Sembcorp Industries FY2022 Earnings: Are Shares Still a Buy?

February 22, 2023

In Singapore, we have seen a host of earnings results for constituent companies listed on the Straits Times Index (STI).

The firms listed on the STI are supposed to be among the biggest, and best, companies that Singapore has to offer investors.

Indeed, some STI stocks have done better than expected in their latest earnings releases. Add one more to that list; Sembcorp Industries Limited (SGX: U96).

The renewable energy-focused operator has been on a tear recently, on the back of its “brown to green transition”.

That has included disposing of its legacy power assets, like coal plants, and shifting towards acquiring more renewable energy assets – like solar and wind farms.

On Tuesday (21 February), Sembcorp Industries announced its H2 2022 and FY2022 earnings.

So, what should investors know about this leading green energy company’s latest numbers? And are its shares still a buy? Let’s dive in and find out.

FY2022 net profit surges; special dividend announced

For the whole of 2022, it was a phenomenal year for Sembcorp Industries, with net profit (before exceptional items) up 87% year-on-year to S$883 million.

A lot of this came from its conventional energy business, with core net profit (another name for “net profit before EI”) of this unit coming in at S$622 million in FY2022 – up 115% year-on-year.

This was mainly due to higher power prices in Singapore and the UK. Even better for investors, around two-thirds of its capacity is locked in on contracts for an average duration spanning from one to three years.

Ultimately, that should mean that profit is supported in 2023-2024, even if spot power prices fall.

On a H2 2022 basis, its conventional energy business saw core net profit of S$326 million, which was down 18% sequentially from H1 2022 but up 74% year-on-year from H2 2021.

Meanwhile, given the strong rise in earnings, Sembcorp Industries announced a final dividend per share (DPS) of 4.0 Singapore cents – a 33% hike from 2021’s final DPS of 3.0 Singapore cents.

The big news, though, was that management announced a special dividend of 4.0 Singapore cents per share, bringing the total DPS to 8.0 Singapore cents and the FY2022 DPS to 12.0 Singapore cents.

What about Sembcorp’s renewables business?

With investors excited about the company’s green transition, this is clearly an important part of Sembcorp Industries’ business. And it didn’t disappoint on this front for FY2022.

Sembcorp’s renewables business recorded FY2022 core net profit of S$148 million, up an impressive 150% year-on-year.

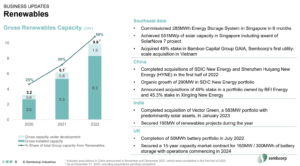

What’s more encouraging was that its gross renewables capacity rose by 50% from FY2021 and renewables now make up just shy of 60% of the group’s power capacity (see below).

Source: Sembcorp Industries H2 2022 and FY2022 earnings presentation

Sembcorp Industries should add another 1.3 gigawatss (GW) of renewables capacity in 2023 given it has already closed on its Vector Green Energy deal in India and should also soon close on its BEI Energy deal in China.

That should help the company’s renewables business start to produce more and more reliable income from long-term power purchase agreements (PPAs).

As a long-term shareholder, that should be comforting given management’s focus on transitioning its net profit profile towards renewable/sustainable sources.

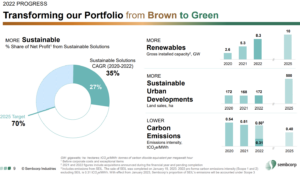

Sembcorp’s “Sustainable Solutions” include both its renewables business and sustainable integrated urban developments, which includes the likes of its water and waste-to-resource solutions businesses.

Yet this Sustainable Solutions segment still only accounted for 27% of the overall group’s net profit in FY2022 (see below).

Source: Sembcorp Industries H2 2022 and FY2022 earnings presentation

Sembcorp Industries management aims to grow this share to 70% by 2025 and it’s already nearly at its 2025 target of 10 GW of gross installed capacity for its renewables business.

In the near future, this could be revised upwards as it continues to acquire clean energy assets.

Valuation looks compelling amid better returns profile

One of the big issues with Sembcorp Industries, pre-Covid, was its poor return on equity (ROE) profile of around 4%.

However, in its most recent FY2022, group ROE was around 10%, a huge improvement.

Given it’s pretty much the only proxy for clean energy exposure on the Singapore Exchange (SGX), it trades an attractive valuation of just 1.3x price-to-book (PB).

That compares to regional peers’ average of 2.1x, with their ROE profile also inferior at around 8%.

At a trailing 12-month dividend yield of 2.1% (ex-the special dividend), along with its strong growth prospects, Sembcorp Industries shares looks to offer Singapore investors a compelling long-term story.

Disclaimer: ProsperUs Head of Content & Investment Lead Tim Phillips owns shares of Sembcorp Industries Limited.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.