Mapletree Industrial Trust Earnings: Portfolio Occupancy Climbs But DPU Drops 3%

January 30, 2023

The earnings engine rumbles on for Singapore’s REITs. Yesterday, another Straits Times Index constituent reported its latest numbers; Mapletree Industrial Trust (SGX: ME8U).

The industrial- and data centre-focused REIT is one of Singapore’s largest and has 141 properties across Singapore, the US, and Canada.

With concerns over how Singapore’s REITs are handling higher interest rates, one of the city state’s largest industrial REITs was a good chance to see how they’re faring.

So, here’s what dividend investors need to know about Mapletree Industrial Trust’s latest earnings for its Q3 FY22/23 (for the three months ending 31 December 2022).

NPI rises but DPU falls

During the REIT’s Q3 FY22/23 period, it saw gross revenue and net property income (NPI) rise 5.0% year-on-year and 4.9% year-on-year, respectively, to S$170.4 million and S$128.8 million.

However, as with many other REITs in Singapore, its borrowing costs soared as interest rates were hiked.

In Mapletree Industrial Trust’s case, its borrowing costs hit S$26 million, up 35.4% year-on-year versus the same period in 2021.

That saw amount available for distribution to unitholders at S$88.3 million, down 1.3% year-on-year.

Yet because of the enlarged unit base – due to the REIT’s Dividend Reinvestment Plan (DRP) – Mapletree Industrial Trust’s distribution per unit (DPU) fell 2.9% year-on-year to 3.39 Singapore cents.

Steady Eddie REIT

Mapletree Industrial Trust continued to highlight why it’s one of the more reliable REITs in the Singapore market as its capital profile and balance sheet remained robust.

As of the end of December 2022, the REIT had an improved gearing ratio of 37.2%, down from 37.8% as of 30 September 2022.

Meanwhile, around three-quarters of its debt is on fixed terms while its interest coverage ratio (ICR) for the quarter was 4.8 times.

Management guided that another 50 basis points (bps) in additional interest rate hikes from the Federal Reserve (Fed) will shave off 0.02 Singapore cents from its DPU – equal to a decline of 0.7% on its DPU.

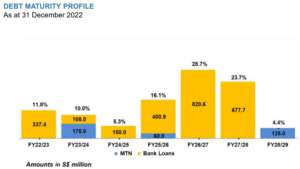

That’s not a huge impact given an additional 50 bps is the base case from here. In terms of its debt profile, its very well spread out with no amount over 15% of total debt due until FY25/26 (see below).

Source: Mapletree Industrial Trust Q3 FY22/23 earnings presentation

Mapletree Industrial Trust also saw a strong DRP take-up rate of 45.8% for its Q2 FY22/23 distribution.

While it will also be applied to this latest Q3 FY22/23 distribution, the REIT announced that the DRP will be suspended thereafter.

Portfolio updates look positive

Management did say that its expects rental reversions to be around the mid-single-digits going forward, after a strong showing from its Singapore portfolio in the latest quarter.

Its Singapore portfolio saw improved occupancy of 96.9% versus the 96.8% in the prior quarter, but positive rental reversions of around +8.5% was broad-based across most property segments in Singapore.

Meanwhile, Mapletree Industrial Trust’s data centre portfolio in North America saw its average occupancy rate remain stable at 93.1%.

One of the big announcements during the earnings release was the news that the REIT had obtained its Temporary Occupation Permit (TOP) for 165 Kallang Way on 10 November 2022.

The Build-to-Suit (BTS) development is a seven-storey puropose-built development that’s fully committed to a global medical device company headquartered in Germany.

It has a minimum lease term of 15 years with annual rental escalation built in.

The remaining blocks of the redevelopment (161 and 163 Kallang Way) are slated for completion in the first half of 2023.

Mapletree Industrial Trust has also ready successfully pre-leased two floors of 163 Kallang Way and, to-date, around 39% of the net lettable area of the total redevelopment known as the Kolam Ayer Cluster 2 – 161, 163 and 165 Kallang Way – have been committed.

Stabilising the 2023 dividend

Investors in Singapore REITs will want to see the REIT managers focusing on ensuring portfolio occupancy remains high and the DPU is protected as best as possible.

For investors, that DPU number is crucial and for most Singapore REITs, it has been falling due to higher interest rates.

In Mapletree Industrial Trust’s case, management has been focused on remaining disciplined and controlling portfolio occupancy as well as stabilising the DPU.

Nearer term, higher funding costs and a slowdown in the global economy could weigh on the REIT.

However, for long-term investors focused on interest rates eventually normalising, Mapletree Industrial Trust offers dividend investors a relatively attractive 12-month forward distribution yield of 5.7%.

Disclaimer: ProsperUs Head of Content & Investment Lead Tim Phillips owns shares of Mapletree Industrial Trust.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.