Can Wayfair Stock Keep Winning in E-Commerce?

November 4, 2020

Wayfair Inc (NYSE: W), the online home-goods and furniture retailer, saw its shares soar 7.2% on positive earnings. Should investors buy into its growth?

Tim’s Take:

A 12-bagger since March this year. That’s what Wayfair shareholders would be sitting on had they picked them up the stock at around US$22 during the massive March sell-off.

Today? They’re trading at around US$275 after yesterday’s 7% pop. Granted, you’d have to be have been a brave buyer at those levels after the stock had fallen around 80% between the start of 2020 and its March low.

However, the reasoning for the extraordinary rebound is clear. Wayfair offers consumers a convenient way to buy home furniture and other home goods; by doing it online.

More so than generalists like Amazon Inc (NASDAQ: AMZN), Walmart Inc (NYSE: WMT) or Target Corporation (NYSE: TGT), specialty online retailers such as Wayfair have thrived in the Covid-19 economy.

What’s more, with young people starting to move to the suburbs, and with the housing market in the US holding up well, Wayfair is ideally-positioned to take advantage of this structural shift.

Solid results and differentiated offering

In fact, Wayfair’s latest earnings attest to the strength of its offerings. The company posted robust revenue growth of 66.5% year-on-year in the third quarter to US$3.8 billion.

Meanwhile its gross margin for the third quarter was just shy of 30%, extraordinary versus a 2019 number of 23.6%.

Wayfair also has a presence in international markets, namely in Europe. Although it only makes up about 17% of Wayfair’s overall revenue, its growing fast.

One of the big reasons for Wayfair’s success has been its diverse product offerings with five separate labels that cut across various price points.

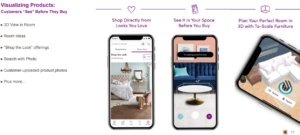

What’s more, the company has also been able to differentiate itself by addressing customer needs, such as utilising technology to help users plan and picture layouts in their home (see below).

Source: Wayfair Q3 2020 earnings presentation

For investors who are taking a long-term approach, Wayfair could prove to be an interesting stock that plays into the long-term trends of younger consumers purchasing home goods online.

With over 28.8 million active customers and an online home category that is growing at approximately 15% per year in the US, Wayfair is well-positioned to keep winning in the online home furnishings sector.

Disclaimer: ProsperUs Head of Content Tim Phillips doesn’t own shares of any companies mentioned.

This material is categorised as non-independent for the purposes of CGS-CIMB Securities (Singapore) Pte. Ltd. and its affiliates (collectively “CGS-CIMB”) and therefore does not provide an impartial or objective assessment of the subject matter and does not constitute independent research. Consequently, this material has not been prepared in accordance with legal requirements designed to promote the independence of research. Therefore, this material is considered a marketing communication.

This material is general in nature and has been prepared for information purposes only. It is intended for circulation amongst CGS-CIMB’s clients generally and does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this material. The information and opinions in this material are not and should not be construed or considered as an offer, recommendation or solicitation to buy or sell the subject securities, derivative contracts, related investments or other financial instruments or any derivative instrument, or any rights pertaining thereto. CGS-CIMB have not, and will not accept any obligation to check or ensure the adequacy, accuracy, completeness, reliability or fairness of any information and opinion contained in this material. CGS-CIMB shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.