5 Things REIT Investors Should Know About Mapletree Pan Asia Commercial Trust’s Latest Earnings

February 1, 2023

The unit prices of Singapore’s REITs have been on a tear since the beginning of 2023, given hopes of a slower interest rate hiking cycle.

While the US Federal Reserve is actually set to announce its latest interest rate hike later today (1 February), Singapore REITs have been busy releasing their latest earnings.

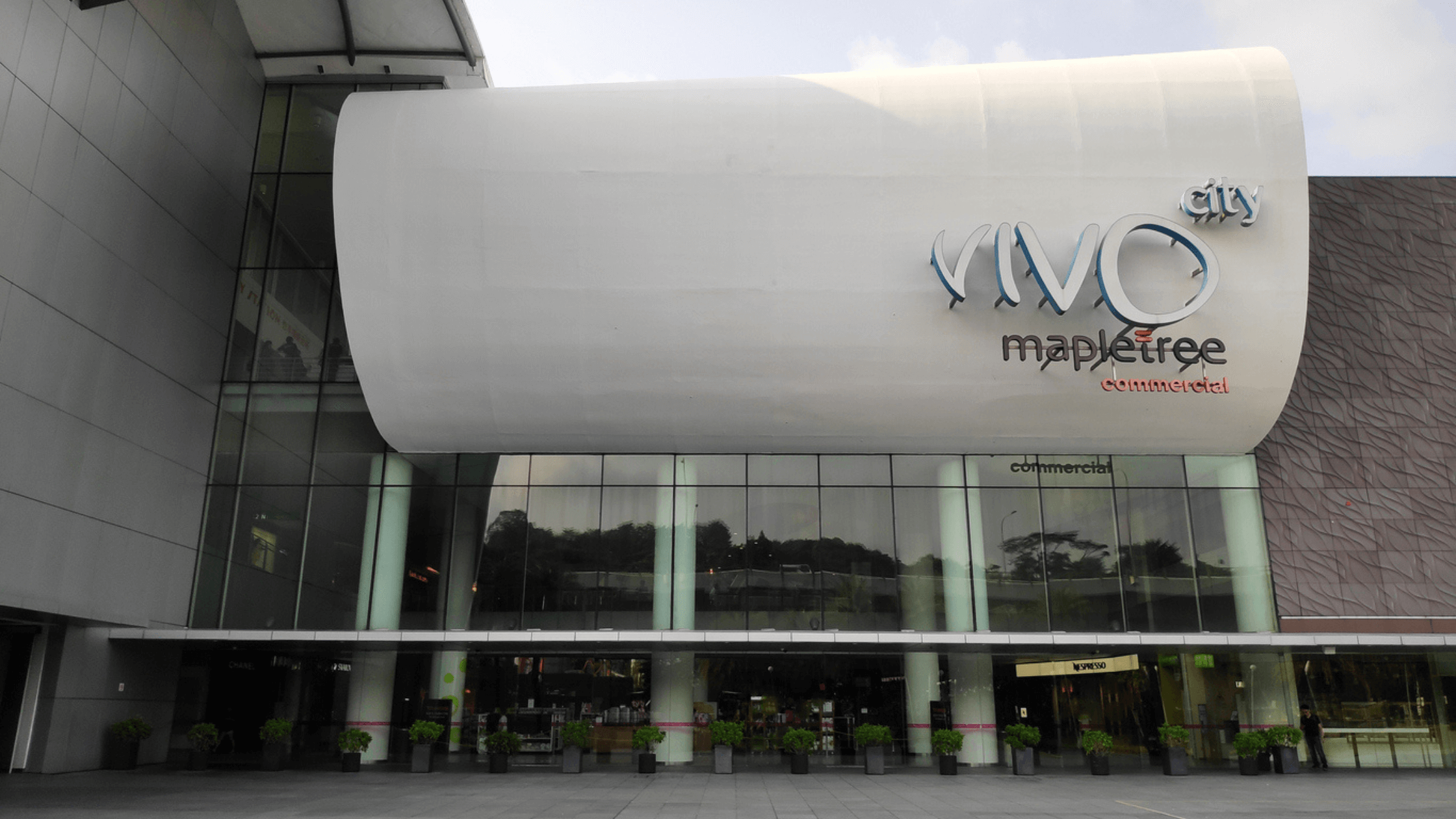

One of the biggest REITs in Singapore, and probably one of the most recognisable for investors and consumers alike, is Mapletree Pan Asia Commercial Trust (SGX: N2IU).

The heavyweight retail and commercial REIT owns multiple properties across Asia, including key Singapore assets like VivoCity and Mapletree Business City.

