Despite concerns surrounding Singapore REITs’ financial performance due to elevated interest rates, CapitaLand Integrated Commercial Trust (SGX: C38U), commonly referred to as CICT, has demonstrated impressive earnings growth in Q1 FY2023.

This highlights the resilience of this investment opportunity for investors who seek out reliable passive income.

So, here are five key highlights from CICT’s strong financial performance during Q1 FY2023.

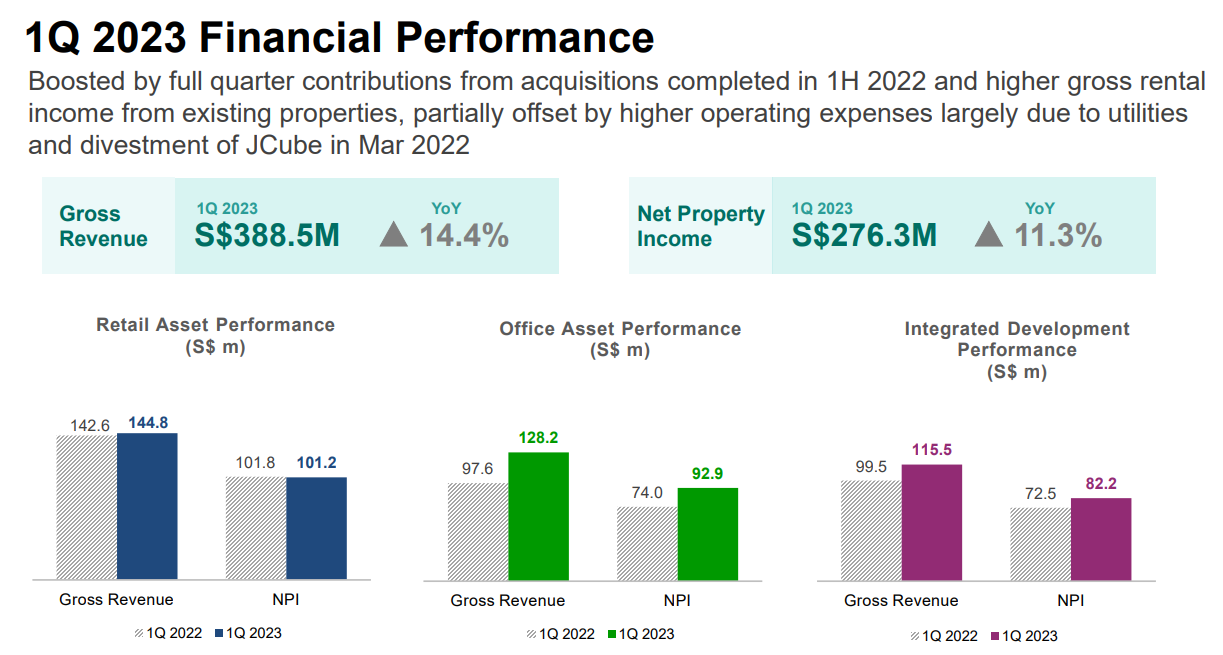

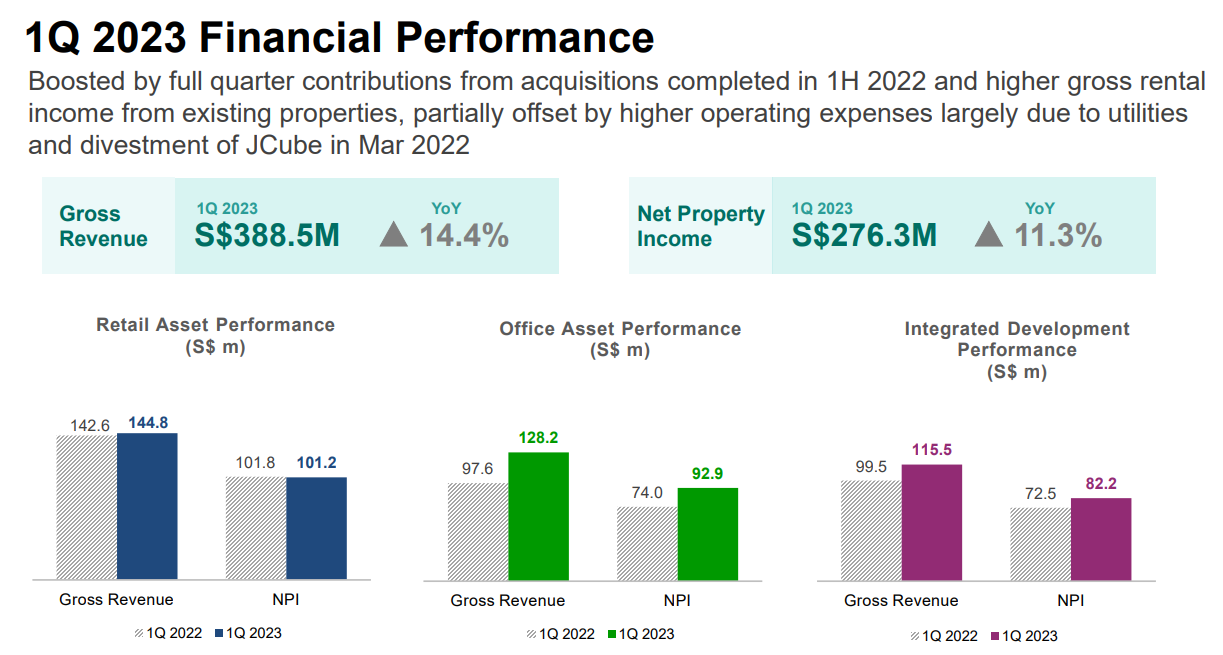

1. Another strong quarter despite rising costs

CICT achieved another strong quarter as revenue increased by 14.4% year-on-year (YoY) to S$388.5 million in Q1 FY2023.

The strong growth was mainly due to acquisitions completed in H1 2022 and higher gross rental income from existing properties.

In line with this, net property income (NPI) rose 11.3% YoY to S$276.3 million.

The growth was partially offset by higher operating expenses – largely due to utilities and the divestment of JCube in March last year.

