3 Best-Performing and Sustainable Straits Times Index Stocks So Far in 2023

September 13, 2023

In Singapore, investors are spoiled for choice when it comes to quality companies listed on the Singapore Exchange (SGX).

Many are mature businesses that throw off dividends to shareholders. However, many investors may not be aware that there are also ample growth opportunities available in the Singapore stock market.

One of those relates to “sustainability” or those companies that are putting sustainability and ESG at the centre of their business models.

Singapore is well-documented as being a country that is keen on growing its status as an Asian hub for sustainability as the world transitions to lower carbon emissions and “Net Zero”.

According to SGX Research, the Straits Times Index (STI) has delivered a total return of 3.0% in 2023 (up to 8 September) but it found that many sustainability-focused businesses listed on the SGX have easily outperformed the benchmark index in 2023.

Furthermore, SGX also found that the top three “sustainable” STI stocks listed on the SGX averaged total returns of +46.5% in 2023.

So, with that, here are the three top-performing Straits Times Index Stocks (so far in 2023) that also happen to have a core sustainability focus.

1. Sembcorp Industries = +56% total return

Top of the list is renewable energy and sustainable solutions provider Sembcorp Industries Ltd (SGX: U96), which has delivered a total return of +56% so far in 2023.

The company is benefitting hugely from its “brown to green” transformation plan that aims to pivot its business away from its reliance on natural gas and towards sustainable solutions.

The firm has already made great progress on its 2025 goal of acquiring 10.0 gigawatts (GW) of renewable energy capacity.

Indeed, its current generating capacity of over 11.0 GW (mainly from acquiring China- and India-based wind and solar assets) has surpassed its 2025 target and a new target is likely to be announced at its Investor Day in November.

Sembcorp Industries has a goal to generate 70% of its net profit from “sustainable solutions” by 2025 and in H1 2023 it managed to generate 27% of net profit from this segment.

Clearly, the runway for growth is there for the company. Sembcorp Industries also raised its H1 2023 interim dividend by 25% to 5.0 Singapore cents.

2. Keppel Corp = +51% total return

In second spot is Keppel Corporation Ltd (SGX: BN4), the former conglomerate that has reoganised itself into a business focused on three segments; fund management, operating platform, and investment platform.

As a result, the company has also grown it assets in sustainable urban renewal and clean energy infrastructure.

To that end, Keppel’s renewable energy capacity has grown to over 3.0 GW, making up over 60% of its total energy portfolio, according to SGX Research.

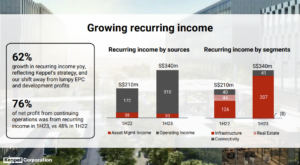

Additionally, this focus on acquiring and operating real infrastructure assets is also aiding in the company growing its recurrent income stream.

As investors can see below, its new strategy has helped boost its infrastructure segment’s recurring income in H1 2023 by a substantial margin.

Source: Keppel Corp’s H1 2023 earnings presentation

3. Yangzijiang Shipbuilding = +32% total return

Finally, in third spot is Yangzijiang Shipbuilding Holdings Ltd (SGX: BS6), which is a shipbuilding and marine engineering firm.

The company reported strong H1 2023 earnings that saw revenue rise 16% year-on-year to RMB 11.3 billion (S$2.1 billion).

Meanwhile, its profit after tax and minority interest (PATMI) saw an even bigger boost as it soared 47% year-on-year in H1 2023 to RMB 1.7 billion.

In terms of its order wins, it H1 2023 order wins of US$5.76 billion is already nearly double its initial FY2023 target of US$3 billion.

The shipping industry is a notoriously dirty one as well, which is why Yangzijiang eyes an opportunity for clean and profitable growth.

Indeed, of its total US$14.7 billion orderbook, clean energy vessels account for 56% of the total.

Sustainability and Singapore stocks for the long term

As we all know, the transition to sustainable practices is one that will take many years – even decades – to achieve.

However, some companies in Singapore are starting to pivot earlier than others. In this scenario, more sustainability-focused stocks could establish a long-term advantage.

As Sembcorp Industries, Keppel Corp, and Yangzijiang Shipbuilding have proved, this could also potentially lead to better shareholder returns.

Disclaimer: ProsperUs Head of Content & Investment Lead Tim Phillips doesn’t own shares of any companies mentioned.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.