HRnet Shares: Strong Earnings and Attractive Dividend

September 1, 2022

As highlighted in my recent article, it is vital for investors to buy into companies with strong balance sheets and solid business models amid a bear market.

With the US Federal Reserve (Fed) maintaining its hawkish tone at the Jackson Hole symposium, investors can expect US interest rate hikes and monetary policy tightening to continue.

This will put a dent in companies’ earnings with the rising interest rate environment.

Excluding the big Singapore banks and REITs, I believe one such name that stands out in the small-cap space is HRnetgroup Ltd (SGX: CHZ).

HRnet is one of Asia’s leading recruitment firms that is based in Singapore and I have written about the company back in June this year on its potential to tap on the robust hiring trend.

Looking at HRnet’s H1 FY2022 strong earnings performance, I believe investors will benefit from the company’s growth potential as well as its strong balance sheet that offers downside protection.

Promising H1 FY2022

HRnet reported strong earnings in the first half financial period ended 30 June 2022 (H1 FY2022).

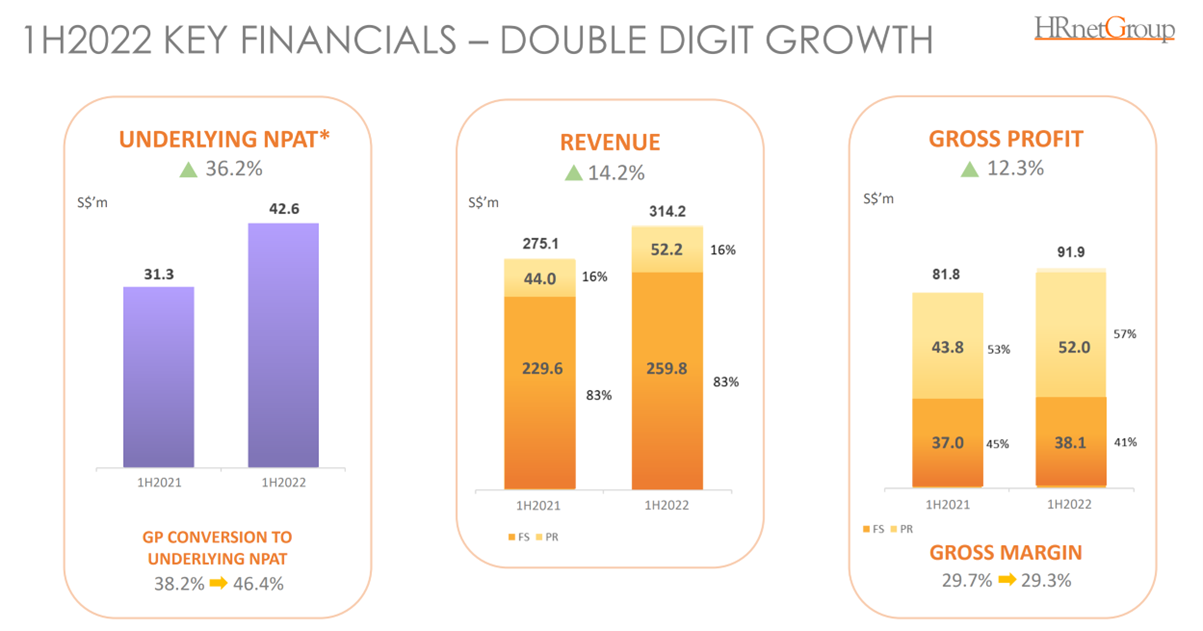

Revenue rose 14.2% year-on-year (yoy) to S$314.2 million while core net profit after tax (NPAT) rose 36.2% yoy to S$42.6 million.

