2 Best Singapore REITs to Buy and Hold in the Second Half of 2022

August 17, 2022

In what’s been a pretty abysmal 2022 for most investors, there have still been some bright spots. One of them is the Singapore stock market.

While some other sectors – such as bank stocks – have performed well, Singapore’s REITs have done alright.

When compared to the over 10% year-to-date decline in the S&P 500 Index, the iEdge S-REIT Index’s 3% drop so far in 2022 looks relatively good.

So, as investors head into the second half of 2022, is it worth buying some REITs? I certainly think that all investors should have at least some exposure to REITs.

With that, here are two of the best Singapore REITs for investors to buy and hold in the second half of this year.

1. Frasers Logistics & Commercial Trust

For anyone looking for exposure to a reliable industrial REIT, there’s always Frasers Logistics & Commercial Trust (SGX: BUOU) – also known as “FLCT”.

The REIT owns 105 properties across five developed countries; Singapore, the UK, Australia, the Netherlands, and Germany.

More than two-thirds of its gross rental income (GRI) comes from properties in the logistics and industrial (L&I) segment.

The remainder of GRI comes from CBD commercial and office & business park properties.

In its latest Q3 FY2022 (for the three months ending 30 June 2022) business update, the REIT saw its overall occupancy rate hit 96.5%.

That was up from 96.1% at the end of March 2022. Moreover, its L&I properties remain fully occupied.

During the quarter, the REIT renewed 173,087 square metres of leases – with an average uplift of 9.9% in rents. This was led mainly by its in-demand L&I segment.

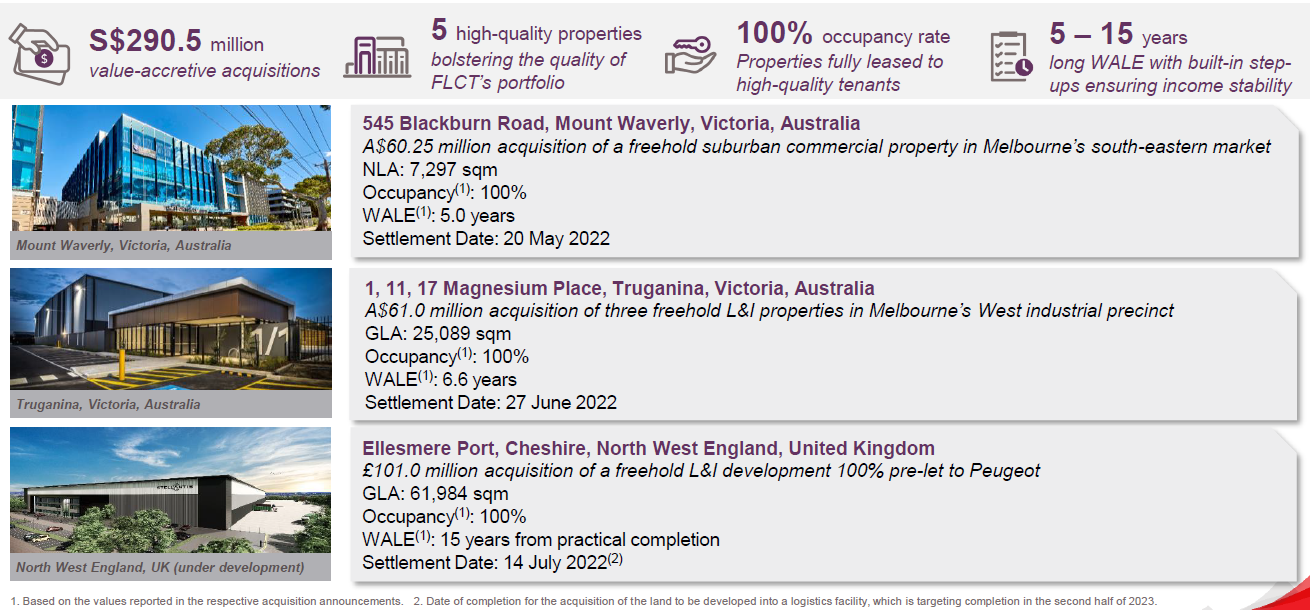

FLCT was also busy on the acquisition front. Over the latest three-month period, it acquired an extra five properties with long weighted average lease expiries (WALEs) (see below).

Source: Frasers Logistics & Commercial Trust Q3 FY2022 business update.

With 80% of its borrowings on fixed rates and boasting a low gearing ratio of only 29.2%, FLCT has plenty of flexibility to acquire further accretive properties.

It has already paid down S$493 million of borrowings with the proceeds of its divestment of Cross Street Exchange. That sets it up perfectly for the rest of 2022.

With a H1 FY2022 distribution per unit (DPU) of 3.85 Singapore cents, FLCT shares are giving investors a 12-month forward dividend yield of 5.3%.

2. Lendlease Global Commercial REIT

Second is Lendlease Global Commercial REIT (SGX: JYEU). It’s often touted as a favourite among retail investors that are looking for reliable yield.

That’s because the assets it owns are familiar to all Singaporeans. Lendlease REIT has three properties, two of which we should all have heard of.

It owns 313@somerset and Jem in Singapore. Its final asset is a collection of three commercial buildings named Sky Complex in Milan, Italy.

The REIT came out with its second-half FY2022 (for the six months ending 30 June 2022) earnings.

Having just completed its Jem acquisition in the first few months of 2022, the REIT saw its net property income (NPI) skyrocket by 72.9% year-on-year to S$45.9 million.

Meanwhile, its DPU for the second half came in 4.9% higher year-on-year at 2.45 Singapore cents.

With no debt due until FY2024, and a healthy interest coverage ratio (ICR) of 9.2 times, Lendlease REIT is poised to continue performing.

That’s because its assets are some of the key beneficiaries of the continued reopening of Singapore and the recovery in consumer sentiment.

With a 12-month forward dividend yield of 6.0%, Lendlease REIT offers Singaporean investors a way to generate passive income from the local economy’s recovery.

Buying into strong assets

As dividend investors think about appropriate REITs in Singapore, it’s important to remember about the REIT’s prospects.

In that sense, REITs’ ability to pay out distributions should be a priority for those looking for income.

Given both those considerations, Frasers Logistics & Commercial Trust and Lendlease Global Commercial REIT should be top REITs to consider buying and holding for the rest of 2022.

Disclaimer: ProsperUs Head of Content & Investment Lead Tim Phillips doesn’t own shares of any companies mentioned.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.