Keppel DC REIT Q1 2023 Earnings: Dividend Rises 3%, Revenue up 6.5%

April 19, 2023

Earnings season is starting once more in Singapore’s stock market. As is customary for SGX-listed firms, most of the companies reporting first are REITs.

With interest rates elevated, and looking like they might stay that way for a while, investors are keen to hear how REITs are managing their portfolios.

One of the first large REITs to report on its Q1 2023 period was data centre-focused Keppel DC REIT (SGX: AJBU).

The REIT reported its numbers for the first quarter of 2023 after the market closed on Tuesday 18 April.

So, for dividend and REIT investors, here’s what they need to know about the pure-play data centre REIT’s latest numbers.

DPU climbs 3% on back of acquisitions

As is usually the case, REIT investors closely watch the distribution per unit (DPU) number each time a Singapore REIT reports their numbers.

That’s been even more true in this environment, where interest rates are higher and the DPU for many Singapore REITs is falling.

Well, Keppel DC REIT seems to be bucking that trend because it reported a 3% year-on-year increase in its DPU to 2.541 Singapore cents for Q1 2023.

That came on the back of a 4.1% year-on-year increase in its distributable income to S$46.3 million during the quarter.

These increases were attributable to income from acquisitions of Guangdong DC 2 and building shell of Guangdong DC 3, as well as various asset enhancement initivaties (AEIs), renewals, and income escalations.

A tax saving from approvals obtained for its NetCo Bonds – as they were classed as qualifying project debt securities (QPDS) – also helped.

Gross revenue rose 6.5% year-on-year to S$70.4 million while net property income (NPI) saw a similar bump, up 6.3% year-on-year to S$63.9 million.

Portfolio and debt metrics still solid

Keppel DC REIT managed to maintain its robust portfolio occupancy rate of 98.5% as of 31 March 2023 and it also has a healthy weighted average lease expiry (WALE) of 8.2 years.

Management stated that built-in income and rental escalations – based on CPI or similar indexation – or fixed rate mechanisms are embedded in more than half of its portfolio.

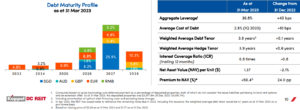

Source: Keppel DC REIT Q1 2023 earnings update

As investors can see above, on the debt side Keppel DC REIT doesn’t have any meaningfully large debt maturities until 2026.

Meanwhile, its cost of debt remains low at 2.8% during Q1 2023 – although this did tick up by 10 basis points (bps) from the previous quarter.

With a gearing ratio of 36.8%, Keppel DC REIT is also comfortably below the 50% MAS-imposed leverage cap.

Quarter in line but Keppel DC REIT’s shares look pricey

It was another impressively robust quarter for the data centre REIT but the market was already expecting it to be one of the few REITs to eke out DPU growth during the quarter.

It duly delivered but after a near-20% rally in its shares so far in 2023, Keppel DC REIT’s price-to-book (PB) ratio of 1.5 times looks expensive versus the broader S-REIT market’s average PB ratio of 0.97 times.

However, that premium is likely because investors are willing to “pay up” for growth in the S-REITs space at this point in time.

At its current share price, Keppel DC REIT is offering dividend investors a 12-month forward yield of 4.8%.

Disclaimer: ProsperUs Head of Content & Investment Lead Tim Phillips doesn’t own shares of any companies mentioned.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.