Stocks that Benefit from Singapore’s Budget 2023

February 15, 2023

Singapore unveiled its S$104.2 billion Budget 2023 yesterday with the theme “Moving Forward in a New Era”.

The Budget will be Singapore’s second consecutive deficit as the government shift from dealing with the COVID-19 pandemic to addressing concerns on the cost of living and global uncertainties.

The spending is aimed at growing the economy and equipping workers amid a new era of greater contestation and fragmentation.

Additionally, the Budget is also focus on helping Singaporean households cope with the high inflation.

There is a lot to unpack in Singapore’s Budget 2023 but here are some of the stocks that will benefit from it.

Consumer stocks

One of the key highlights of Budget 2023 is the increase in handouts to Singaporean households.

Budget 2023 has set aside an additional S$3 billion for the Assurance Package, which includes a $1.4 billion top-up announced in November last year, bringing it to a total of S$9.6 billion.

The handouts aim to help Singaporean households cope with high inflation and cushion the impact of the rising Goods and Services Tax (GST) rates.

There is also a one-off Cost-of-Living Special Payment expected to benefit around 2.5 million adult Singaporeans.

This will benefit consumer stocks such as Sheng Siong Group Ltd (SGX: OV8), one of the largest Singapore supermarket operators.

With the cash handouts, I expect to see a boost on consumption in the domestic market.

Other beneficiaries include Fraser and Neave Ltd (SGX: F99), or F&N for short. F&N is a leading Southeast Asian consumer group with a prominent standing in the Food & Beverage and Publishing & Printing industries.

Its renowned brand name allows F&N to enjoy market leadership and with more money at the hands of consumers, small-ticket items and products sold by F&N will be among the first to benefit from it.

Restaurant and food operators such as Jumbo Group Ltd (SGX: 42R) and Kimly Ltd (SGX: 1D0) are also winners from this Budget.

Singapore’s leading transport company, ComfortDelGro Corporation Ltd (SGX: C52) will also benefit from this.

Healthcare stocks

Another key aspect of Budget 2023 is the allocation for lower-income seniors in Singapore.

This will benefit those in the healthcare sector such as Raffles Medical Group Ltd (SGX: BSL).

Raffles Medical Group was also one of the recession-proof stocks mentioned in my article at the beginning of this year.

Similarly, Parkway Life REIT (SGX: C2PU) could also benefit from this given its exposure in Singapore, Japan and Malaysia.

Parkway Life REIT is a healthcare REIT with three Singaporean hospitals, 57 Japanese nursing homes and strata-titled units in MOB Specialist Clinics in Kuala Lumpur, Malaysia.

Human capital-related stocks

Singapore’s focus to equip its workers for the new era will also benefit manpower solutions provider, HRnetgroup Ltd (SGX: CHZ).

Singapore’s Budget 2023 saw an increase in the national productivity fund by S$4 billion to develop labour-market intermediaries that can go through industry training, employment facilitation, extension of Senior Employment Credit as well as Part-time Re-employment Grant.