Source: HRnetgroup’s H1 FY2022 Results Announcement

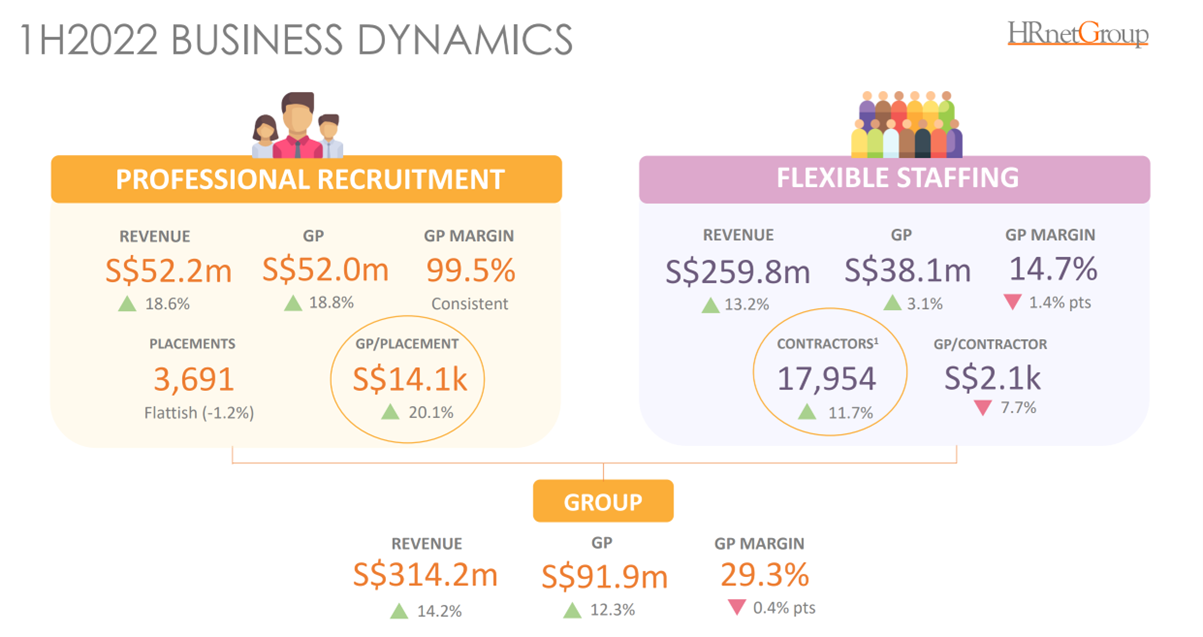

This was supported by the 13.2% and 18.6% increases in revenue from its flexible staffing (FS) and professional recruitment (PR) business segments.

