2 Singapore REITs I’d Buy Right Now With $1,000

May 23, 2023

After the latest earnings season from Singapore’s REITs, it might be understandable that investors aren’t that optimistic.

That’s because many REITs are being negatively impacted by rising interest rates, which makes funding more expensive.

As a result, many Singapore REITs are having to cut their dividends, or distributions. However, that’s not the case for all of them.

With uncertainty on the horizon for the global economy, it’s worth thinking about picking up REITs on the SGX market that are strong and still able to grow without taking on too much leverage.

Given that, here are two Singapore REITs I’d buy right now with S$1,000.

1. Mapletree Logistics Trust

For those of us who like Straits Times Index component stocks, then Mapletree Logistics Trust (SGX: M44U) is as sturdy as they come.

The REIT, an STI member, owns 185 logistics and industrial properties across Singapore, Hong Kong, Mainland China, Australia, Japan, South Korea, Vietnam, Malaysia, and India.

It’s also super well diversified across its various income streams, with a tenant base numbering 887. In fact, its number one tenant – in terms of gross revenue – only contributes around 4.4% to Mapletree Logistics Trust’s top line.

The REIT’s most recent Q4 FY2023 earnings were also positive with its quarterly distribution per unit (DPU), or dividend, flat year-on-year at 2.268 Singapore cents.

However, on a like-for-like basis, if we used Q4 FY2022 exchanges rates, Mapletree Logistics Trust’s DPU would have risen 3.3% year-on-year.

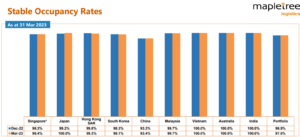

From a portfolio occupancy perspective, the REIT’s occupancy rate was stable over the quarter (see below).

Source: Mapletree Logistics Trust Q4 FY2023 and FY2023 earnings presentation

This implies that tenants find its properties as highly sought after and that the broader Asian region continues to see robust demand for logistics properties.

Testament to that is Mapletree Logistics Trust’s recent deal announcement to buy eight logistics properties in Japan, South Korea, and Australia.

With a unit price of S$1.66, investors could buy around 600 units for S$1,000. At its current price, Mapletree Logistics Trust shares are offering dividend investors a yield of 5.5%.

2. Parkway Life REIT

Up next is reliable healthcare-focused Parkway Life REIT (SGX: C2PU).

This healthcare REIT has been one of the best long-term REIT compounders listed on the SGX. That’s because it operates in a space that delivers a necessity – healthcare.

The REIT does this via its Parkway Life hospitals in Singapore and its array of nursing homes in Japan.

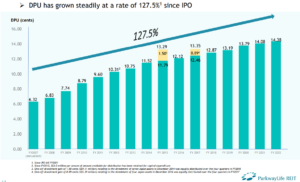

Additionally, the REIT has been a master at controlling the rate of dividend growth to ensure it’s sustainable.

That means, although while it may be slow-growing, its full-year ordinary dividend has never been cut since the REIT first went public (see below).

Source: Parkway Life REIT Q1 2023 business update

And that track record is likely to continue as the REIT posted a Q1 2023 DPU that was up 2.5% year-on-year to 3.65 Singapore cents.

Investors should be reminded that Parkway Life REIT pays out its dividend twice a year – so on a semi-annual basis. Yet, this slight uptick in the first quarter DPU bodes well for the H1 2023 distribution payout.

With long-term leases and very visible cash flows into the future, it’s no surprise that Parkway Life REIT trades at a price-to-book (PB) ratio of 1.7 times – expensive by REIT standards.

However, it has proven to be a long-term winner. With S$1,000, investors can buy 200 shares of Parkway Life REIT now and still have over S$200 left over.

At its current unit price, Parkway Life REIT offers REIT investors a 12-month forward dividend yield of 3.8%.

Buying into consistent S-REITs for the long term

For long-term investors, it’s important to remember that Singapore REITs are primarily there for their reliable and consistent income generation.

With Mapletree Logistics Trust and Parkway Life REIT, those of us who loves reliable dividends should be able to hold these and sleep well at night.

Disclaimer: ProsperUs Head of Content & Investment Lead Tim Phillips owns shares of Mapletree Logistics Trust and Parkway Life REIT.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.