Here’s Why Investors Should Avoid Uber Stock

November 6, 2020

Uber Technologies Inc (NYSE: UBER), the ride-hailing firm, saw shares fall nearly 2% in after-hours trading following disappointing earnings. Here’s why long-term investors should avoid it.

Tim’s Take:

We’ve probably all taken an Uber ride at some point in our lives. Although it departed from the Southeast Asian market a few years ago, the ride-sharing firm has a dominant presence in the US, Europe and other Asian countries.

Uber’s third-quarter earnings came in line with expectations but that doesn’t mean they were pretty. In fact, revenue was down 17% year-on-year to US$3.1 billion while its loss-making ways continued.

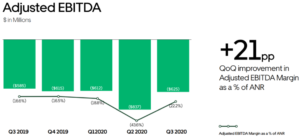

Uber posted an adjusted EBITDA loss of US$625 million and this hasn’t improved much over the past year or so (see below).

Source: Uber Technologies Q3 2020 earnings presentation

Uber’s share price reflects this. Since going public in May 2019, its shares sit about 10% below its IPO price of US$45 per share.

Uber, and competitor Lyft Inc (NASDAQ: LYFT), both recently scored a win when Californian residents voted to keep classifying drivers as independent contractors.

However, if they had lost “Prop 22”, then both companies’ businesses in the state would have been effectively destroyed overnight.

Bleak outlook and profitless

So despite the pop in share prices in response, it was actually just a continuation of the status quo. And that status quo – as far as ride-hailing is concerned – isn’t great.

Although the number of trips on Uber’s platform has picked up from the nadir in the second quarter, the 1.15 billion figure is still well below the first quarter of 2020 and about 40% off the numbers seen in the last quarter of 2019.

As we head into the winter months, with Covid-19 infections in the US and Europe starting to pick up again, that number isn’t likely to be sustained.

Beyond that, Uber hasn’t charted a sustainable path to profitability for investors. Buzzwords like “mobility”, “logistics” and “Internet of Things” are espoused by senior management but concrete plans on how that’s going to be monetised and eventually profitable is far from clear.

Uber does have a delivery business (which Uber Eats and a general freight delivery come under). Admittedly, that has seen an uptick in business.

Yet competition in the space is fierce and on the broader logistics front you have giants like Amazon.com Inc (NASDAQ: AMZN) that are investing billions and building out their own logistics capabilities.

That’s without including the likes of FedEx Corporation (NYSE: FDX) and United Parcel Service Inc (NYSE: UPS), who are not resting on their laurels.

For long-term investors who are looking to buy and hold great businesses, Uber is one to avoid.

Disclaimer: ProsperUs Head of Content Tim Phillips doesn’t own shares of any companies mentioned.

This material is categorised as non-independent for the purposes of CGS-CIMB Securities (Singapore) Pte. Ltd. and its affiliates (collectively “CGS-CIMB”) and therefore does not provide an impartial or objective assessment of the subject matter and does not constitute independent research. Consequently, this material has not been prepared in accordance with legal requirements designed to promote the independence of research. Therefore, this material is considered a marketing communication.

This material is general in nature and has been prepared for information purposes only. It is intended for circulation amongst CGS-CIMB’s clients generally and does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this material. The information and opinions in this material are not and should not be construed or considered as an offer, recommendation or solicitation to buy or sell the subject securities, derivative contracts, related investments or other financial instruments or any derivative instrument, or any rights pertaining thereto. CGS-CIMB have not, and will not accept any obligation to check or ensure the adequacy, accuracy, completeness, reliability or fairness of any information and opinion contained in this material. CGS-CIMB shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.