Better Dividend Stock: DBS vs. UOB

April 7, 2022

For Singapore dividend investors, there’s a wealth of choice in the local stock market. We have real estate investment trusts (REITs), telcos and bank stocks to choose from.

It’s this last one – banks – that have been getting a lot of attention recently from income investors. That’s for good reason.

The big three bank stocks have all reverted to paying out dividends at the level they did prior to the “dividend cap” imposed by the Monetary Authority of Singapore (MAS) in 2020.

Bank stocks also tend to benefit from rising interest rates given widening spreads that contribute to higher net interest income (NII).

Two of the biggest banks in Singapore are DBS Group Holdings Ltd (SGX: D05) and United Overseas Bank Ltd (SGX: U11), which is also known as UOB.

Both banks have also announced recent acquisitions; DBS buying Citigroup Inc’s (NYSE: C) Taiwan retail operations while UOB managed to snap up the American bank’s Southeast Asian retail assets.

Yet, for local dividend investors, which big Singapore bank if the better long-term buy?

Dividend growth

Both DBS and UOB pay out solid dividends. But a much more important metric over the longer term (say, 10 years) for shareholders is the growth of that dividend. So, let’s take a look at their track records.

For DBS, it paid out a dividend per share (DPS) of S$0.56 in 2011. By 2021, that DPS – if we assume the bank’s first-quarter 2021 dividend wasn’t capped by the MAS – had grown to S$1.35.

That means DBS delivered a compound annual growth rate (CAGR) for its dividend of 9.2% over the past 10 years.

Meanwhile, UOB paid out a DPS of S$0.60 to its shareholders in 2011. By 2021, the bank’s full-year dividend (which it pays out twice a year) had increased to a total of S$1.20.

Therefore, UOB’s dividend had increased at a CAGR of 7.2%. While relatively impressive, it was below the pace that DBS notched up.

Winner: DBS Group

Dividend payout ratio

For investors focused on buying dividend stocks, it’s critical to understand how sustainable that dividend is.

One way to tell is to look at the dividend payout ratio, which will let you know the proportion of company earnings are going towards paying the dividend.

If we look at DBS and its latest 2021 full-year earnings, and using the annualised DPS from above for consistency’s sake, the company paid out a total DPS of S$1.35.

Meanwhile, DBS posted an earnings per share (EPS) figure of S$2.61 for the whole of 2021. That means its dividend payout ratio for 2021 was 51.7%.

For UOB, the bank paid out a full-year 2021 DPS of S$1.20. If we then look at the bank’s EPS for 2021, that was S$2.39.

Therefore UOB had a dividend payout ratio in 2021 of 50.2%, marginally better than DBS for the whole of 2021.

Winner: UOB

Capital buffers

Finally, looking at capital buffers – in terms of its leverage ratios and common equity Tier-1 (CET1) capital – is a good way of understanding the headroom banks have to raise payouts.

That’s because banks are required to hold minimum capital buffers by regulators. Having more flexibility (in the form of higher capital ratios) allows banks to more easily hike dividends.