Source: HRnetgroup’s H1 FY2022 Results Announcement

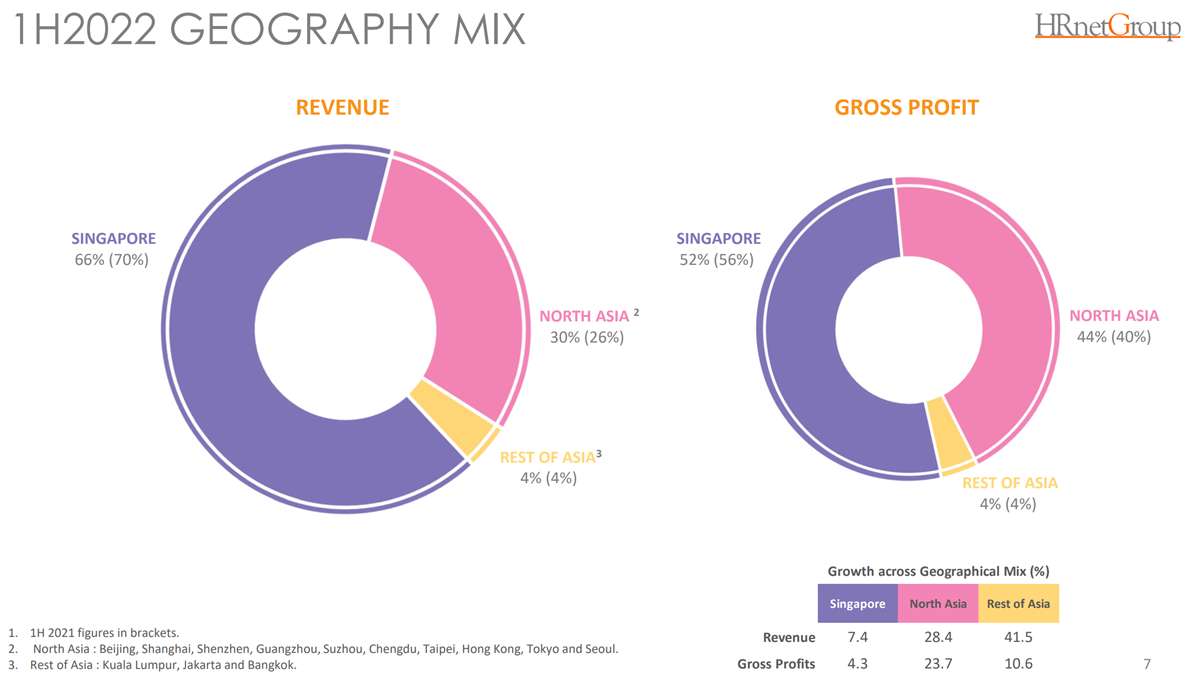

Singapore continues to be the main market for HRnetgroup, contributing 66% of the Group’s revenue but we’re seeing strong growth momentum in the North Asia market.