So, for dividend and S-REIT investors keen to see how retail is faring, here are five things they should about Mapletree Pan Asia Commercial Trust’s latest Q3 FY22/23 earnings (for the three months ending 31 December 2022).

1. DPU stagnant on higher funding costs

Mapletree Pan Asia Commercial Trust, also known as MPACT, saw both gross revenue and net property income (NPI) surge by 84% and 76.8%, respectively, to S$239.7 million and S$179.3 million.

This was down to the full-quarter contribution from the properties acquired in the merger between Mapletree Commercial Trust and Mapletree North Asia Commercial Trust that resulted in MPACT being formed.

Yet the key distribution per unit (DPU) number for the Q3 FY22/23 period was flat year-on-year at 2.42 Singapore cents.

However, for its 9M FY22/23 period, the DPU was up 8.1% year-on-year to 7.36 Singapore cents.

The flat DPU for the quarter was mainly due to higher finance costs, which jumped a whopping 184% year-on-year to S$50.3 million – an indication that no REIT is being spared from the impact of higher rates.

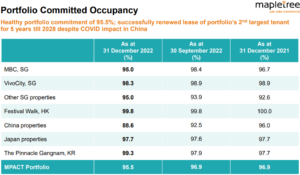

2. Portfolio’s committed occupancy drops to 95.5%

The retail and commercial REIT managed to record a portfolio committed occupancy rate of 95.5% as of 31 December 2022.

However, this was down from its portfolio’s committed occupancy rate of 96.9% as of 30 September 2022.

Most of this drop came from Mapletree Business City, where committed occupancy fell to 95.0% from 98.4% as of the prior quarter.

There was also a bit of weakness in VivoCity’s committed occupancy which, while still healthy at 98.3%, was down slightly from the 98.9% as of the end of September 2022.

This was partially offset by a rise in the committed occupancy rate of The Pinnacle Gangnam, MPACT’s sole Korean property (see below).

Source: Mapletree Pan Asia Commercial Trust’s Q3 FY22/23 earnings presentation

3. Positive rental reversions in all markets except Greater China

The good news for MPACT was the its rental reversion rates for its 9M FY22/23 period (for the nine months ending 31 December 2022) was broadly positive.

In fact, rental reversions were positive across all properties except those in Greater China, given the impact of prolonged Covid-19 restrictions.

VivoCity saw positive rental reversion of +7.9% while The Pinnacle Gangnam boasted a strong positive rental reversion of +14.2% for 9M FY22/23.

While Hong Kong’s Festival Walk saw negative rental reversions of -12.7%, this is likely to reverse at some point now that both Hong Kong and China are open again.

4. Portfolio WALE of 2.6 years

A portfolio’s weighted average lease expiry (WALE) is important as it gives investors a good idea of the lease expiries coming up and how long the income visibility stream is.

For MPACT, it’s portfolio’s overall WALE is 2.6 years, with the retail portion of its portfolio coming in at 2.1 years and its office/business park portion having a WALE of 2.9 years.

As readers can see below, its lease expiries are well-staggered over the next three or four fiscal years.

It’s also perhaps positive that around 13.1% of retail leases are coming up in FY23/24 – just in time for what should be a robust recovery in the retail sector in Hong Kong and China.

Source: Mapletree Pan Asia Commercial Trust’s Q3 FY22/23 earnings presentation

5. Gearing ratio of just over 40%

For any REIT, managing its debt profile and gearing ratio in this rising interest rate environment has never been more important.

As of 31 December 2022, MPACT has a gearing ratio of 40.2%, which was marginally higher than the 40.1% as of the end of September 2022.

That’s a higher gearing ratio than most S-REITs at the moment but MPACT also has 78.3% of its overall debt on fixed rates, which can help mitigate some of the uncertainty around interest costs.

Meanwhile, it has a relatively well spread-out debt maturity profile. In the next 15 months, it has only 18% of its debt coming due.

MPACT to benefit from China reopening

While MPACT’s latest set of results was somewhat underwhelming, from the perspective of its Greater China portfolio, this should change in the coming months.

That’s because in addition to Festival Walk in Hong Kong, MPACT also has commercial and retail properties in Shanghai and Beijing.

While consumer spending in China is likely to be dampened in the early months, as the first wave of Covid-19 infections hit citizens, the recovery over the next six to nine months should be strong.

So, with a gearing ratio which does warrant monitoring, there’s still a lot optimism over potential positive rental reversion in Hong Kong and China in FY23/24.

At MPACT’s current price of S$1.80, dividend investors are being offered up a 12-month forward distribution yield of 5.4%.

Disclaimer: ProsperUs Head of Content & Investment Lead Tim Phillips doesn’t own shares of any companies mentioned.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.