Broker’s Call: Sasseur REIT’s Q2 Dividend Falls 1.6%, Maintain Add

August 16, 2022

CGS-CIMB Analyst take

China’s economy has had a rough 2022 with multiple lockdowns given its “Covid-Zero” strategy. So for investors in China have also suffered.

However, there will always be exceptions. In Singapore’s stock market, REITs with exposure to China have performed relatively well.

One such REIT is China-centric, retail-focused Sasseur REIT (SGX: CRPU). Sasseur owns four premium outlet malls in China; two in Chongqing, one in Hefei, and one in Kunming.

Sasseur REIT recently reported its Q2 and H1 2022 earnings. The research team at CGS-CIMB Securities maintains our “ADD” call and the S$1.06 target price for Sasseur REIT remains unchanged.

So, here’s what investors should know about the REIT’s latest earnings.

H1 2022 earnings driven by fixed rent and FX

First off, readers should be aware of Sasseur REIT’s unconventional business model. The REIT – unlike other retail REITs – operates via an entrusted management agreement (EMA).

Instead of collecting fixed rents from tenants, it pegs a portion of the rent to tenant sales. This better aligns the interests of the mall owner, entrusted manager, tenants, and the REIT’s unitholders.

However, there is also a portion of the REIT’s income that is fixed and that grows at a set rate of 3% each year.

For Sasseur REIT’s H1 2022, EMA-derived revenue expanded by 1.6% year-on-year to S$63.5 million.

Weaker Q2 2022 variable rent (tied to tenant sales) were offset by the 3% annual escalation in the fixed component as well as favourable foreign-exchange (FX) rates.

More importantly for dividend investors, the REIT’s distribution per unit (DPU) in H1 2022 was up 1.1% year-on-year. However, its Q2 2022 DPU was down 1.6% year-on-year to 1.588 Singapore cents.

This wasn’t anything unusual, though, as sales tend to be higher in the first quarter given the presence of large-scale sales events, such as Chinese New Year.

Leasing traction holding up well

On the leasing side, Sasseur REIT has a relatively short weighted average lease expiry (WALE) of just 1.1 years.

It started this year with 63.6% of leases – by gross rental income (GRI) – expiring in FY2022. Yet despite the macro uncertainty, tenant sentiment has remained upbeat.

As a result, 14.7% of GRI has been de-risked as of H1 2022 and there are pre-commitments already received for 92.6% of the remaining expiring leases.

Portfolio occupancy for Sasseur REIT improved to 96.0% as at 30 June 2022, from the 95.4% rate as at 31 March 2022.

Diversifying loan maturity

Sasseur REIT has 100% of its loans (around S$511 million) maturing in May 2023. With that lumpy debt expiry, it was good to understand that management is currently negotiating with new and existing lenders on refinancing these loans.

They’re aiming to refinance into two maturity dates, which should diversify its debt maturity profile.

Outside of that, the REIT has a low gearing ratio of 26.5%. That equates to an extra S$650 million of debt headroom (assuming a 45% gearing).

Meanwhile, its interest coverage ratio (ICR) remains healthy at 5.0x while new potential acquisition targets from its sponsor could drive inorganic growth.

How’s Sasseur REIT doing on ESG?

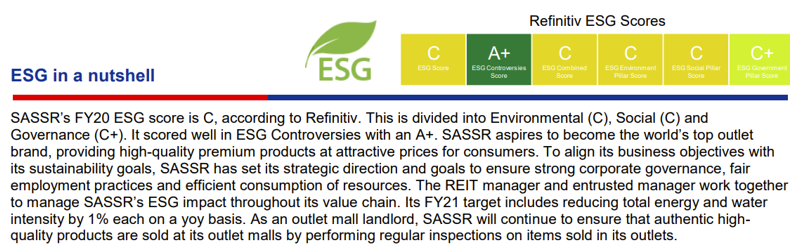

Source: CGS-CIMB Research

On the Environmental, Social and Governance (ESG) front, Sasseur REIT scores a “C” for its FY2020 performance. It’s rated D- on environmental innovation, D+ on community and D+ on shareholders.

The REIT has managed to achieve some success on the ESG front, by lowering its total energy consumption by 16.4% year-on-year and water intensity usage by 17.2% year-on-year in FY2020.

Sasseur REIT has also strengthened its annual report disclosures and was ranked 25th on Singapore Governance and Transparency Index 2020 (REITs and Business Trust category).

While not great on first glance, that’s still a huge improvement from its 45th place rank in 2019

Reiterate our Add rating

As for Sasseur REIT’s projections, we keep our DPU estimates unchanged for FY22-24 and maintain our target price of S$1.06 (shares currently trade for around S$0.79 apiece).

Potential upside catalysts could come from better-than-projected tenant sales and accretive acquisitions.

However, downside risks include a slowdown in discretionary consumption in China.

Disclaimer: CGS-CIMB Securities REITs Analyst Mun Yee Lock doesn’t own shares of any companies mentioned.