Source: HRnetgroup’s H1 FY2022 Results Announcement

Diversified client base

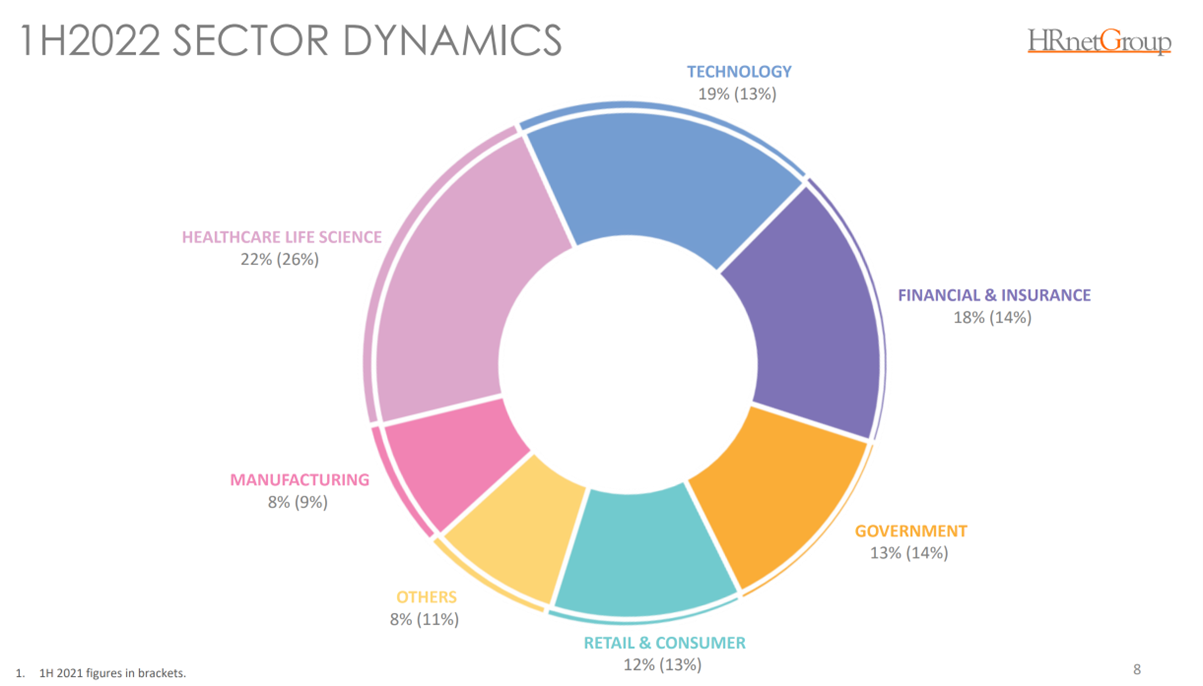

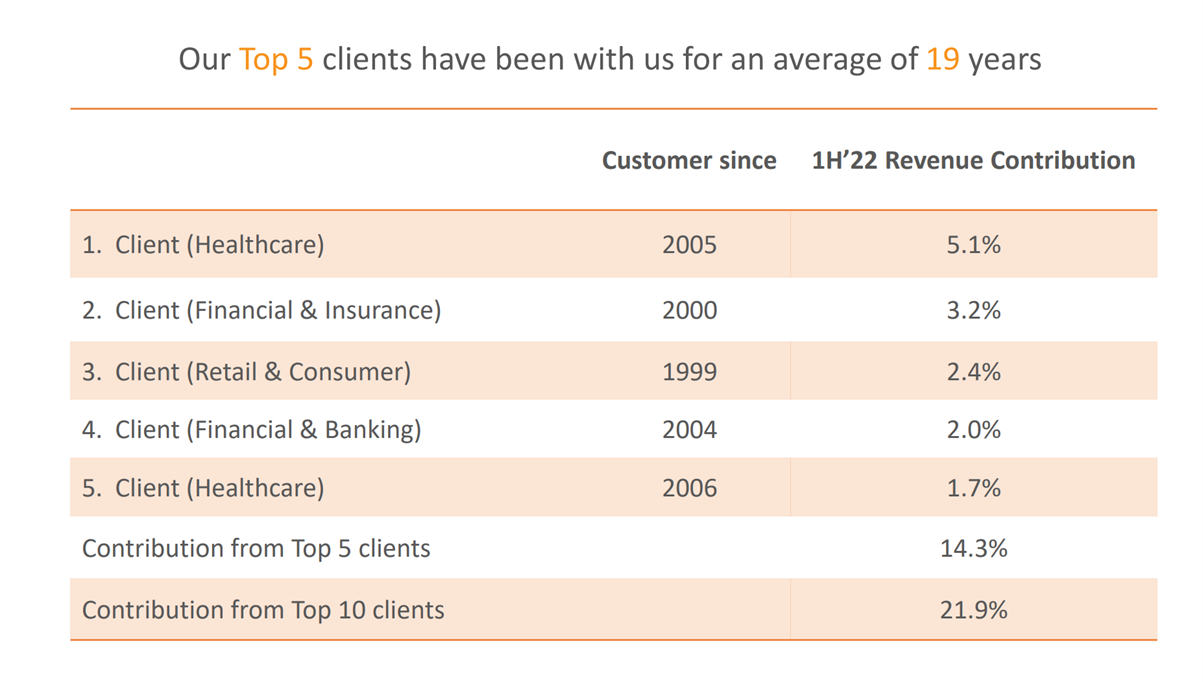

Aside from the strong earnings shown in the H1 FY2022, HRnetgroup also has a resilient business model that does not rely on a single sector and has no customer concentration risk.

Source: HRnetgroup’s H1 FY2022 Results Announcement

During H1 FY2022, the highest contributing sectors were healthcare life science (22%), technology (19%) and financial & insurance (18%). The sector dynamics are relatively balanced across the different sectors.

In terms of its client base, HRnetgroup’s top five clients only contributed 14.3% of the Group’s total revenue while its top 10 clients contributed 21.9% of its total revenue.

The top five clients are also from different sectors and have been with the Group for an average of 19 years.

Source: HRnetgroup’s H1 FY2022 Results Announcement

Hiring outlook remains positive but weaker economic growth is a concern

Management remains bullish for both its recruitment segments across all geographical areas and sees strong demand for its services for the remainder of 2022.

I think this will be supported by the ongoing tightness in the labour market, which should keep salaries elevated.

The reopening of the economy and international borders will also drive demand for labour, especially those in the travel and consumer-related sectors.

However, the slowing economy, amid the macroeconomic environment and inflationary pressure, could dampen some of the growth momentum.

