Dividend Alert: Buy Singapore’s Largest Bank at a Discount

June 28, 2022

The global stock market has been on a downtrend during the first half of 2022. That’s been clear to any investor.

While Singapore’s stock market has been relatively more stable given its tilt towards “value” names, it has not been immune to the broader selloff pressure in the market.

In fact, Singapore’s largest bank, DBS Group Holdings Ltd (SGX: D05), has seen its share price fall by 19.9% from its 52-week high of S$37.49 to its current share price of S$30.02.

I think that long-term investors who are looking for a defensive play – with a strong track record and resilient business model – should take this opportunity to buy into DBS. Here’s why.

Significant earnings upside with faster rate hikes

The US Federal Reserve’s (Fed) jumbo-size rate hike stirred worries of a potential recession and more volatile trading ahead. But in fact, DBS Group is one of the beneficiaries of faster rate hikes.

The US Fed’s Chairman, Jerome Powell, said during the most recent press conference that the US central bank will most likely raise interest rates by 50 or 75 basis points (bps) in July.

Since banks usually benefit from these rate hikes, as they can expand their net income margin (NIM), then DBS should benefit from this.

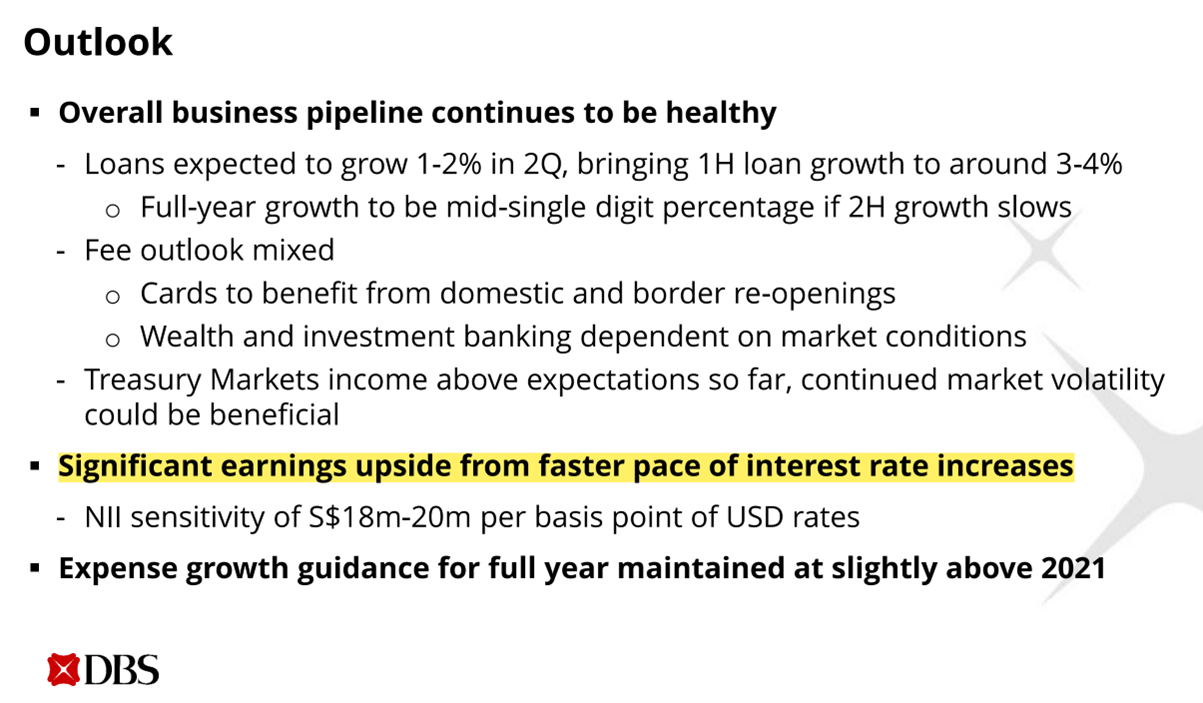

In fact, during the bank’s Q1 FY2022 earnings presentation in February, DBS management highlighted that the bank will see significant earnings upside from the faster pace of interest rate increases.

