Mapletree Industrial Trust’s Net Property Income Surges 24%, DPU Rises 4%

July 26, 2022

Going into the second half of 2022, investors have experienced a traumatic first half of the year as most global stock markets have seen heavy declines.

However, Singapore’s stock market has performed relatively well in comparison so far this year.

The benchmark Straits Times Index (STI) is up around 2% in 2022 while the S&P 500 Index in the US is down over 17% over the same period.

All investors’ eyes are now on earnings in Singapore. With one of the big Mapletree REITs reporting last week, yesterday was the turn of another STI component stock; Mapletree Industrial Trust (SGX: ME8U).

Mapletree Industrial Trust has been one of the best-performing Singapore REITs that you could have owned over the past decade.

While its shares are marginally down around 1% so far this year, did the REIT’s portfolio perform well during its latest quarter? Let’s find out.

Another solid quarter but inflation bites

Mapletree Industrial Trust, an industrial and data centre-focused REIT, saw its net property income (NPI) increase by 24% year-on-year to 129. 9 million for its Q1 FY22/23 (for the three months ending 30 June 2022).

Meanwhile, the all-important dividend – or distribution per unit (DPU) – was up 4.2% year-on-year to 3.49 Singapore cents.

While the DPU did increase on a year-on-year basis, it was flat on a quarter-on-quarter basis and was also its second consecutive quarter of flat sequential growth.

Versus the year-ago period, these increases in NPI and DPU were driven primarily by the REIT’s acquisition of 29 data centres in the US.

The average overall portfolio occupancy rate for the most recent quarter stood at 95.3%, which was an improvement over the prior quarter’s 94.0% rate.

While all the metrics were solid on the revenue, NPI and DPU fronts, these were overshadowed by a 62.4% year-on-year increase in property expenses to S$37.9 million.

While Mr Tham Kuo Wei, CEO of the REIT manager, did acknowledge the improvement of operational performance he also commented that:

“We expect headwinds in the coming quarters as inflation pressure will result in higher property operating expenses and interest expenses.”

Financial metrics remain robust

Good news for investors, though. Mapletree Industrial Trust’s balance sheet continues to be strong as it enters a period of rising costs.

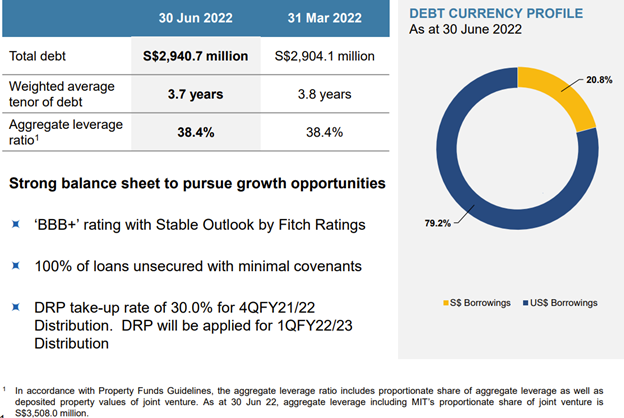

With an aggregate leverage ratio (also known as “gearing ratio”) of 38.4% and a weighted average tenor of debt of a relatively lengthy 3.7 years (see below), the REIT continues to be proactive in managing its liabilities.

Source: Mapletree Industrial Trust Q1 FY22/23 earnings presentation

The REIT also announced that it would apply its distribution reinvestment plan (DRP) for the third consecutive quarter.

If shareholders opt to be paid in new units, rather than cash, then this should continue to help Mapletree Industrial bring down its gearing ratio.

Being conservative amid uncertainty

Dividend investors who rely on the regular income from Mapletree Industrial Trust shares should be thankful that management is being conservative with how it manages the REIT’s portfolio.

In the most recent quarter, the REIT completed two divestments; one of a two-storey light industrial building in Singapore and the other a four-storey data centre in the US.

Both were sold at a profit and the proceeds will be deployed to help fund committed investments, working capital requirements, and/or reduce existing debt.

With another solid quarter behind it, Mapletree Industrial Trust units are now trading at around S$2.68 and offer investors a 12-month forward dividend yield of 5.2%.

Disclaimer: ProsperUs Head of Content & Investment Lead Tim Phillips owns shares of Mapletree Industrial Trust.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.