5 Key Highlights from Tesla’s Q1 2023 Earnings

April 21, 2023

Electric vehicle (EV) giant Tesla Inc (NASDAQ: TSLA) reported its Q1 FY2023 results, which saw a decline of more than 20% in its earnings during the quarter.

Investors reacted negatively to the results as Tesla’s share price was down by 6% in after-hours trading on Wednesday (20 April).

This came amid concern about the downward pressure on margins with the continued aggressive price cuts by Tesla into the first quarter of the year.

So, for Tesla stock investors here are five key highlights that you should know from the EV maker’s Q1 earnings.

1. Revenue surged by 24%

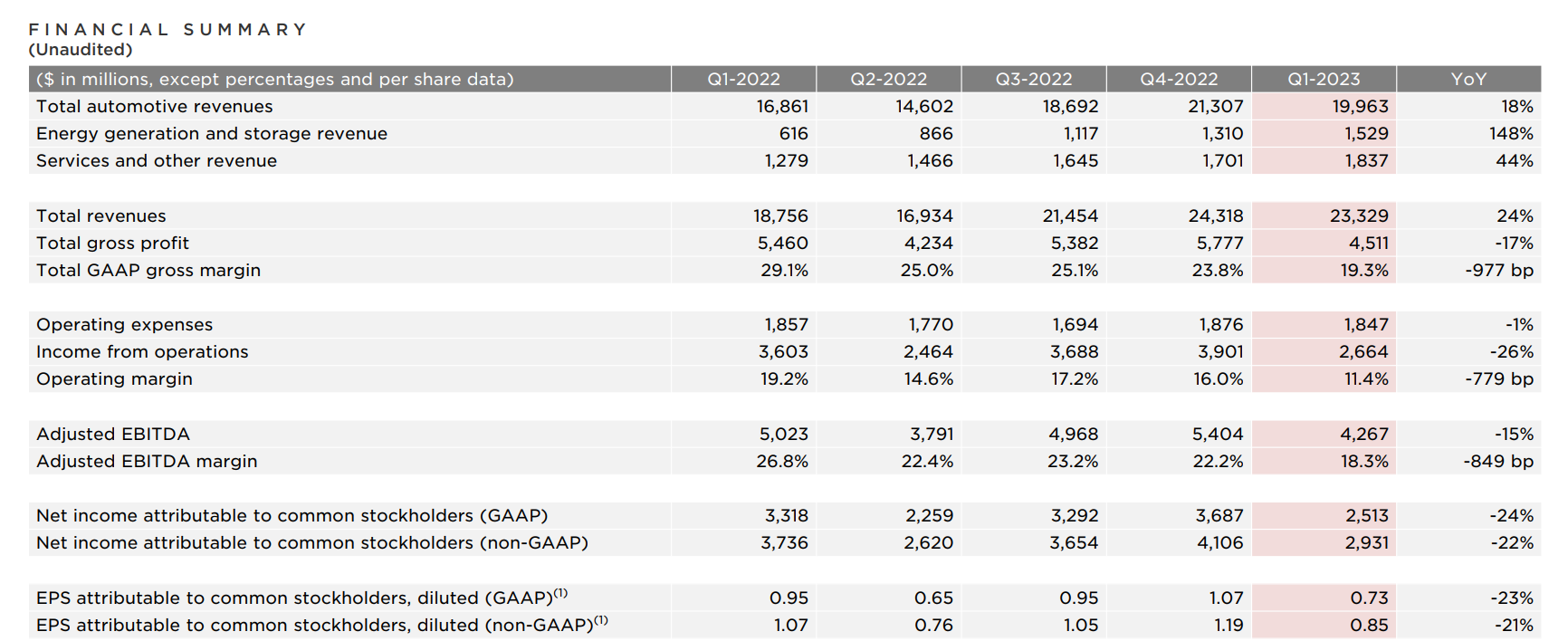

Tesla’s revenue for Q1 FY2023 jumped by 24% year-on-year (yoy) to US$23.33 billion, in line with Wall Street’s consensus estimate of US$23.21 billion.

Source: Tesla’s Q1 2023 Update

Revenue growth was propelled by an uptick in vehicle deliveries and expansion in its energy generation and storage business segment.

Its automotive segment revenue rose by 18% to US$19.96 billion while energy generation and storage revenue skyrocketed by 148% to US$1.53 billion.

This growth was fuelled by a 360% surge in energy storage capacity deployments to a record 3.89 gigawatt hours (GWh) and a 40% increase in solar power deployments to 67 megawatts (MW).

Services and other revenue climbed by 44% to a record US$1.84 billion, led by growth in used car and part sales as well as a boost in paid usage of Superchargers.