Source: CICT’s Q1 2023 Business Update

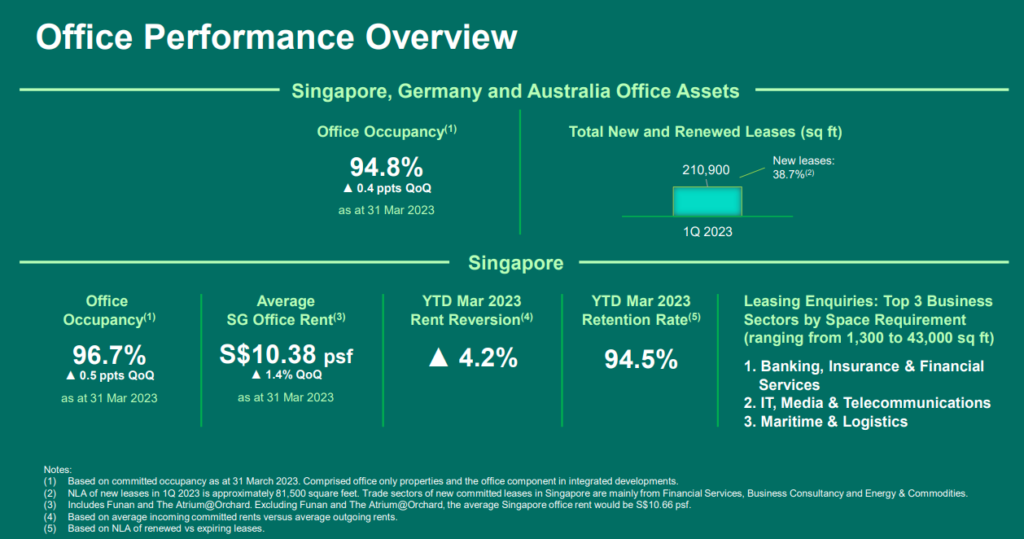

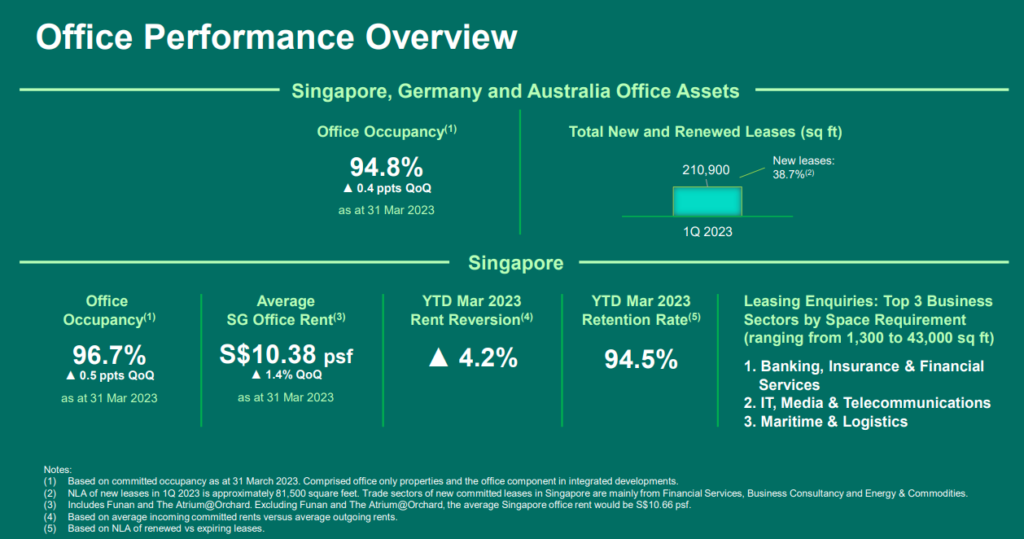

2. Office portfolio remains resilient

The office division also demonstrated strong performance, with high occupancy rates of 94.8% across CICT’s Singapore, German, and Australian office assets, and nearly 211,000 square feet of renewed leases.

The Singapore office segment boasted an even higher occupancy rate of 96.7% and an impressive retention rate of 94.5%.

The strong office asset performance also boosted gross revenue and NPI.

