Bank stocks are one of the biggest beneficiaries of the rising interest rate environment. Luckily for Singapore investors, there are many listed banks here.

Given that interest rates are expected to rise further in the near term, my colleague Tim and I have recommended investors to allocate some of their stock holdings into Singapore’s big banks.

I think that one of the standouts of the Singapore banking stocks is DBS Group Holdings Ltd (SGX: D05).

In fact, in June this year, I wrote that investors should buy Singapore and Southeast Asia’s largest bank at a discount.

It was trading at S$30.15 at that time. Since then, the share price is up by 11.2% to its current price of S$33.54.

In the bank’s most recent earnings DBS recorded another solid quarter of earnings. Net profit was up by 7% with an increase in its net interest income (NII).

DBS is probably in the best position among the three largest banks in Singapore to benefit from higher interest rates in the second half of 2022.

DBS taking the lead towards low-carbon economy

Just this week, DBS has shown its leadership on the Environmental, Social, and Governance (ESG) front. This gives investors another reason to invest in the bank.

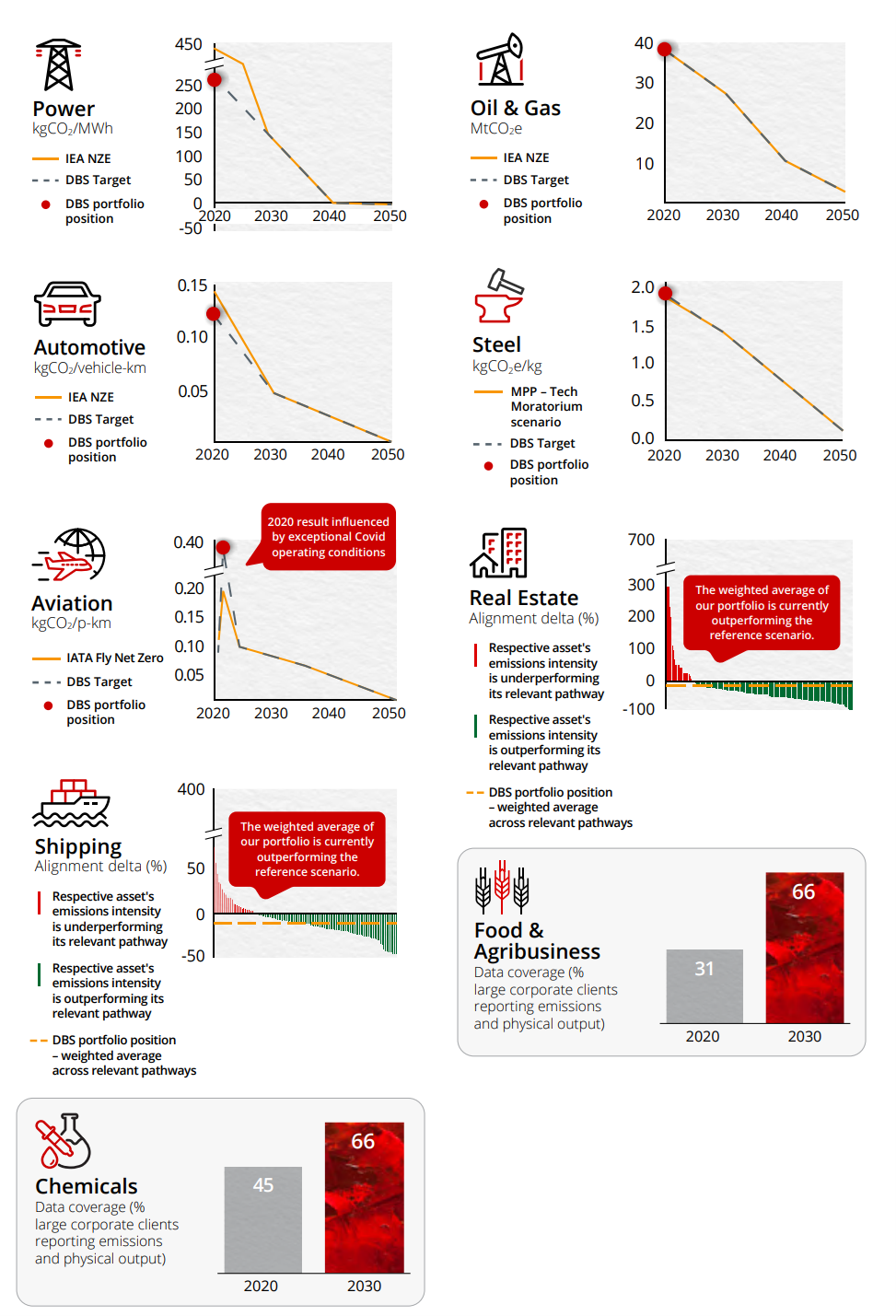

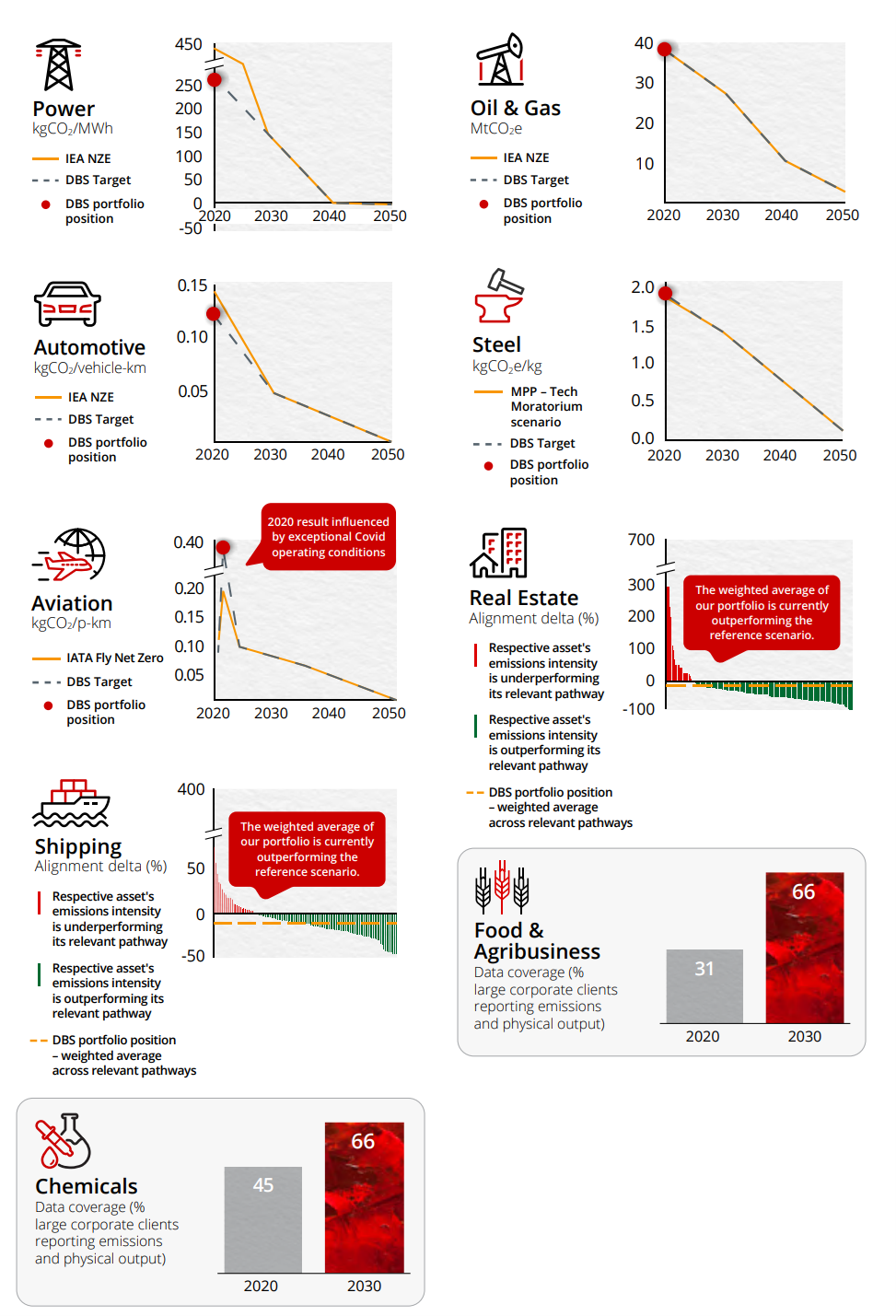

DBS announced that it has set decarbonisation targets in seven sectors that include power, oil & gas, automotive, aviation, shipping, steel and real estate.

The decarbonisation targets go beyond the bank’s institutional lending book and will cover capital market activities.

