5 Top Stocks to Buy in May

May 4, 2022

Stock market investing has been a test of nerves so far in 2022. That’s because the “easy money” trades in 2020 and into 2021 – where seemingly everything went up – have reversed in a violent fashion.

Blame high inflation, the war in Ukraine, rising interest rates and snarled supply chains. Besides that, the US Federal Reserve (Fed) is also starting so-called Quantitative Tightening (QT), by running off its near-US$10 trillion balance sheet.

As a result, there’s been a lot of red in markets recently. In April, the S&P 500 Index fell 8.8% for it worst April since 1970.

Meanwhile, the tech-centric Nasdaq plunged by 13.3% in April – marking its worst April since 2000, the height of the Dotcom Crash.

So, with all the negative news in the headlines, how should investors position themselves? It all comes down to buying great businesses and riding out the volatility.

For long-term investors who have at least a five-year time horizon, here are five great stocks to buy in May.

1. Booking Holdings

As we can all see, everyone is back to travelling now that Covid-19 seems to have subsided and contained in most of the world.

One of the biggest beneficiaries of this re-opening of international travel will be Booking Holdings Inc (NASDAQ: BKNG).

While we may think of Airbnb Inc (NASDAQ: ABNB) as the natural “go-to” play on travel, Booking is actually one of the world’s biggest online travel firms with local partners in more than 220 countries worldwide.

It owns a stable of platforms across various price points, including the eponymous Booking.com, Priceline, Agoda, KAYAK and OpenTable.

While the company is set to report its first-quarter earnings after the close on Wednesday (4 May), Booking’s latest fourth-quarter 2021 numbers were impressive.

Its revenue for the last three months of the year was US$3.0 billion up a whopping 141% year-on-year as travel roared back to life. Meanwhile, room nights booked in the fourth quarter increased 100% year-on-year.

And there have been positive signs that this rebound is likely to continue.

On an earnings call, management of Google owner Alphabet Holdings Inc (NASDAQ: GOOGL) commented that the company was seeing strong searches for travel – so much so that travel-related searches in the first quarter of this year were higher than in Q1 2019.

With shares of Booking down over 14% so far in 2022, the rebound of travel going into the summer months will likely propel the business forward.

2. Waste Management

While “rubbish” is rarely glamourous, someone needs to dispose of it. That’s what Waste Management Inc (NYSE: WM) does.

The waste disposal, waste management, and environmental services company has easily outperformed the S&P 500 Index so far this year – falling only 2% in 2022.

For its latest first-quarter 2022 results, Waste Management saw its revenue expand by over 10% year-on-year to US$4.68 billion while its operating EBITDA also expanded at a double-digit percentage pace to hit US$1.25 billion for the quarter.

While Waste Management isn’t immune to higher inflation – with operating expenses up 120 basis points during the first quarter due to higher wages for front-line workers as well as higher commodity prices for recyclables – the company is investing for the future.

For example, over the first three months of 2022, the company allocated US$47 million to sustainability growth investments, versus just US$11 million in the first quarter of 2021.

Finally, Waste Management’s free cash flow and capital allocation is impressive. The firm generated free cash flow of US$845 million in the first quarter while it also returned US$525 million to shareholders during the quarter – with US$275 million in dividends and US$250 million in share buybacks.

With its latest price of around US$160, shares of Waste Management are offering a 12-month forward dividend yield of 1.6%.

3. Visa

Another play on the return of international travel is in the payments space and here Visa Inc (NYSE: V) is one of the leaders.

The company is well known for its credit and debit cards as well as being part of a global duopoly for payments processors, along with competitor Mastercard Inc (NYSE: MA).