Source: CICT’s Q1 2023 Business Update

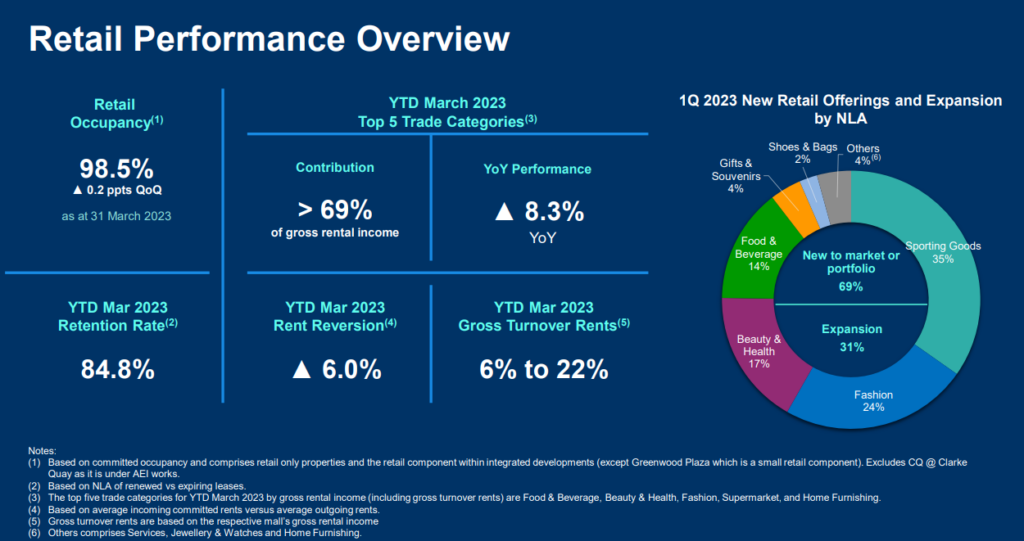

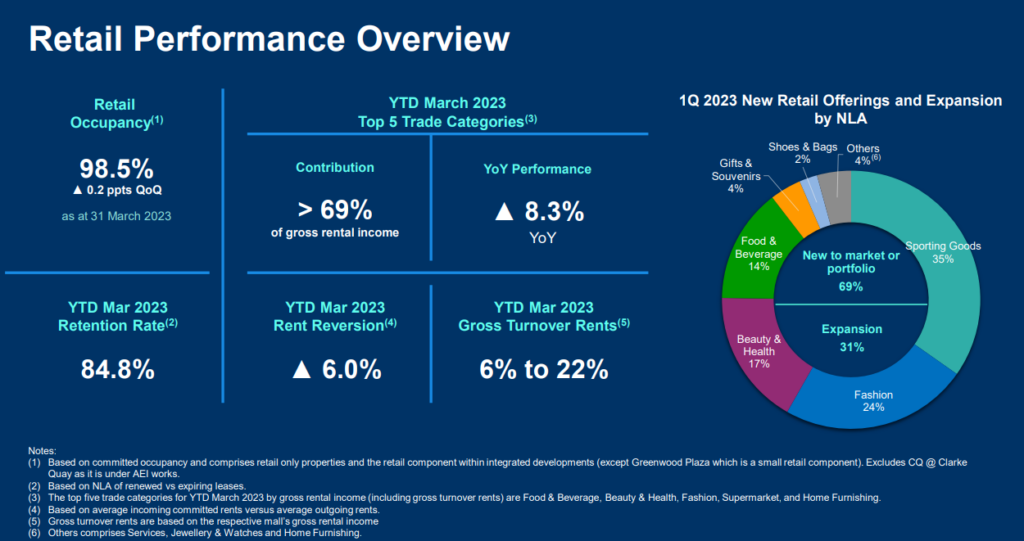

3. Retail recovery continues

The retail division is experiencing a healthy recovery as international borders reopen and air travel resumes.

Retail occupancy remained high at 98.5% as of 31 March 31 2023, and the retention rate was close to 85%.

With more tourists visiting Singapore, downtown malls experienced better rental reversion rates (7.2%) compared to suburban malls (5.3%).

Downtown malls also enjoyed a 20.3% YoY increase in shopper traffic and a nearly 30% YoY increase in tenant sales, highlighting the benefits of tourism.