As was maintained by DBS CEO – Piyush Gupta – during the presentation, the bank has net interest income (NII) sensitivity of S$18 million to S$20 million per basis point of US Dollar (USD) rates.

This means that a 25-basis point increase in USD rates translates to an additional S$450 million to S$500 million of NII for DBS.

Source: Q1 FY2022 CEO Presentation

Source: Q1 FY2022 CEO Presentation

Strong earnings growth

Even without the upside potential from the interest rate hikes, DBS has maintained resilient earnings growth.

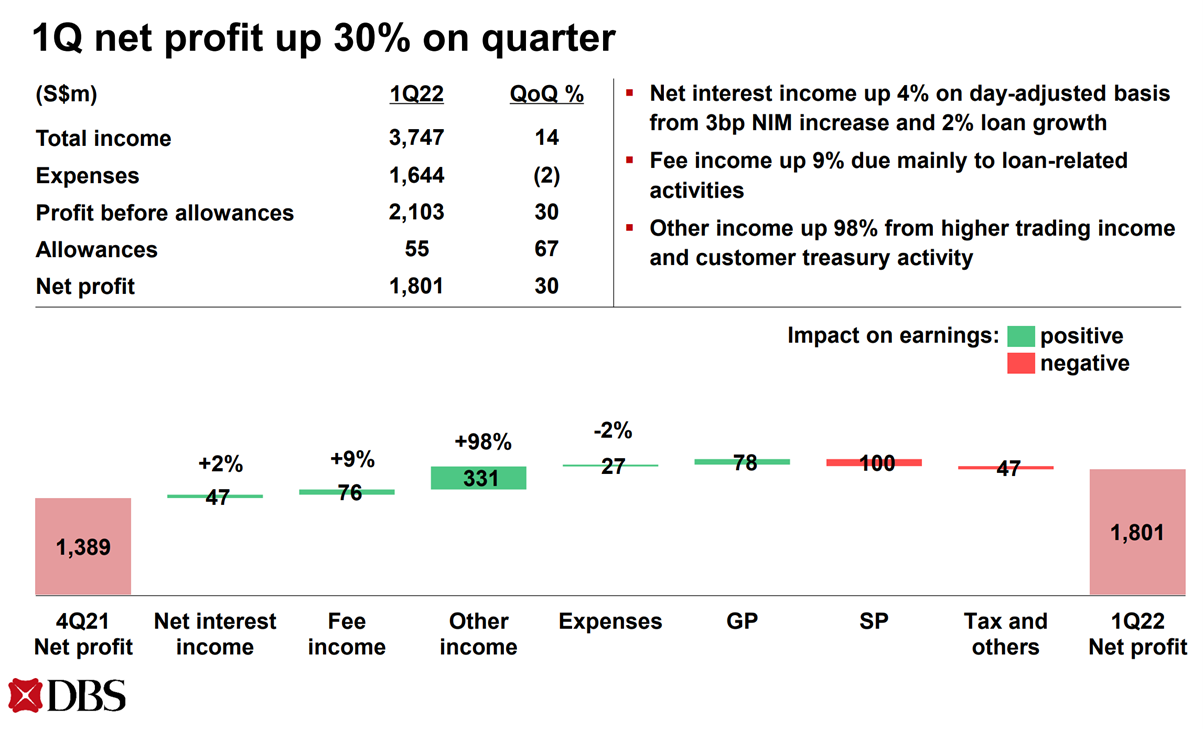

In the Q1 FY2022, DBS net profit was up 30% quarter-on-quarter.

