2 Top Singapore Office REITs to Buy for the Rest of 2022

May 17, 2022

Singapore real estate investment trusts (REITs) have had a rough 2022 so far as interest rates rise in the US and inflation skyrockets across the world.

Yet, as dividend investors, we shouldn’t be put off buying into Singapore REITs entirely – just because conventional wisdom suggests that rising rates is “bad” for the asset class.

That’s not necessarily true, as I’ve written about before, as REITs can actually provide some protection against inflation.

In Singapore, the reopening of the local economy has indeed created its own opportunities – that function separately to the issues raging in the global economy.

One of these positive trends unfolding is the “return to office”, which is taking place as employees return to spending more of their working week in the office.

That’s obviously benefitting specific office REITs in Singapore. With that in mind, here are two top office S-REITs that investors can consider buying for the rest of 2022.

1. Keppel REIT

One of the oldest Singapore-listed REITs, office-focused Keppel REIT (SGX: K71U) is a stalwart of the local commercial property scene.

The REIT owns 11 properties across Singapore, Australia and South Korea, with nearly 80% of its S$8.9 billion in assets under management (AUM) residing in the Lion City.

Keppel REIT owns iconic local office properties in the CBD, such as Marina Bay Financial Centre, Ocean Financial Centre and One Raffles Quay.

With people returning to the office in Singapore, Keppel REIT has seen an improvement in its business recently.

In the first quarter of 2022, Keppel REIT saw net property income (NPI) hit S$44.2 million, up 8.6% year-on-year while distributable income from operations was up 4.3% year-on-year to S$53.8 million.

Even better, was that its all-in interest rate came down during the quarter, to 1.81% from a previous 2.01%.

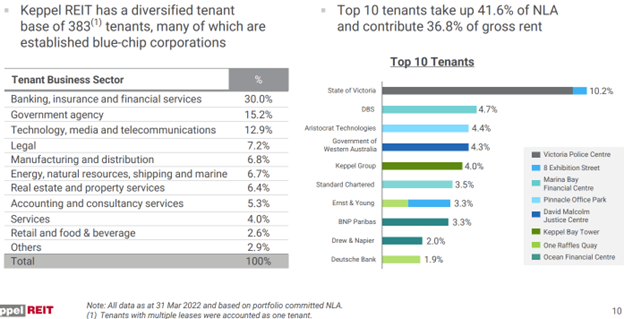

In terms of its tenant profile, Keppel has strong occupants renting out its space.

Its top 10 tenants – as of 31 March 2022 – contribute over one-third of its gross rent while the financial services sector makes up 30% of its tenant base (see below).

Source: Keppel REIT Q1 2022 business update

Finally, its portfolio’s weighted average lease expiry (WALE) is a solid 6.1 years with the WALE for its top 10 tenants doing even better, coming in at 10.7 years.

With a solid outlook for Singapore’s Grade A office space for the rest of this year, Keppel REIT is set to continue offering investors an interesting re-opening opportunity.

With Keppel REIT units trading at S$1.15, it’s offering income investors a trailing 12-month dividend yield of 5.1%.

2. Mapletree Commercial Trust

Second on the list is Mapletree Commercial Trust (SGX: N2IU), also known as “MCT”, which recently announced that it planned to merge with fellow Mapletree REIT Mapletree North Asia Commercial Trust (SGX: RW0U).

While there’s a lot for investors to pore over regarding the deal, Mapletree Commercial Trust’s own office business continued to perform well.

MCT does own large shopping centre VivoCity but it also has commercial properties such as Mapletree Business City I and II, Mapletree Anson and Bank of America HarbourFront.

The REIT was hit hard by the Covid-19 pandemic but the fiscal year 2021/2022 (for the 12 months ending 31 March 2022) saw it regain a sense of normalcy.

MCT’s occupancy rate as of 31 March 2022 rose to 94.3%, from 92.5% at the end of 2021, yet its “committed occupancy” actually stood at an even healthier 97.0% level.

For the FY21/22, the office/business park segment of its portfolio saw a retention rate (by NLA) of 87.9%, much better than the retail segment’s 78.6% retention rate.

With Alphabet Inc’s (NASDAQ: GOOGL) Google Asia Pacific unit making up 10.5% of MCT’s gross rental income, the REIT is also geared towards Singapore being a hub for tech talent.

One thing to note for long-term investors is that the proposed merger with Mapletree North Asia Commercial Trust will mean that the combined entity will have exposure to commercial and retail properties in Hong Kong and China.

With MCT units trading around S$1.81, it’s offering investors a trailing 12-month dividend yield of 5.3%.

Investing in Singapore’s office space

For dividend investors who love REITs, it’s worth having some exposure to various sectors within the local S-REIT market.

That’s why the re-opening of Singapore’s local economy and the “return to office” theme means that Keppel REIT and Mapletree Commercial Trust are two top office REITs to think about investing in for the remainder of 2022.

Disclaimer: ProsperUs Head of Content & Investment Lead Tim Phillips doesn’t own shares of any companies mentioned.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.