Source: CICT’s Q1 2023 Business Update

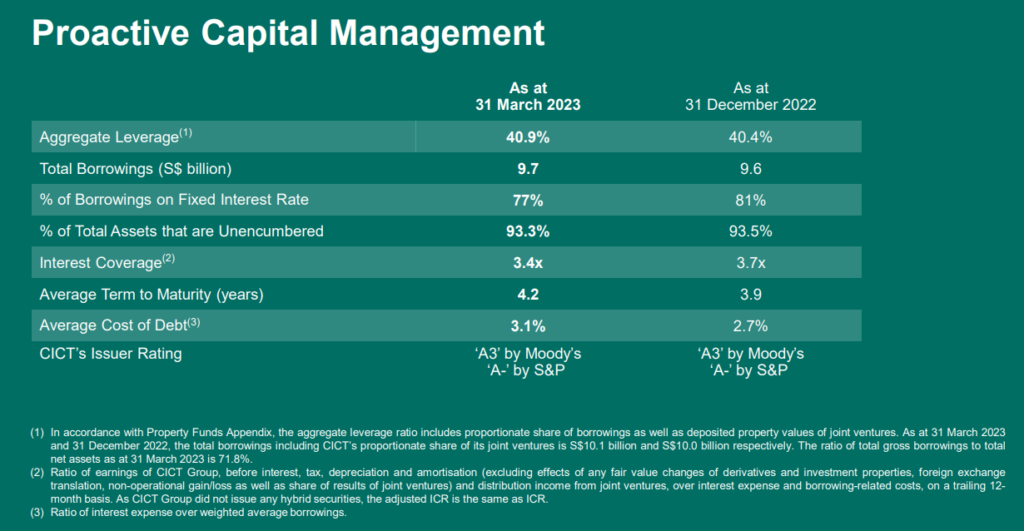

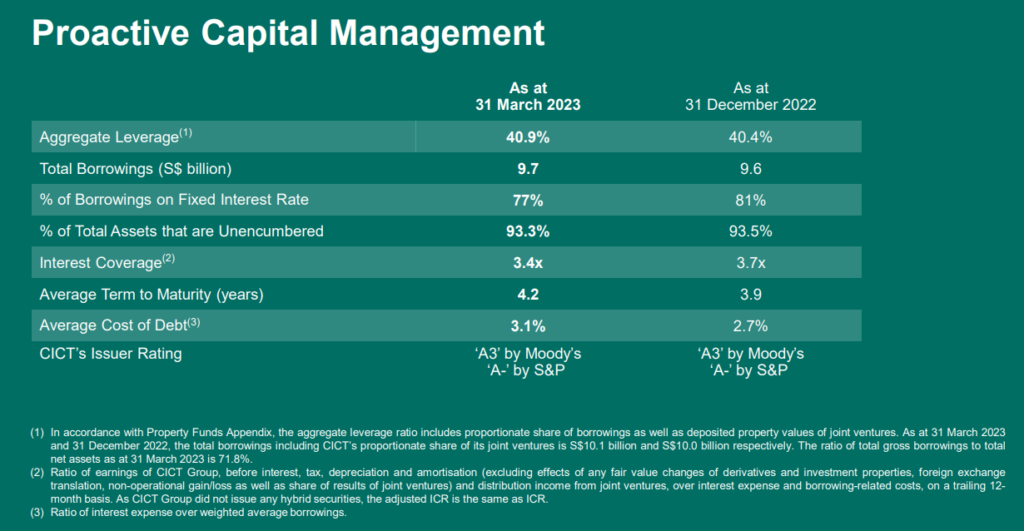

4. Rising gearing level and average cost of debt

Source: CICT’s Q1 2023 Business Update

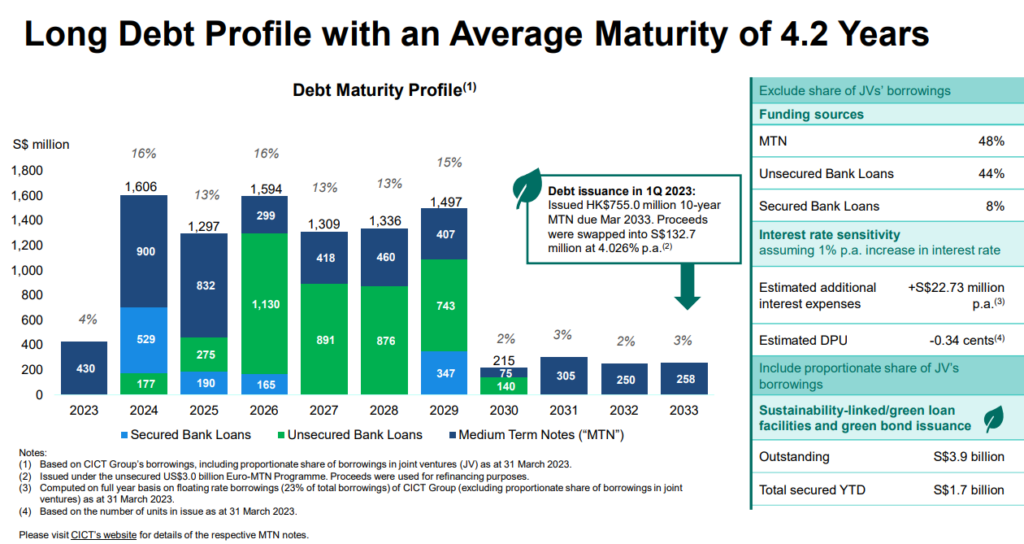

One of the concerns from CICT’s business update was the rising gearing level and cost of debt.

As of 31 March 2023, the REIT’s gearing level stood at 40.9%, which has increased again from the previous quarter.

A year ago its gearing level was at the 39.1% level.