In addition, DBS has also set data coverage targets in two sectors; food and agribusiness as well as chemicals.

Source: DBS Group’s OUR PATH TO NET ZERO – Supporting Asia’s Transition to a low-carbon economy report

The nine sectors, which make up some 31% of the bank’s outstanding loans, represent the most carbon-intensive banking segments financed by DBS.

Among the seven decarbonisation targets set, six of them – namely the power, automotive, aviation, shipping, steel and real estate – are set as intensity metrics with the objective to achieve lower emissions per unit of output or activity.

These sectoral targets set by DBS are in alignment with science-based decarbonisation glidepaths in its report: “OUR PATH TO NET ZERO – Supporting Asia’s Transition to a Low-carbon Economy”.

ESG investing will continue to gain prominence

DBS is one of the leading banks in Southeast Asia and it is great to see the lender taking the lead to support Asia’s transition to a low-carbon economy.

It is worth noting that management recognised that the Group’s Net Zero ambition relies heavily upon the success of its clients in delivering their own transition plans.

However, with a clear and detailed roadmap and plan, DBS will be more proactive in providing its partners with financial advisory and transition finance solutions.

This will put DBS at the top in terms of ESG stock picks as the sustainable investing movement continues to gain prominence.

Disclaimer: ProsperUs Investment Coach Billy Toh doesn’t own shares of any companies mentioned.