In the longer term, the North Asia market should provide support for growth when lockdowns are eased.

Attractive dividend and share buyback

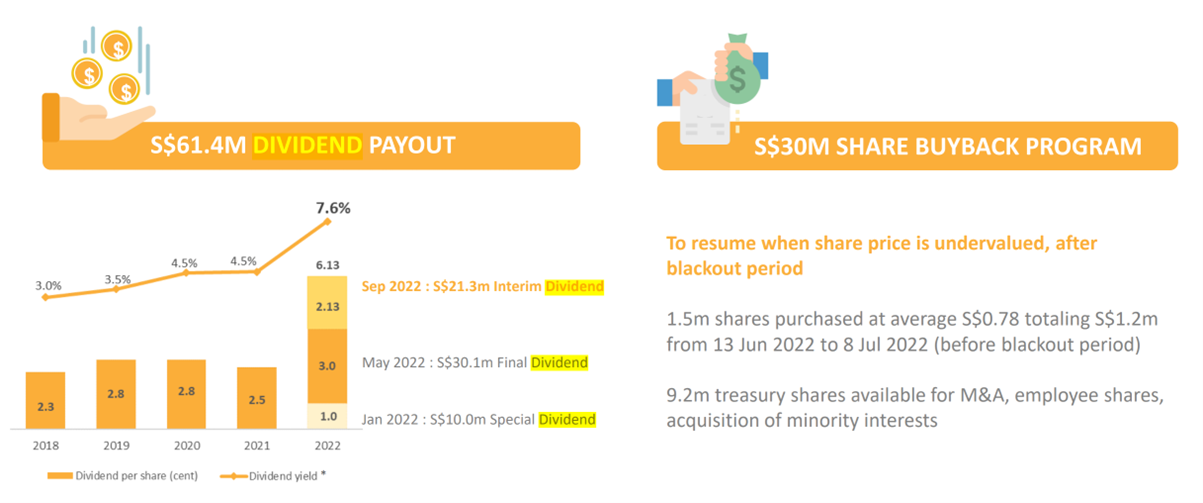

HRnetgroup has declared its first ever interim dividend of 2.13 Singapore cents.

With the strong financial performance expected to continue, I believe management will continue to reward shareholders via its dividend payout.

The forward dividend yield is expected to be between5.3% and 5.5%.

Aside from that, management intends to buy up to S$30 million of HRnetgroup’s shares via the open market.

Source: HRnetgroup’s H1 FY2022 Results Announcement

Strong net cash position with zero borrowings

Aside from the Group’s strong earnings growth potential and its rewards to shareholders via dividends, HRnetgroup also has a strong balance sheet.

As of 30 June 2022, the Group has cash & cash equivalents of S$312.7 million with zero borrowings.

This means that the Group is sheltered from the rising interest rate environment and will not be affected by the higher interest or borrowing costs.

It also has positive operating cashflow of S$33.7 million.

Attractive valuation and strong balance sheet

Given the current market volatility, investors should consider investing in companies that could withstand a bear market.

While the business model of HRnetgroup is not immune to the potential recession risk, the company is trading at an attractive valuation with a price-to-earnings (PE) ratio of around 12 times.

Given its asset-light and cash rich position, as well as a forward dividend yield of more than 5%, I believe investors should accumulate a position in HRnetgroup during a bear market to capture upside potential.

Disclaimer: ProsperUs Investment Coach Billy Toh doesn’t own shares of any companies mentioned.

Billy Toh

Billy is deeply committed to making investment accessible and understandable to everyone, a principle that drives his engagement with the capital markets and his long-term investment strategies. He is currently the Head of Content & Investment Lead for Prosperus and a SGX Academy Trainer. His extensive experience spans roles as an economist at RHB Investment Bank, focusing on the Thailand and Philippines markets, and as a financial journalist at The Edge Malaysia. Additionally, his background includes valuable time spent in an asset management firm. Outside of finance, Billy enjoys meaningful conversations over coffee, keeps fit as a fitness enthusiast, and has a keen interest in technology.