2. Strong growth in vehicle production and deliveries

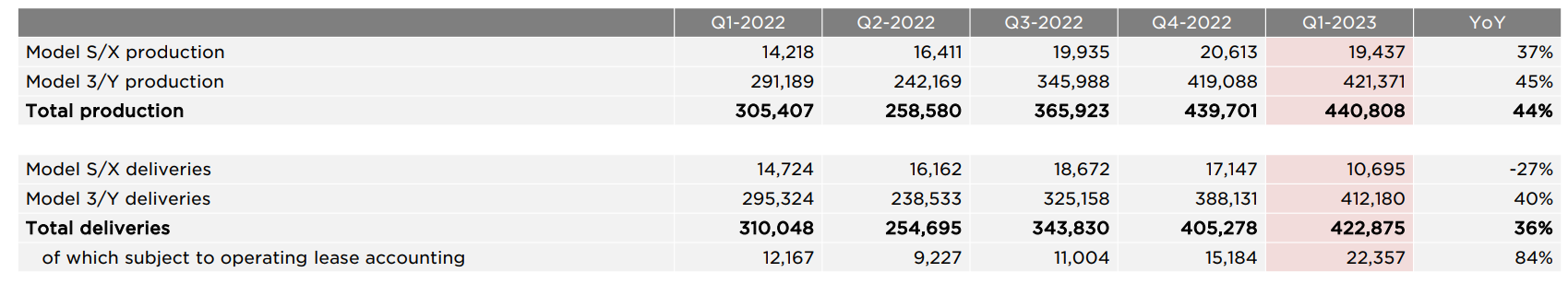

During Q1 FY2023, Tesla manufactured 440,808 vehicles, representing an increase of 44% from a year ago.

Meanwhile, Tesla delivered 422,875 vehicles during the quarter, reflecting a 36% yoy growth.

Source: Tesla’s Q1 2023 Update

3. Sharp decline in auto segment gross margin

One of the key highlights during the quarter was the decline in Tesla’s automotive gross margin.

It is something that analysts had been looking forward to given Tesla’s aggressive price reductions currently.

The EV maker’s automotive segment gross margin was down to 21.1% as compared to 32.9% reported in Q1 FY2022.

It was also a further deterioration from the 25.9% automotive gross margin reported in Q4 FY2022.

However, Tesla’s auto gross margin remains higher than other automakers.

This means that the EV maker has strong pricing power as compared to its competition and the current price reductions could strengthen its market share and put pressure on competitors.

In line with the lower margin, Tesla’s operating income was down by 26% yoy to US$2.7 billion during Q1 FY2023.

4. Operating cash flow declined by 37%

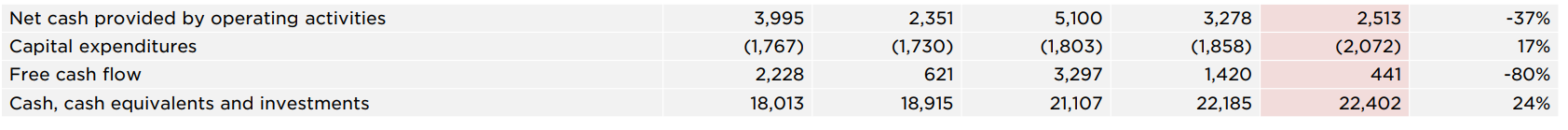

In line with the weaker financial performance in Q1 FY2023, operating cash flow fell by 37%.

The quarter’s operating cash flow saw a 37% yoy reduction to US$2.5 billion as free cash flow plunged by 80% to $441 million.

Tesla concluded the quarter with US$22.4 billion in cash, cash equivalents, and short-term investments, reflecting a 24% increase from the same quarter last year and a 1% rise from the previous quarter.

Source: Tesla’s Q1 2023 Update

5. Supercharger stations grew by 33%

One of the positive takeaways from Tesla’s Q1 earnings results is the steady expansion of its Supercharger station network.

By the end of Q1 FY2023, Tesla had 4,947 stations, a 33% increase from the same period last year. Supercharger connectors saw a 34% yoy growth, totalling 45,169.

Tesla’s aggressive price war could stimulate transition to EVs

Tesla’s Q1 FY2023 earnings reflect the weakness that the market had anticipated amid the current market environment and the aggressive price reductions adopted by Tesla.

One of the key downsides to the earnings is the weaker-than-anticipated automotive gross margin but overall, there were no significant surprises.

In fact, I believe Tesla’s decision to decrease prices will stimulate the transition and shift towards EVs and could prove to be beneficial to the EV maker in the long term.

Given its strong margin, cash flow and cash position, Tesla can afford the current pricing strategy given the potential lifetime value that a Tesla vehicle will add through autonomy, supercharging, connectivity, and service.

Disclaimer: ProsperUs Investment Coach Billy Toh doesn’t own shares of any companies mentioned.

Billy Toh

Billy is deeply committed to making investment accessible and understandable to everyone, a principle that drives his engagement with the capital markets and his long-term investment strategies. He is currently the Head of Content & Investment Lead for Prosperus and a SGX Academy Trainer. His extensive experience spans roles as an economist at RHB Investment Bank, focusing on the Thailand and Philippines markets, and as a financial journalist at The Edge Malaysia. Additionally, his background includes valuable time spent in an asset management firm. Outside of finance, Billy enjoys meaningful conversations over coffee, keeps fit as a fitness enthusiast, and has a keen interest in technology.