1 ESG Stock to Buy That Keeps Winning

October 22, 2021

Long-term investors should try to invest into, and buy, companies that are exposed to what we call “megatrends”.

One of these megatrends involves companies focused on environmental, social and governance, also known as “ESG”, factors.

Increasingly in the ESG investment space, many retail – as well as institutional – investors are honing in on the “E” of the environmental aspect as the world moves towards a carbon “net zero” future.

A great example of this trend has been the success of Tesla Inc (NASDAQ: TSLA), which recently reported impressive third-quarter earnings as it leads the way towards the full electrification of vehicles globally.

Another big name that is part of this global clean energy transition is the world’s largest renewable energy provider; NextEra Energy Inc (NYSE: NEE).

The wind and solar power giant recently reported another solid set of results earlier this week. Here’s why investors should considering buying this ESG stock that’s riding powerful tailwinds and is set to keep on winning.

Solid earnings growth

NextEra Energy posted impressive adjusted third-quarter earnings of US$1.48 billion versus US$1.3 billion in the year-ago quarter.

On an adjusted earnings per share (EPS) basis, EPS of US$0.75 in its latest quarter was up 12% year-on-year against the US$0.67 in adjusted EPS it posted in the third quarter of 2020.

NextEra’s main division – electric utility provider Florida Power & Light (FPL) – saw another impressive quarter as net income hit US$836 million, up 10% year-on-year.

Meanwhile, its listed subsidiary NextEra Energy Partners LP (NYSE: NEP) – a growth-oriented yieldco that owns clean energy assets – posted adjusted EBITDA of US$334 million for the quarter, up 7.5% year-on-year.

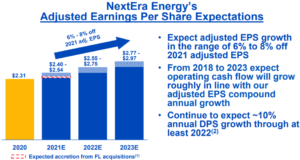

All this is contributing to an incredibly stable growth profile for NextEra Energy, with the company forecasting adjusted EPS growth of 6-8% through 2023 (see below).

Source: NextEra Energy Q3 2021 investor presentation

Not only that but NextEra also expects to grow its annual dividend by around 10% through 2022. Furthermore, according to NextEra CEO James Robo, management would be:

“Disappointed if we are not able to deliver financial results at or near the top of our adjusted EPS expectations through 2023”.

Leading the green revolution

Overall, it was another strong quarter for one of the world’s largest energy companies. In 2020, NextEra Energy briefly overtook Exxon Mobil Inc (NYSE: XOM) as the world’s biggest energy company by market cap.

Longer term, the trend is clear. As NextEra continues to invest heavily into raising capacity in wind and solar, while also expanding into new areas such as green hydrogen and battery storage, the company will likely go from strength to strength.

Disclaimer: ProsperUs Head of Content & Investment Lead Tim Phillips owns shares of NextEra Energy Inc and NextEra Energy Partners LP.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.