3 Monster Growth Stocks Heading to the Moon

June 22, 2021

Although cryptocurrencies and meme stocks have encouraged a lot of reckless speculation, there are also some lessons within them for long-term investors looking to buy and hold great companies.

While stocks such as GameStop Inc (NYSE: GME) and cinema operator AMC Entertainment Holdings Inc (NYSE: AMC) have been labelled “to the moon” plays amid ridiculous gains so far in 2021, it’s clearly not a sustainable trend.

Instead, as long-term investors we should continue to invest in companies that are “winning” in everything they do – whether that’s serving customers, taking market share or its share price crushing the S&P 500’s return.

That’s because the winners tend to keep winning and as long-term investors, we want to compound those gains over time.

So, with that, here are three growth stocks that continue to win over the long term and are heading to the moon.

1. Shopify

Anyone who’s familiar with e-commerce will have heard of digital storefront provider Shopify Inc (NYSE: SHOP).

The company has been crucial in providing millions of entrepreneurs with the ability to sell their wares online. During the Covid-19 pandemic, Shopify’s value became even more obvious to both its clients and the end buyer.

As a result, Shopify’s earnings throughout the pandemic have been turbocharged. However, with lockdowns easing and people heading back out, does that mean a reversal in fortunes?

Far from it. In fact, the ease of selling online has seen an explosion in merchants joining Shopify’s platform as they realise how easy it really is to set up shop virtually.

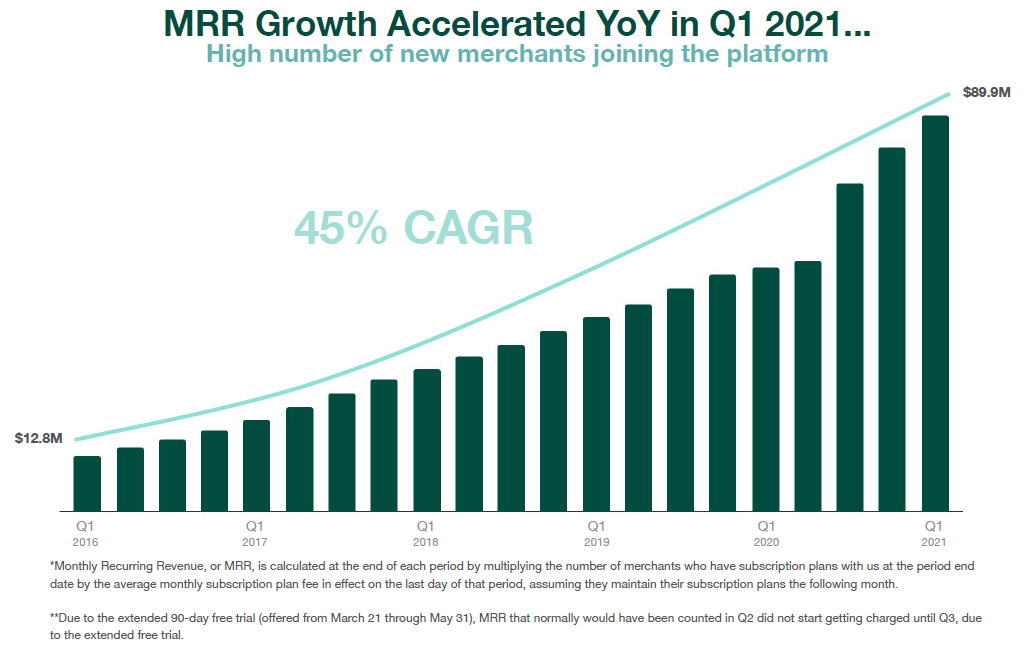

That led to a jump in already-impressive growth in monthly recurring revenue (MRR), which hit US$89.9 million in Shopify’s most recent quarter (see below).

Source: Shopify Q1 2021 earnings presentation

Although it only listed in 2016, Shopify shares are up nearly 5,000% since first hitting the public market.

With a market cap just north of US$180 billion – and with Shopify’s gross merchandise value (GMV) in the US only making up 8.6% of overall US retail e-commerce sales versus Amazon.com Inc’s (NASDAQ: AMZN) 39% – there is still clearly room for Shopify to keep growing.

2. Fiverr

Freelance services platform provider Fiverr International Ltd (NYSE: FVRR) has been a solid winner as “gig economy” workers looked to earn extra money online.

However, what was already a strong tailwind from connecting freelancers with clients, the Covid-19 pandemic spurred Fiverr’s fortunes. That seems to be something that looks set to stay with us post-Covid-19 as well.

In the first quarter of 2021, active buyers on Fiverr’s platform reached 3.8 million, up 56% year-on-year while spend per buyer also rose – hitting US$216, up 22% year-on-year.

Even more impressive is Fiverr’s non-GAAP gross margin, which was 84.1% in the first quarter of 2021, up from 81.6% in the same quarter of 2020.

By connecting buyers and sellers of services online, Fiverr has managed to build a comprehensive platform that connects people globally.

Again, it has been an impressive winner since listing its shares in the middle of 2019. In just around two years’ time, Fiverr shares are up over 600%.

3. ASML

Finally, there’s semiconductor equipment manufacturer ASML Holding NV (NASDAQ: ASML) which hails from the Netherlands.

As the only company capable of making extreme ultraviolet (EUV) lithography machines that are required to make cutting-edge semiconductors, ASML has an effective monopoly on its tech know-how.

With the largest foundries as key customers, like Taiwan Semiconductor Manufacturing Co Ltd (NYSE: TSM), also known as TSMC, ASML has a consistent stream of income from selling its high-value equipment.

Its first quarter 2021 sales figure of €4.4 billion came in above expectations while the company also has a gross margin of 53.9%, an impressive number in a traditionally capex-heavy industry like semiconductors.

Furthermore, ASML also pays a dividend, with its dividend per share (DPS) in 2020 hitting €2.75, up 15% year-on-year.

Over the past five years, ASML shares have gone from strength to strength, returning just over 620%.

Keep on winning

We should think about the long term movements of the companies we invest in and resist the temptation to “time the market” based on what dominates the financial media.

In the end, buying quality companies and holding them for the long term will result in that compounding of gains that’s so satisfying to watch play out over time.

Disclaimer: ProsperUs Head of Content Tim Phillips owns shares of Shopify Inc and Taiwan Semiconductor Manufacturing Co Ltd.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.