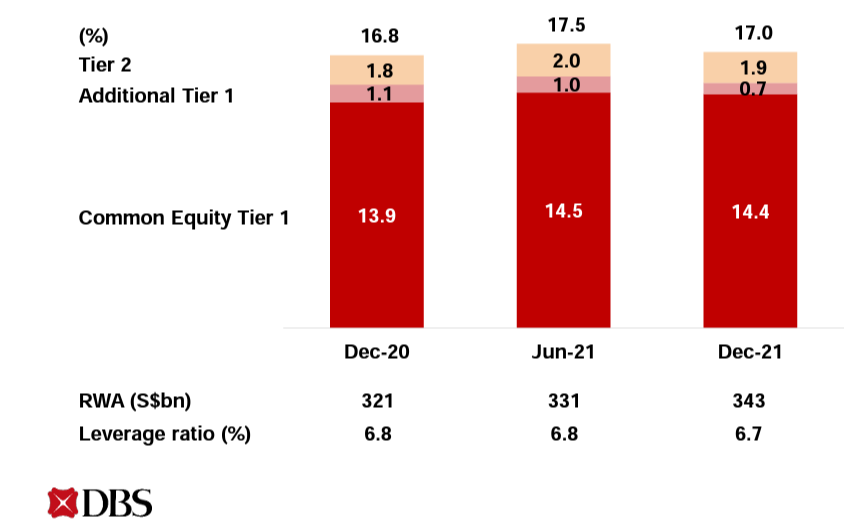

At the end of 2021, DBS had a common equity Tier-1 capital ratio of 14.4% while its leverage ratio was 6.7% (see below).

Source: DBS Group Q4 and FY2021 earnings presentation

Source: DBS Group Q4 and FY2021 earnings presentation

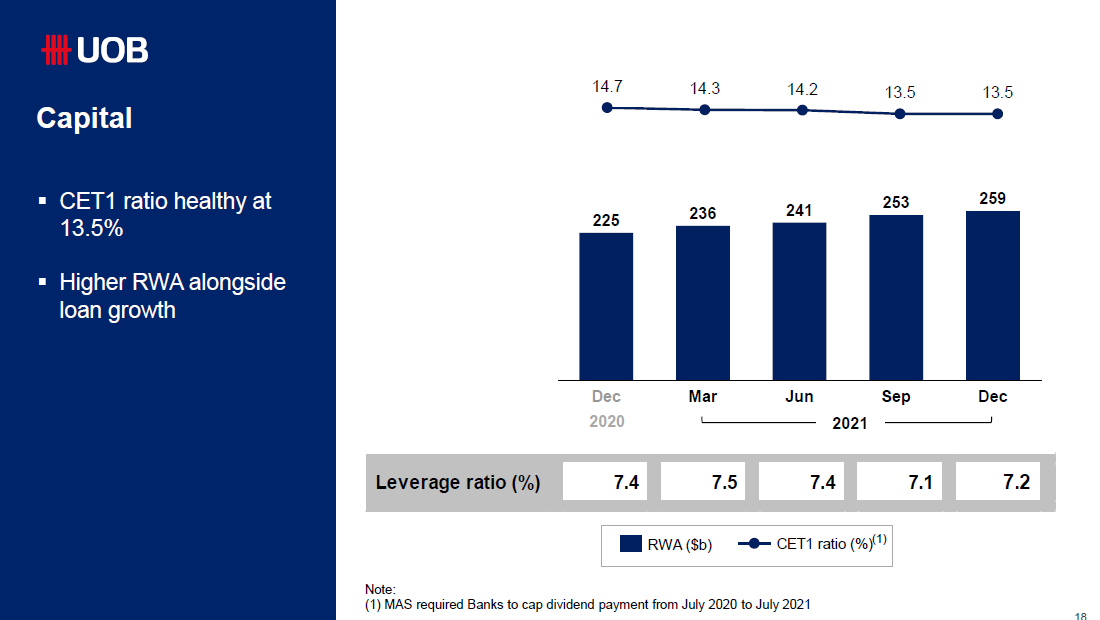

Source: UOB Q4 and FY2021 earnings presentation

Source: UOB Q4 and FY2021 earnings presentation

On the other hand, UOB finished 2021 with a CET1 of 13.5% and a leverage ratio of 7.2% (see above). That means that DBS comes out the winner on this front.

Winner: DBS Group

Size matters in dividend land

Similar to the REITs space, size really proves to be a determining factor in the long-term track records of bank stocks and their ability to grow dividends.

Looking at total returns over the past 10 and five years, DBS has also come out on top. It delivered a total return of 278% and 132%, respectively, over those timeframes.

If we look at UOB, those total return numbers over the same periods are less appealing; 160% and 79%, respectively.

For dividend investors overall, the superior dividend growth over time for DBS, as well as its more robust capital ratios, far outweigh the slightly higher dividend payout ratio it has versus UOB.

Disclaimer: ProsperUs Head of Content & Investment Lead Tim Phillips owns shares of DBS Group Holdings Ltd.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.