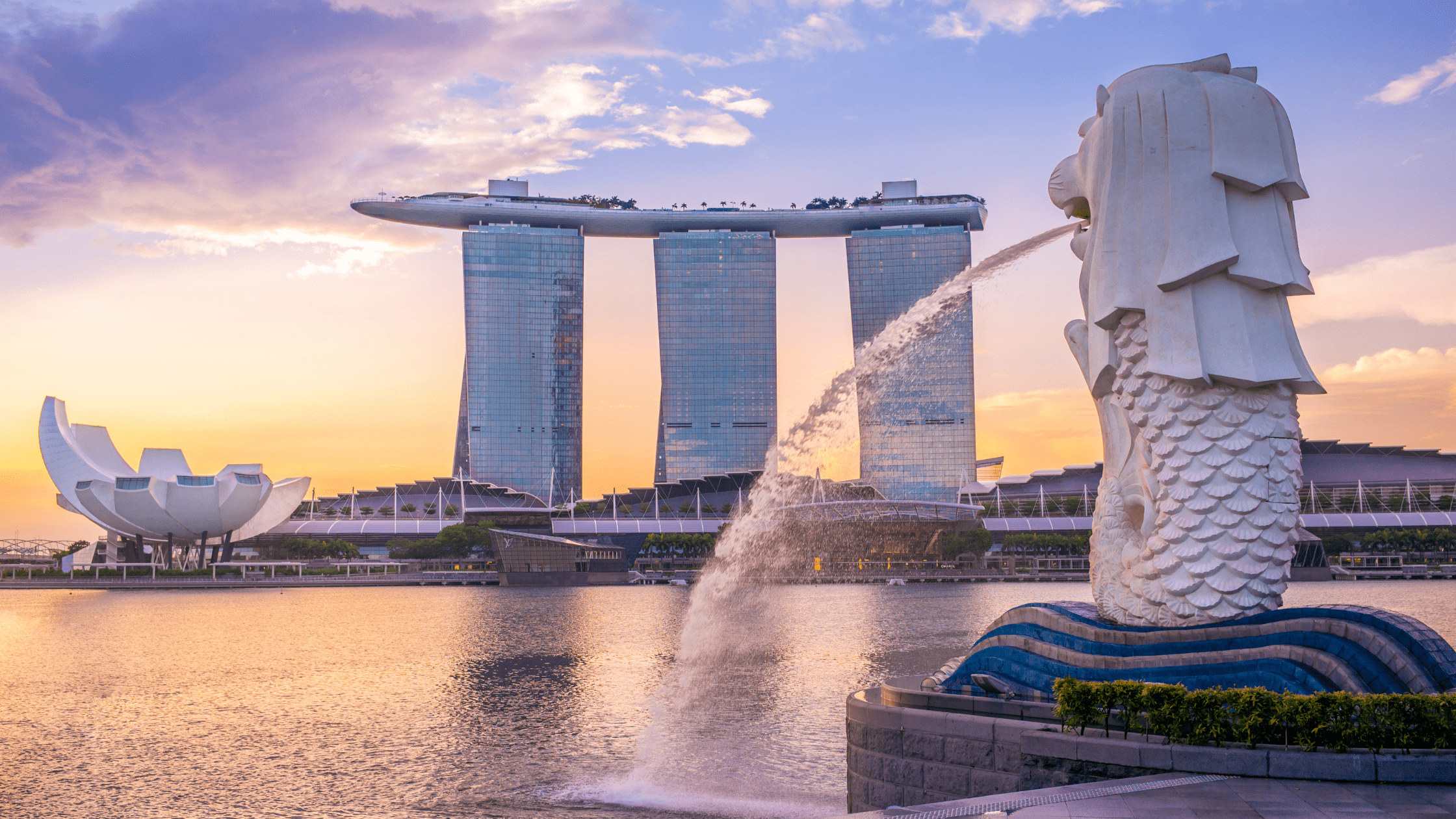

Travel and leisure stocks

With the increase in cash handouts to Singapore citizens, this will also increase the disposable income that could be used for travel and leisure.

I believe the support for Singaporeans to cope with the rising inflation and higher GST rate will cushion the impact on leisure companies such as Genting Singapore Limited (SGX: G13), the owner and operator of Resorts World Sentosa (RWS) Integrated Resort.

Aside from Genting Singapore, the likes of Singapore Airlines Ltd (SGX: C6L) and mall-focused REITs could also benefit from the Budget 2023.

Singapore well-positioned in the post-COVID era

The Singapore government continues to take a proactive measure to lead the recovery in the post-COVID era.

Some of these stocks mentioned are likely to benefit from the measures introduced in the Budget 2023.

However, downside risks remain, as seen by the market reaction, mainly due to the concern on the impact from higher top-end taxes for properties and cars.

Singapore government also intends to set its effective tax rate for multinational enterprises at 15% starting from 2025, in line with a global agreement to increase the floor rate.

Such moves will also have an impact on some of the SGX-listed companies that are deemed as multinational corporations.

Overall, the Budget 2023 shows a lot of focus on positioning Singapore for future economic and social growth.

Disclaimer: ProsperUs Investment Coach Billy Toh doesn’t own shares of any companies mentioned.

Billy Toh

Billy is deeply committed to making investment accessible and understandable to everyone, a principle that drives his engagement with the capital markets and his long-term investment strategies. He is currently the Head of Content & Investment Lead for Prosperus and a SGX Academy Trainer. His extensive experience spans roles as an economist at RHB Investment Bank, focusing on the Thailand and Philippines markets, and as a financial journalist at The Edge Malaysia. Additionally, his background includes valuable time spent in an asset management firm. Outside of finance, Billy enjoys meaningful conversations over coffee, keeps fit as a fitness enthusiast, and has a keen interest in technology.