1 Semiconductor Stock That Just Crushed Earnings

May 11, 2022

Stock markets have been volatile of late with the S&P 500 Index down nearly 17% so far in 2022. The Nasdaq is even worst off and is in bear territory, down nearly 25%.

That has created a lot of tension for Singapore, as well as global, investors given the importance of US stock markets.

Yet while stocks sell off, the companies behind them continue to report their latest numbers. In some cases, these results have been impressive.

One such area which investors have loved in recent years is semiconductors, given they go into literally everything nowadays – from toasters to cars to smartphones.

So, when semiconductor fabless firm Advanced Micro Devices Inc (NASDAQ: AMD), better known as AMD, reported its first-quarter earnings last week there was a lot of expectation.

AMD, as usual, didn’t disappoint. Here’s what investors should know about this leading semiconductor company’s latest set of results.

Revenue growth, margins still strong

AMD reported revenue of US$5.9 billion for the first quarter, up 71% year-on-year, and beating analyst expectations.

Backing out the recent Xilinx acquisition (which closed during the quarter), core revenue would still have been US$5.3 billion, implying organic growth of 55% year-on-year.

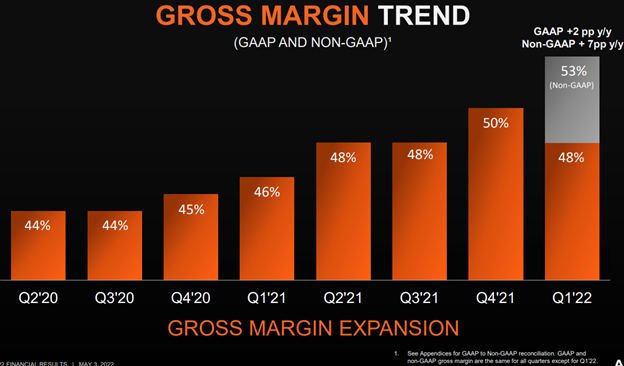

Meanwhile, gross margin was at 48% in the first quarter of 2022, up from 46% in the same period last year.

Its non-GAAP gross margin was at 53%, up a whopping seven percentage points from the year-ago period. (see below).

Source: AMD Q1 2022 earnings slides

While AMD has traditionally been known – or at least perceived – to be geared towards the PC market (also known as “CPUs” in chip parlance), the latest results go some way to dispelling that notion.

Mainly, that was down to its data centre business, where revenue was up 88% year-on-year to a record US$2.5 billion during the quarter. Sales of its EPYC server processors has been robust.

In fact, AMD CEO Lisa Su, said that the company has “more than doubled server processor revenue year-over-year in eight of the last 10 quarters”.

AMD’s data centre business well outpaced the growth of its computing segment, which “only” saw growth of 33% year-on-year to US$2.8 billion.

On the profit side, the numbers also boded well. Operating income was at US$951 million in the first quarter of 2022, up 44% year-on-year, and equating to an operating profit margin of 16%.

Xilinx acquisition will boost margins

Besides the well-known reasons for AMD buying Xilinx – expanding into various other chip sectors such as autos, industrial and 5G – the actual business will benefit from higher margins.

AMD managed to close on the US$35 billion acquisition, the largest ever deal in the semiconductor space, during the first quarter.

For the remaining six weeks of the first quarter after the transaction closed, Xilinx managed to generate US$559 million in revenue and an operating income of US$233 million.

That means Xilinx delivered an operating profit margin of 42%, well above the 16% that AMD as a whole generated during the quarter.

As more quarters go by, the full benefits of the Xilinx deal should become evident. In addition, AMD also raised full-year guidance for 2022 to US$26.3 billion – or 60% year-on-year revenue growth for the full year.

Stock still falls as growth is shunned

While AMD posted an impressive beat all round, the stock is still down over 40% so far in 2022 as growth stocks get punished.

However, with a profitable and growing business, as well as being supported by structural tailwinds, AMD’s business continues to be looking strong.

That’s something that investors are coming to realise in the latest earnings season; that the business results of companies increasingly don’t matter to a market gripped by fear.

As Warren Buffett once said, “You should be fearful when others are greedy and greedy when others are fearful”.

Disclaimer: ProsperUs Head of Content & Investment Lead Tim Phillips owns shares of Advanced Micro Devices Inc.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.