Better Buy: Coca-Cola vs. Pepsi

August 5, 2022

Recently, I have written about The Coca-Cola Company (NYSE: KO) as one of the top stock buys in August and how PepsiCo Inc (NASDAQ: PEP) is winning the inflation battle.

Both Coca-Cola and PepsiCo are among the most valuable brands in the world and benefit from their strong pricing power.

Most investors also see Coca-Cola and Pepsi as similar investment picks. Their iconic products compete head-to-head and both are seen by average consumers as a beverage or soda company.

The two stocks are also seen as safe investments that provide a steady income stream via their dividend payouts.

However, which of the two beverage stocks is a better buy at the current valuation and market environment?

Let’s find out.

Diversification

One important difference between the two companies is the fact that PepsiCo does not only operate in the beverage industry but also in the snack and food business industry.

Meanwhile, Coca-Cola’s business is primarily focused on the sale of beverages as it doesn’t have a snacks portfolio.

With a product portfolio of snacks such as Cheetos, Doritos and Lay’s, Pepsi provides a blend of diversification that reduces the reliance on its beverages segment.

Winner: PepsiCo

Earnings outlook

Coca-Cola reported positive earnings report that beat Wall Street estimates last week.

Its revenue for the Q2 FY2022 surpassed estimates by US$730 million, reporting total sales of US$11.3 billion.

Similarly, its non-GAAP earnings per share (EPS) of US$0.70 topped estimates by US$0.03.

The management has also raised its future guidance and now anticipates organic revenue growth of 12% to 13% as compared to a prior expectation of 7% to 8%.

PepsiCo has also reported a strong quarter earnings results as the iconic beverage and convenience food company has been able to pass on some of these higher costs to consumers.

According to the earnings call, consumers appear willing to treat themselves to relatively affordable snacks and beverages despite the higher average price of 12%.

Pepsi management has also upgraded their outlook guidance with 10% organic revenue growth expected for FY2022 as compared to the previous 8%.

In terms of outlook, I think Coca-Cola is the winner here with a stronger guidance and better growth in Q2 FY2022.

Winner: Coca-Cola

Dividend track record

Both Coca-Cola and Pepsi are known for their commitment to reward shareholders. Both are Dividend Kings with at least 50 years of consecutive dividend growth.

Currently, Coca-Cola has a 12-month forward dividend yield of 2.8% while Pepsi’s is slightly lower at 2.6%.

However, Coca-Cola’s dividend payout ratio is slightly higher at 70.5% as compared to Pepsi’s 67.6%.

However, Coca-Cola has a stronger track record with 59 consecutive years of dividend growth as compared to Pepsi’s 50 years.

Pepsi is definitely catching up as seen by its five-year dividend growth rate of 7.4% as compared to Coca-Cola’s 3.6%.

However, since Coca-Cola currently offers a higher dividend yield and a better track record, I believe it’s the winner here.

Winner: Coca-Cola

Share price performance

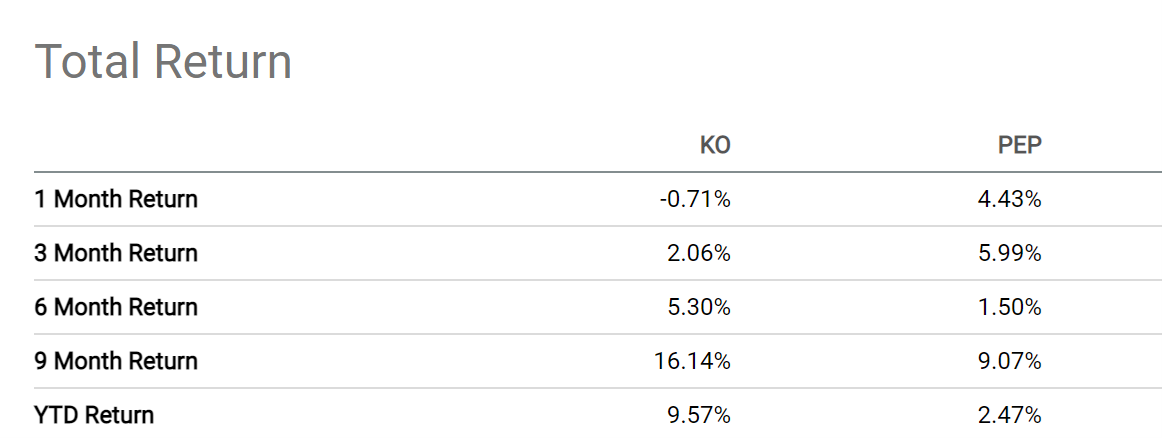

Coca-Cola’s year-to-date total return has outpaced Pepsi’s (9.6% versus 2.5%).

This shows investors’ preference for Coca-Cola so far this year.

This makes Coca-Cola a clear winner here but investors should take note that Pepsi is gradually catching up over the last three months as compared to Coca-Cola.

Winner: Coca-Cola

Relative valuation

A look at a simple relative valuation model puts Pepsi as the better buy than Coca-Cola.

For example, Coca-Cola’s 12-month forward price-to-earnings (PE) ratio is at 28.2 times, which is higher than Pepsi’s 22.8 times.

At this level, Coca-Cola is trading at 9.9% above its 5-years average PE. In comparison, PepsiCo is trading below its 5-years average PE.

Winner: Pepsi

Coca-Cola shares deserve the premium

It is tough to choose between Coca-Cola and PepsiCo.

Both the beverage heavyweights have been going back and forth against one another.

While Pepsi is definitely more attractive in terms of valuation (and its diversified business model), I believe Coca-Cola’s stronger outlook and better dividend track record means that it deserves its premium.

This is reflected in Coca-Cola’s strong share price performance so far in 2022.

For these reasons, I believe Coca-Cola would be a better place to invest as compared to Pepsi.

Disclaimer: ProsperUs Investment Coach Billy Toh doesn’t own shares of any companies mentioned.

Billy Toh

Billy is deeply committed to making investment accessible and understandable to everyone, a principle that drives his engagement with the capital markets and his long-term investment strategies. He is currently the Head of Content & Investment Lead for Prosperus and a SGX Academy Trainer. His extensive experience spans roles as an economist at RHB Investment Bank, focusing on the Thailand and Philippines markets, and as a financial journalist at The Edge Malaysia. Additionally, his background includes valuable time spent in an asset management firm. Outside of finance, Billy enjoys meaningful conversations over coffee, keeps fit as a fitness enthusiast, and has a keen interest in technology.