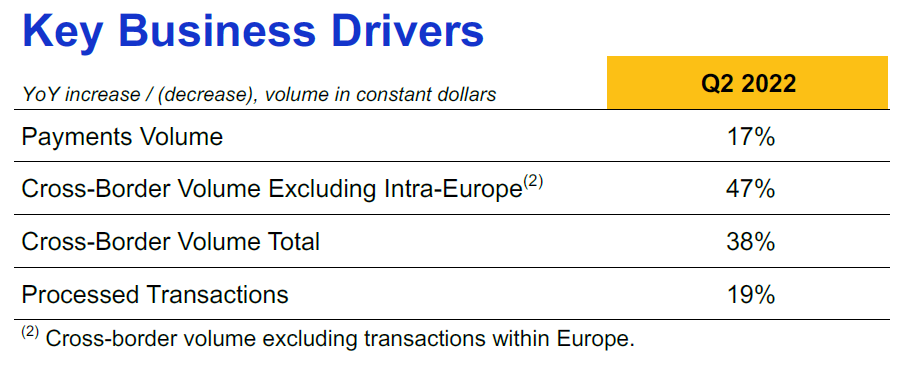

Visa’s latest fiscal second-quarter 2022 earnings were solid, with the company seeing net revenues of US$7.2 billion – up 25% year-on-year.

Similarly, earnings per share (EPS) came in at US$1.79, 30% higher than the year-ago period. As I’ve discussed before, cross-border transactions are a huge driver of fees for the payments processors.

Indeed, Visa saw robust cross-border volumes in its most recent quarter with cross-border transactions rising 38% year-on-year overall, while it saw a 47% bump if you exclude intra-Europe (see below).

Source: Visa Q2 FY2022 earnings presentation

Source: Visa Q2 FY2022 earnings presentation

With the re-opening set to continue, Visa could be a solid stock to hold as travel resumes worldwide.

4. Zscaler

As cybersecurity is a big topic these days, it’s worth paying attention to Zero Trust cybersecurity and cloud native firm Zscaler Inc (NASDAQ: ZS).

Focusing on Zero Trust Exchange architecture, where essentially cybersecurity is built with a “cloud-first” mentality, has seen Zscaler gain popularity with enterprise clients.

Its latest fiscal second-quarter 2022 earnings highlight that. Zscaler’s revenue saw 63% year-on-year growth to US$255. 6 million while its billings expanded by 59% year-on-year to US$367.7 million.

Even better, for a high-growth tech firm, it was free cash flow positive in it latest quarter – to the tune of US$29 million.

With a dollar-based net retention rate (DBNRR) of over 125% and a cash position in excess of US$1.5 billion, Zscaler looks in a great position to continue growing in 2022 and beyond.

5. Costco

Finally, we have one of the gold-standard retailers in the US; Costco Wholesale Corporation (NASDAQ: COST).

Perhaps the epitome of a company that possesses pricing power, Costco has shown that it can charge more for its membership fees without bleeding any meaningful amount of customers.

A great indication of this came in its latest fiscal second-quarter earnings (for the 12 weeks ended 13 February 2022), when Costco released its February comp sales, with US comps seeing an impressive 12.9% uplift – excluding changes from gasoline prices and foreign exchange.

Meanwhile, Costco’s net income for the period saw an over-30% expansion, hitting US$1.3 billion from US$951 million in the year-ago period.

While it does trade at a premium to its peers, it seems to be a premium well worth paying given Costco’s consistent long-term performance.

The cherry on top for investors is that Costco recently raised its quarterly dividend by 14% to US$0.90. While it only yields 0.6%, Costco has paid out a dividend since 2004 and consistently raises it.

Looking through market volatility

April may have been a month to forget for investors but, as anyone who thinks long term will know, reduced prices offer us buying opportunities on great companies.

We can build a resilient portfolio by being diversified and owning a fair mix of growth, dividend and value stocks, according to our own risk profile.

In that vein, Booking Holdings, Waste Management, Visa, Zscaler, and Costco offer a good mix of all of the above for long-term investors.

Disclaimer: ProsperUs Head of Content & Investment Lead Tim Phillips doesn’t own shares of any companies mentioned.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.