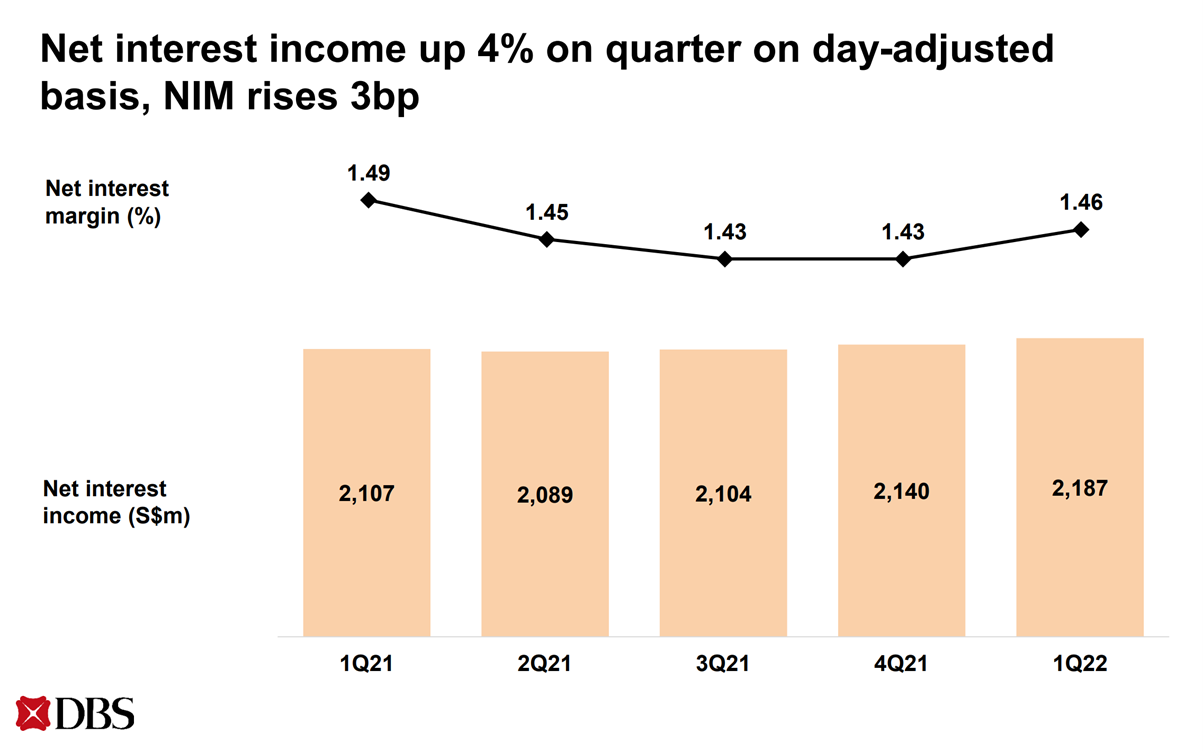

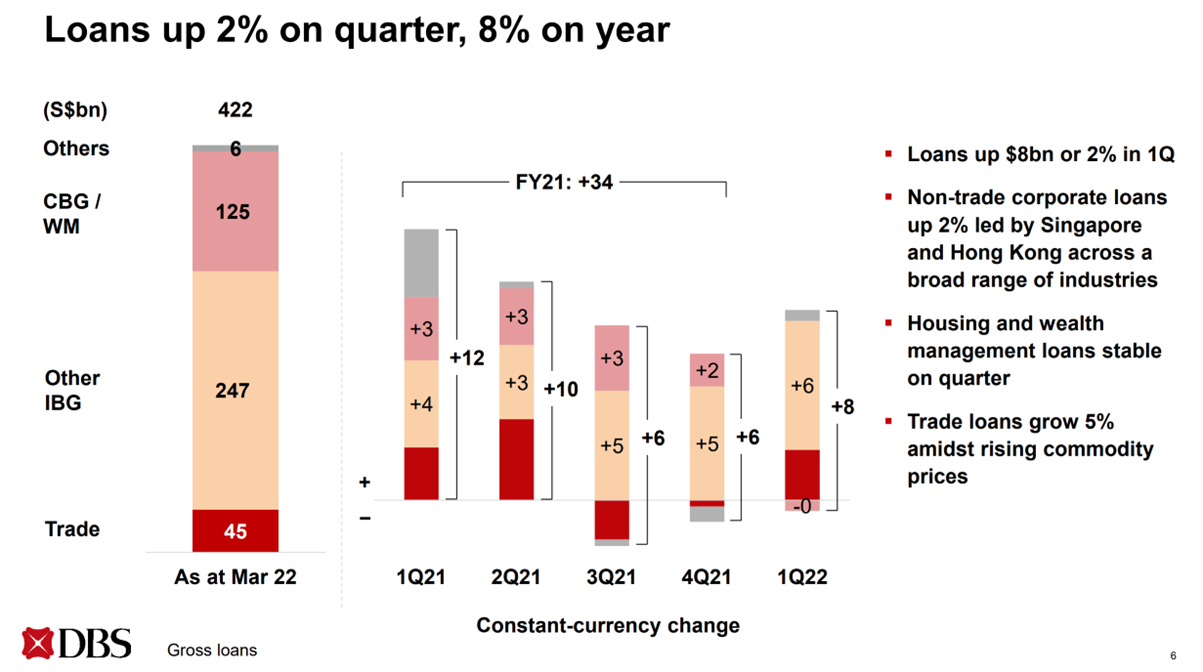

During the period, the 2% loan growth and 3bps NIM increase led to a 4% increase in NII on day-adjusted basis.

Fee income was up by 9% due to loan-related activities while there was a surge in other income to 98% on higher trading income and customer treasury activity.

Source: Q1 FY2022 CFO Presentation

Source: Q1 FY2022 CFO Presentation

Leading bank in Southeast Asia

While the valuation of DBS is slightly more expensive than its peers, it is also worth pointing out that the premium is due to its size.

As the largest bank in Southeast Asia by asset size, DBS is in a good position to tap into the economic recovery in this region.

The Group is also expanding into India, China and Taiwan based on some of its recent acquisition activities.

This is a reflection of DBS’s commitment to grow its presence in the Asia region.

As a leading bank in the region, I am also happy to see some of the diversification plans that the Group has embarked on to increase its revenue streams.

Among some of the initiatives include the setup of a digital exchange and its collaboration with various partners to develop next-generation solutions.

The Group has also invested over S$1 billion over the past four years into its technology infrastructure.

Additionally, the bank is expecting its tech employee base to grow by an average of 1,000 employees annually over the next couple of years.

