% yoy, respectively.

Overall portfolio occupancy rate of the REIT was at 97.1% as of 31 December, 2022.

Emerging interest in S-REITs among retail investors

In February, S-REITs’ total return was down by 2% based on the iEdge S-REIT index.

The decline was mainly due to the rising interest rate environment, which could lead to rising borrowing costs and lower margins in the near term for REITs.

Despite that, it is worth noting that retail investors are buying into the S-REITs sector with a net inflow of S$89 million.

It is also interesting to see that S-REITs, with significant Singapore-based retail assets, have continued to perform well with the exception of CICT – the REIT has seen a decline of 4.9% in its year-to-date total return.

Retail S-REITs will benefit from return of international tourists

The return of tourists in Singapore is expected to benefit retail S-REITs significantly.

Retail sales in Singapore are expected to remain robust, which bodes well for retail S-REITs.

Investing in retail S-REITs is an excellent way for investors to gain exposure to the recovery of the tourism industry and benefit from the stable income and potential capital appreciation that these investments offer.

With the expected increase in footfall and sales, retail S-REITs are likely to see growth in their net asset value (NAV) and distribution per unit (DPU), which could result in capital appreciation of their unit prices.

Disclaimer: ProsperUs Investment Coach Billy Toh doesn’t own shares of any companies mentioned.

Billy Toh

Billy is deeply committed to making investment accessible and understandable to everyone, a principle that drives his engagement with the capital markets and his long-term investment strategies. He is currently the Head of Content & Investment Lead for Prosperus and a SGX Academy Trainer. His extensive experience spans roles as an economist at RHB Investment Bank, focusing on the Thailand and Philippines markets, and as a financial journalist at The Edge Malaysia. Additionally, his background includes valuable time spent in an asset management firm. Outside of finance, Billy enjoys meaningful conversations over coffee, keeps fit as a fitness enthusiast, and has a keen interest in technology.