Here’s something investors probably aren’t aware of: Sonic the Hedgehog 2 became the highest-grossing kids movie of the pandemic era, generating an estimated US$71 million in its domestic debut in the US.

For anyone interested in investing in the “reopening economy”, it’s another encouraging sign. It also comes as movie theatres after “The Batman” movie officially climbed past US$735 million at the global box office.

Those in the films studio industry believe that there are signs that people are ready to return to theatres in large numbers this year, and I believe one of the big winners from this is The Walt Disney Co (NYSE: DIS).

Disney’s strong brand content with its Marvel franchise is obvious. In 2021, the release of Spider-Man: No Way Home had grossed US$1.8 billion worldwide, putting it on the top 10 list of the highest-grossing movies of all-time.

With the return of the “Big Screen” this year, I expect to see a significant boost to Disney’s earnings.

I’ve written about the five reasons to buy Disney in February and while share prices remain lacklustre, the recovery in movie theatres is a boon for Disney. Here is a look at the numbers.

Four notable movie releases for Disney

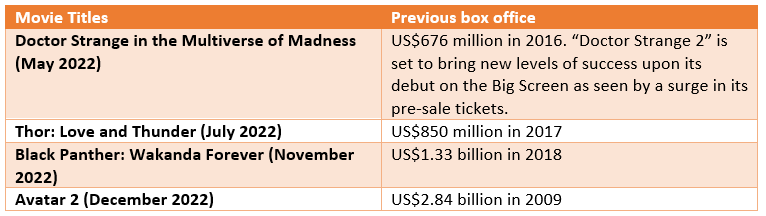

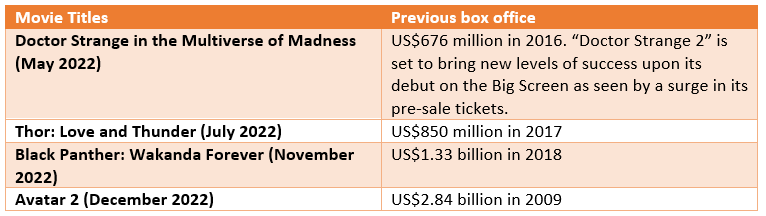

Disney has an exciting slate of highly anticipated movies scheduled for release this year.

Even without mentioning all of them, there are four notable movie releases this year that could surpass the US$1 billion mark in box office revenues.

When you look at the Marvel franchise, which includes all three – Doctor Strange, Thor, and Black Panther – sales have been trending upwards.

Aside from these four, there are other highly-anticipated movies, which include Lightyear, a spinoff from the Toy Story franchise. That series of films has grossed more than US$3 billion at the box office globally.

Content and licensing sales still has space to grow

Another key area to take note of is that the impact of COVID-19 on its content and licensing sales business remains as production of movies were delayed.

In fact, despite recording a 43% year-on-year increase to US$2.4 billion in its content and licensing business segment in the 1Q FY2022, it’s still a decline of 37.8% from its pre-COVID level in 4Q FY2019.

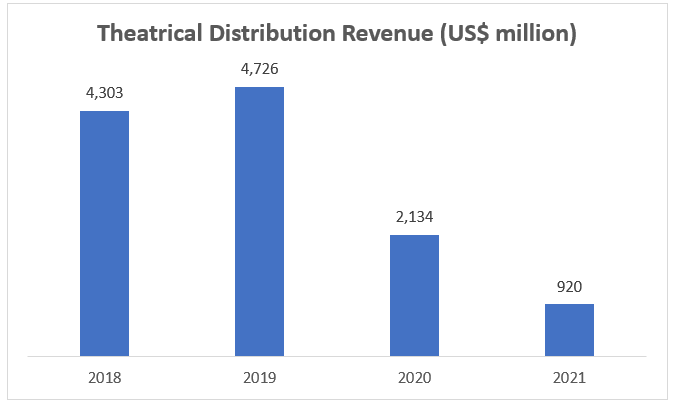

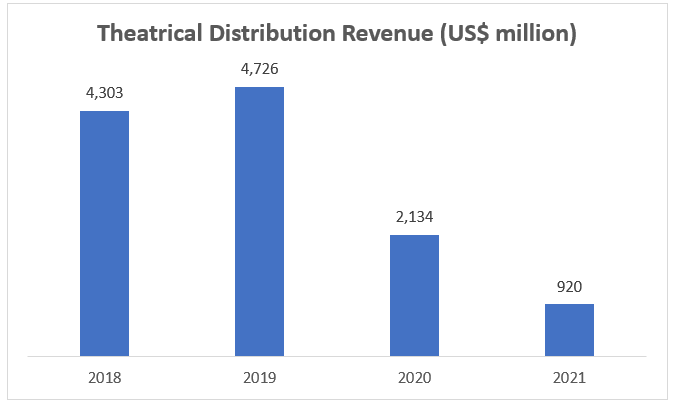

Looking at the breakdown of the content and licensing business segment into theatrical distribution (see below), we saw an even greater impact.

Source: The Walt Disney Co.’s Annual Report, ProsperUs

Revenue generated from theatrical distribution in FY2021 was only at US$920 million, which is only about 25% of the revenue generated from the business in 2018 and 2019.

The sharp decline in the revenue was mainly due to fewer theatrical releases and production delays.

A pickup in FY2022 will generate a recovery towards the pre-COVID level, which would represent a significant jump for the Mickey Mouse company.

Return to cinema will boost Disney’s revenue

Despite some of the delays in some of the anticipated movies, including Indiana Jones 5, into 2023, it is obvious that we have seen significant progress in terms of production.

In fact, if the studio target release date materialises, I expect to see the theatrical releases revenue return to its pre-COVID level.

This will boost Disney’s revenue back to its 2019 level or even breach the US$70 billion level.

This will provide Mickey Mouse & Co the buffer to shift its business model from the reliance on its linear TV segment to streaming services.

There are other bright spots in its Parks, Experiences and Products segment with the reopening of the economy but given the lagging data, it is hard to gauge the performance of the company until the release of its financial earnings.

Personally, with the box office data updated on a weekly basis, I think investors should pay attention to the performance of movie releases to gauge if the recovery will materialise.

At this juncture, it is saying that investors can enjoy the popcorn and soda without being too worried about the share price fluctuation.

Disclaimer: ProsperUs Investment Coach Billy Toh doesn’t own shares of any companies mentioned.