2 Metaverse Stocks to Buy and Hold Forever

November 25, 2021

As stock markets have fluctuated over the past few weeks, yet still remain at near record highs, investors have rightly become concerned about all manners of issues.

These range from higher inflation that isn’t just “transitory”, the likelihood of the US Federal Reserve (Fed) raising interest rates and the nosebleed valuations of high-flying tech growth stocks.

The last point was in full show during the latest earnings season in the US, when growth companies that beat expectations and raised forward guidance still saw their share prices get punished.

However, if we’re investing with a longer timeframe of a few months, or years, then buying small positions in the big winners over the next decade could be a smart decision today for long-term investors.

One of the biggest investment themes and megatrends recently has been the “metaverse”. There are real-world applications to how the metaverse develops and the winners are starting to become more clear.

With that, here are two metaverse stocks that long-term investors can buy and hold forever.

1. Nvidia

One of the biggest semiconductor firms in the world is Nvidia Corporation (NASDAQ: NVDA) and it’s set to play a key role in the development in the metaverse.

How? Well, Nvidia designs chips that are on the bleeding-edge of tech and that power everything from our smartphones to data centres to autonomous vehicles. This will also include powering the metaverse.

One of the biggest advantages that the company has over other semiconductor firms is the superiority of its tech, which has allowed it to establish a lead over incumbent competitors that have now fallen behind, such as Intel Corporation (NASDAQ: INTC).

This has been particularly true in artificial intelligence (AI), where Nvidia is the default chip supplier for the semiconductors that are required to power AI.

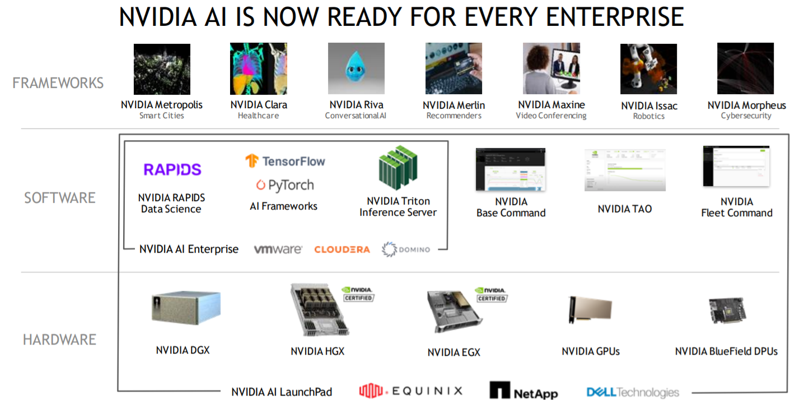

More importantly, within its ecosystems, Nvidia has a broad range of both hardware and software services, across multiple use cases, that serve these markets (see below).

Source: Nvidia slides, Piper Sandler Global Technology Conference as of September 2021

This has led to impressive results. Nvidia’s latest third-quarter earnings saw the company post record revenue of US$7.1 billion – up 50% year-on-year.

In fact, Nvidia CEO Jensen Huang commented on the earnings call that:

“Demand for Nvidia AI is surging, driven by hyperscale and cloud scale-out, and broadening adoption by more than 25,000 companies.”

With companies such as Facebook, now newly-branded as Meta Platforms Inc (NASDAQ: FB), and Microsoft Corporation (NASDAQ: MSFT) talking about building the metaverse in both social and enterprise environments, Nvidia is set to be one of the biggest winners.

2. Unity Software

Second, there’s Unity Software Inc (NYSE: U), which is the world’s leading game development engine and real-time 3D (RT3D) platform.

As I’ve previously written – in This Gaming Software Stock Plunged But It’s Still a Buy. Here’s Why – Unity is moving just beyond gaming.

Increasingly, it has moved into other verticals that could utilise its software while also allowing it to monetise its content.

For example, recently it launched Unity Metacast, a RT3D sports platform that creates and delivers interactive content.

Being able to view live sports in either an augmented reality (AR) or virtual reality (VR) setting is the end goal and, crucially, allowing users to monetise this will be another step into the metaverse for Unity.

One of the key portions of its “Operate” division is Unity Ads, one of the pillars that allow content creators to monetise their work across various platforms – whether its iOS, Android, or any other operating system.

In its latest earnings, Unity reported revenue of US$286.3 million – up 43% year-on-year – while also raising its full-year 2021 revenue guidance to 40%.

Unity also announced the planned acquisition of Peter Jackson’s New Zealand-based design and visual effects (FX) firm Weta Digital.

This will provide Unity with even more tools for it to help its clients build more realistic worlds using Unity services.

Watch this trend over the long term

While the metaverse is a hot topic right now, it’s important to remember that we are still in the very early stages of this theme.

There are likely to be multiple winners across the evolution of the metaverse over the next few years.

While nearly all companies will see advantages from the metaverse in one way or the other, Nvidia and Unity Software are set to be key beneficiaries over the long term.

Disclaimer: ProsperUs Head of Content & Investment Lead Tim Phillips owns shares of Nvidia Corporation, Unity Software Inc and Microsoft Corporation.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.