Another thing to note is the increase in its cost of debt to 3.1% in Q1 2023 from 2.3% a year ago.

While I believe the positive rental reversion could help manage the rising cost of debt, investors should keep an eye on how the debt profile evolves, especially in the rising interest rate environment.

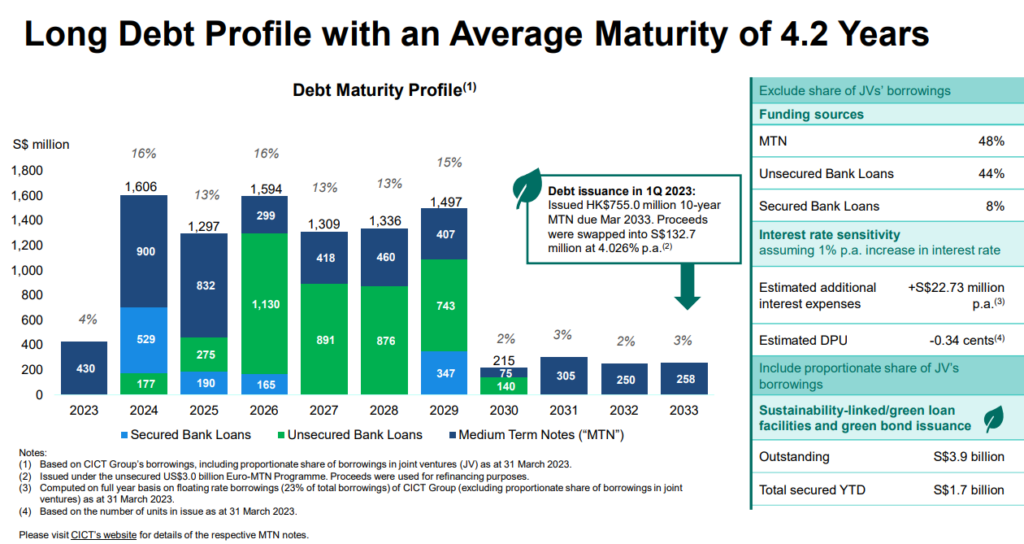

One positive takeaway from this is the proactive management of debt by the management.

CICT has a long debt profile with an average maturity of 4.2 years, which will provide some stability to the REIT.