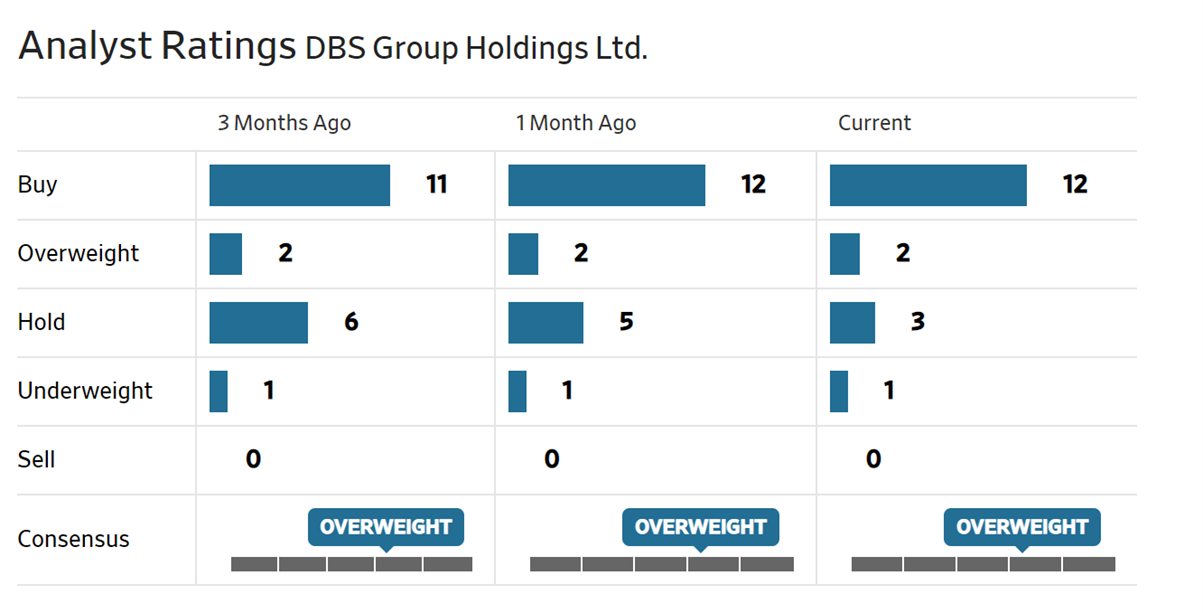

Market remains confident in DBS stock

Despite the weakness in its share price, most research house remains confident with DBS.

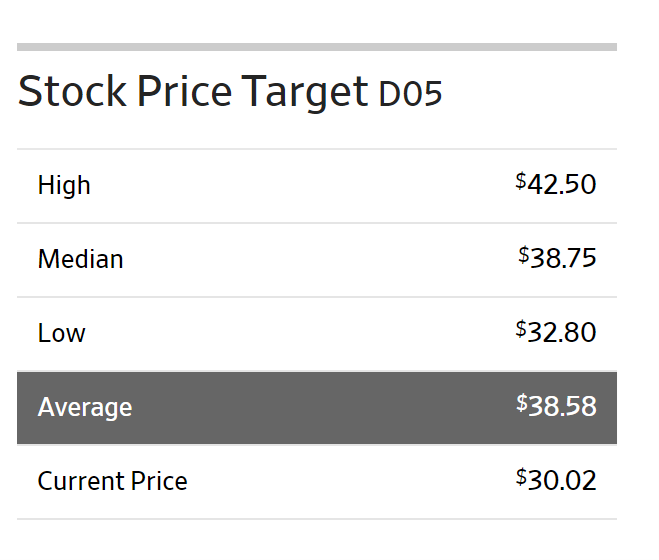

A total of 14 analysts have a buy or overweight rating on DBS, while only one analyst has a sell call on the company.

The average target price set by analysts is at S$38.58, which represents 28.5% upside from its current share price.

Source: WSJ, ProsperUs

Source: WSJ, ProsperUs

Play the long game

Investors should look beyond the near-term volatility in the stock market and buy into companies with a strong track record.

In that regard, DBS offers a 12-month forward dividend yield of around 4.8% at its current level, which should offset some of the impact from the high inflation environment.

It also has a resilient loan portfolio and multiple revenue streams that could sustain its business.

Overall, I believe this is a good opportunity for investors to buy into the largest bank in Southeast Asia that has continued to show its commitment to grow in the Asia region.

Disclaimer: ProsperUs Investment Coach Billy Toh doesn’t own shares of any companies mentioned.

Billy Toh

Billy is deeply committed to making investment accessible and understandable to everyone, a principle that drives his engagement with the capital markets and his long-term investment strategies. He is currently the Head of Content & Investment Lead for Prosperus and a SGX Academy Trainer. His extensive experience spans roles as an economist at RHB Investment Bank, focusing on the Thailand and Philippines markets, and as a financial journalist at The Edge Malaysia. Additionally, his background includes valuable time spent in an asset management firm. Outside of finance, Billy enjoys meaningful conversations over coffee, keeps fit as a fitness enthusiast, and has a keen interest in technology.