5 Key Takeaways From Netflix’s Earnings

January 20, 2021

With much fanfare about Walt Disney Inc’s (NYSE: DIS) Disney+ streaming service, and its success in attracting subscribers, investors seem to have forgotten about the OG streaming giant Netflix Inc (NASDAQ: NFLX).

Netflix’s fourth-quarter earnings report, reported last night, was a reminder that the company has still got that Midas touch when it comes the allure of its streaming platform.

With competition heating up in the streaming space – I find it amazing that Netflix had the space all to itself for so long – many investors are weighing up who the winners will be.

However, for those of us inclined to look long term, we should already be aware that Netflix has been one of the big winners. Here are five key takeaways from its latest earnings and why it looks set to keep winning.

1. Big subscriber growth

Doubts have been raised over Netflix and its continued subscriber growth given the competition of Disney+, which has added 86.8 million subscribers since launching.

All eyes were on Netflix’s subscriber growth number and it easily exceeded expectations. In the fourth quarter of 2020, Netflix added 8.51 million net new subscribers. This came in well ahead of the company’s own forecast of 6 million.

For the full year, Netflix added 37 million new members – which was up 31% from the 28 million added in 2019. Clearly, the Covid-19 pandemic has been a boon to its growth.

2. Higher operating margin

Netflix also managed to post a higher operating margin over the period (of 14.4%) as the company posted a 600 basis-point increase in the figure as compared to the fourth quarter of 2019.

However, this number was down on a sequential basis (from 20.4% in Q3 2020) due to an unrealised loss on some of is Euro-denominated debt.

Still, Netflix shareholders should take comfort in the fact that operating margin has been in the double-digit percentage range over the past four quarters now.

3. Growing in international markets

One of the big things that Netflix bears have always missed is the streaming giant’s opportunity set in international markets.

North America makes up less than 5% of the world’s population. If you exclude China (1.4 billion) as well, you could argue that Netflix’s total addressable market (TAM) in the rest of the world is huge – perhaps in the range of 5-6 billion people.

Indeed, the Europe, Middle East and Africa (EMEA) region accounted for a whopping 41% of Netflix’s full-year paid net additional subscriptions in 2020.

Meanwhile, the Asia-Pacific (APAC) region was the second-largest contributor as it saw net adds of 9.3 million, which was up 65% year-on-year.

4. Netflix content is king

Netflix continues to show that its original content is in demand. In the past few years, multiple movies have been produced by Netflix that have been either nominated or won awards at various film festivals.

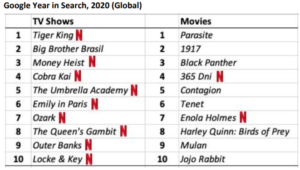

Of course, Netflix’s main staple is still its huge offering of original TV series content. In 2020, the company continued to display that much of its original programming still goes on to be hits with consumers (see below).

Source: Netflix Q4 2020 shareholder letter, Google. Note: Cobra Kai seasons 1 & 2 originally debuted on YouTube Red. Season 3 is a Netflix Original.

Amazingly, only one of the top 10 shows of Google’s most searched shows wasn’t made by Netflix. It was noted that Lupin, a French-language heist thriller series, has already been a huge hit and it “projects that up to 70 million member households will choose to watch Lupin in its first 28 days of release”.

5. Streaming big enough for two

Disney+ and its extraordinary success was actually touched on in Netflix’s fourth-quarter shareholder newsletter.

Noting that their strategy was simple (delighting customers in order to be the first choice in streaming), management also noted an interesting fact:

“Disney+ had a massive first year (87 million paid subscribers!) and we recorded the biggest year of paid membership growth in our history”.

If anything, it highlights that these two streaming behemoths can still be successful in the space. I don’t think it will be a winner-take-all space (say, like certain tech verticals are) over the next decade.

Netflix’s extraordinary 2020, in spite of heightened competition, highlights this. It’ll be an interesting ride ahead as Disney and Netflix continue to battle it out in the content arena in a bid for more members.

Disclaimer: ProsperUs Head of Content Tim Phillips doesn’t own shares of any companies mentioned.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.