Source: CICT’s Q1 2023 Business Update

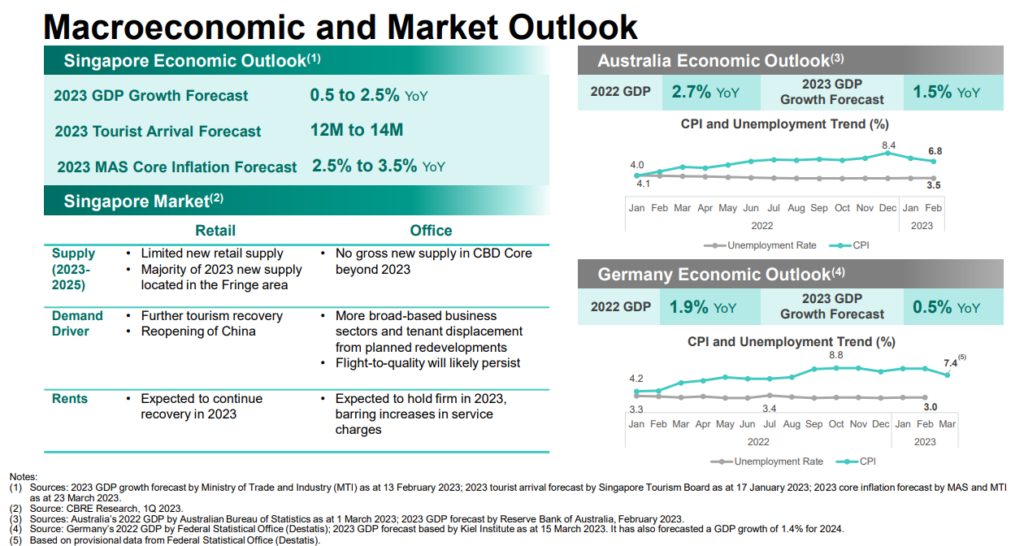

5. Strong retail recovery and resilient office market

Source: CICT’s Q1 2023 Business Update

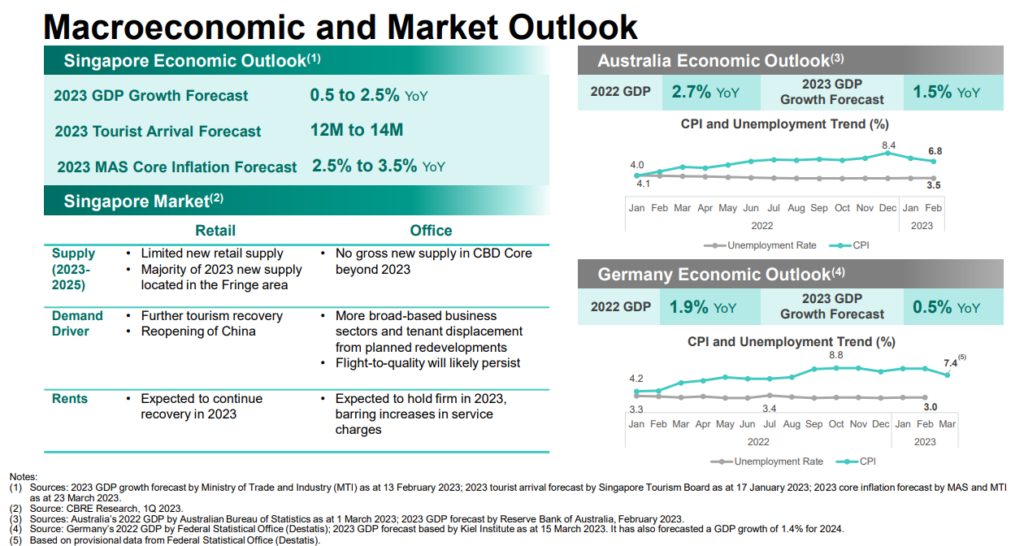

CICT is expected to maintain its earnings momentum with a strong retail recovery and resilient office market in Singapore.

Australia and Germany are also expected to maintain positive economic growth for 2023, albeit at a slower rate from 2022.

Strong financial performance will lead to increase in DPU

With a strong occupancy rate of 96.2% in Q1 2023, healthy weighted average lease expiry (WALE) of 3.7 years and positive rental reversions of 6% and 4.2% for both the retail and office divisions, respectively, CICT should see strong financial performance for H1 2023 given the outlook and guidance provided by management.

The stronger financial performance is likely to lead to a higher distribution per unit (DPU) for investors.

Disclaimer: ProsperUs Investment Coach Billy Toh doesn’t own shares of any companies mentioned.