5 Top Dividend Growth Stocks to Buy in October

October 4, 2022

Global investors have experienced an ugly 2022. In fact, it’s been an almost-relentless tsunami of red in stock markets.

That’s been particularly true for those of us who hold US stocks as the market there just had its worst September since 2002.

The benchmark S&P 500 Index lost an eye-watering 9.3% in September, while the tech-heavy Nasdaq-100 Index was even worse off – falling double digits in a 10.5% decline.

In times like this, we should think about deploying some of that “dry powder”, aka cash, that we’ve been storing. However, it’s important to also focus on buying into solid, cash-generating businesses.

That means businesses that preferably pay a dividend and ensuring that dividend is also growing at a sustainably fast pace.

So, for dividend growth investors, here are five top stocks to consider buying and holding in October.

1. Broadcom

If you’re familiar with technology, you’ll be aware of the importance of semiconductors. Broadcom Inc (NASDAQ: AVGO) is one of the world’s biggest designers, developers and suppliers of chips.

Its products span offerings in the data centre, networking, software, broadband, and wireless spaces. While its shares are down over 30% this year, its business is a solid cash generator.

In its latest Q3 Fiscal Year 2022 (FY2022) earnings, for the three months ended 31 July 2022, Broadcom saw revenue of US$8.46 billion. That figure was up 25% year-on-year.

Meanwhile, operating cash flow was a whopping US$4.42 billion during the period. Free cash flow? Well that was US$4.3 billion – an amazing 51% of its total revenue during the quarter.

That free cash flow generation is supporting a solid quarterly dividend per share (DPS) of US$4.10. Over the past five years, Broadcom has grown its DPS at a compound annual growth rate (CAGR) of 32.1%.

At its current share price of around US$456, Broadcom shares are offering investors a dividend yield of 3.6%.

2. NextEra Energy Partners

Next up is clean energy assets owner NextEra Energy Partners LP (NYSE: NEP). The yieldco is a subsidiary of renewable energy giant NextEra Energy Inc (NYSE: NEE).

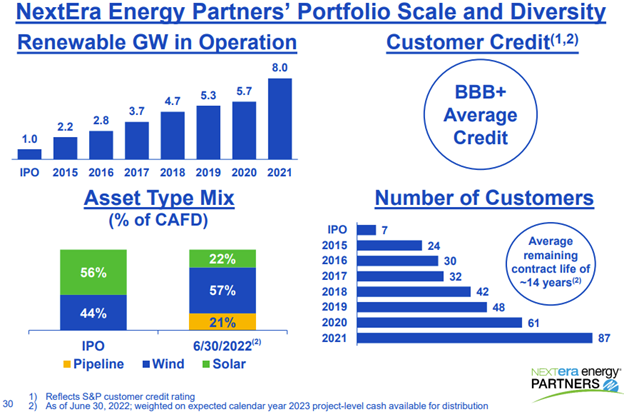

NextEra Energy Partners owns and operates a host of clean energy assets with total generation capacity of 8 gigawatts (GW).

This spans assets in wind, solar, battery storage and a small number of gas pipelines. Generating renewable electricity from these assets, it then sells the power to either utilities or large corporate buyers via power purchase agreements (PPAs).

Its steadily-expanding portfolio has enabled it to grow its dividend by over 300% since it first listed in 2014.

In addition, NextEra Energy Partners’ growing customer base and asset type mix has diversified its available channels of expansion (see below).

Source: NextEra Energy Partners August 2022 investor presentation

Meanwhile, with an average remaining contract life of around 14 years, its income visibility is particularly high.

That’s supported a fast-growing dividend that has a CAGR of 18.1% over the past seven years. Not only that but NextEra Energy Partners also hikes its dividend every quarter.

With a share price of US$75.56 currently, NextEra Energy Partners shares are giving investors a dividend yield of 4.0%.

3. Sherwin-Williams

The housing market in the US is huge. That’s where Sherwin Williams Co (NYSE: SHW) comes in as it’s a paints and coating manufacturer.

It also happens to be one of the biggest suppliers of paints to large home improvement retailers for professional contractors as well as DIY-ers looking to improve their homes.

Despite increasing revenue for its latest quarterly earnings for Q2 2022, its earnings per share (EPS) fell by 8.7% year-on-year to US$2.21.

However, this was mainly due to some foreign exchange (FX) headwinds as well as softening European demand and the impact from rising raw materials costs.

This hasn’t really affected its ability to pay out its quarterly dividend, which is currently US$0.60 meaning its dividend payout ratio is a relatively low 27%.

Over the past decade, Sherwin-Williams has seen its dividend expand at a CAGR of 16.5%. At its current share price of US$214.38, Sherwin-Williams shares are offering investors a dividend yield of 1.1%.

4. Tractor Supply

In rural America, one of the biggest retailers that dominates the scene is Tractor Supply Co (NASDAQ: TSCO). Contrary to its name, it doesn’t actually sell tractors.

Instead, it flogs items for home improvement, agriculture, lawn and garden maintenance, livestock, and pet care.

With an incredibly well-run structure, Tractor Supply has managed to grow its business sustainably.

Its latest Q2 2022 earnings report saw the company report record-high sales of US$3.9 billion – up 8.4% year-on-year from the same period in 2021.

While customer transactions were down 2.0% during the period, the average ticket was up 7.5%. While not immune to cost pressures (gross margin was down 24 basis points), Tractor Supply did see its operating income expand by 8.1% year-on-year to US$525 million.

Its dividend growth is where the company really shines. Over the past 10 years, Tractor Supply’s dividend has seen a whopping CAGR of 26.2%.

At its current share price of US$194, Tractor Supply shares give investors a dividend yield of 1.9%.

5. Target

Finally, we have Target Corporation (NYSE: TGT), which is one of the largest general retailers in the US.

The retailer has struggled over the past few quarters with excess inventory, which has been evident in its numbers.

During the second quarter, operating income was US$321 million – down from US$2.5 billion in the year-ago period.

That saw its operating income margin plunge to 1.2% in its latest second quarter, from the 9.8% in Q2 2021. That reflected a broader gross margin erosion.

However, with the company clearing out its excess inventory over the past two quarters, the worst of these issues are likely behind it.

Meanwhile, Target is a Dividend Aristocrat, having paid out a rising dividend for 50 consecutive years. Over the past decade, Target has seen its dividend expand at a CAGR of 11.6%.

At its current share price of US$151.79, Target shares are offering investors a dividend yield of 2.9%.

Grow those dividends over the long term

If you’re looking for cash-generating companies, you should also look at the dividend track records of companies.

Do they pay cash to shareholders? Have they done it sustainably over the long term? Those are some key questions.

In this volatile environment of rising inflation, it’s important to grow your passive income streams at a rate higher than inflation.

With this in mind, Broadcom, NextEra Energy Partners, Sherwin-Williams, Tractor Supply, and Target are businesses that produce both solid cash flows and fast-rising dividends.

Disclaimer: ProsperUs Head of Content & Investment Lead Tim Phillips owns shares in NextEra Energy Partners LP and Target Corporation.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.