Unbeknownst to a lot of people, some of the world’s biggest leaps in innovation – including the advent of the Internet – were created by governments and its various agencies.

It’s in this vein that one of the hottest software stocks recently, Palantir Technologies Inc (NYSE: PLTR), got its own start. The company helps clients make sense of enormous datasets through the use of two key platforms.

However, Palantir actually began life back in 2003 with funding from the Central Intelligence Agency (CIA).

Although many of its customers were government entities – helping them with big data analytics – Palantir has now also branched out to commercial customers.

With the charismatic entrepreneur Peter Thiel as one of its founders and having gone public via a direct listing at US$10 a share in September last year, is Palantir a buy for long-term investors?

Business growth

Palantir’s push outside of the government sphere, and into the commercial space, clearly illustrates that the company’s technology is applicable to both realms.

In fact, management of Palantir currently predict that its total addressable market (TAM) is a whopping US$119 billion, with US$63 billion in the government sector and US$56 billion in the commercial space.

With 2020 full-year revenue of only US$1.1 billion – which was up 47% year-on-year – the runway for Palantir to keep growing into the space is huge.

In the fourth quarter of 2020, the company signed multiple large deals with companies in the automotive, energy, healthcare, insurance and mining sectors.

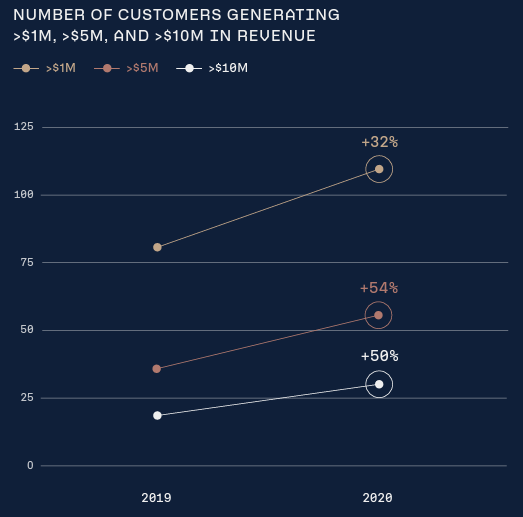

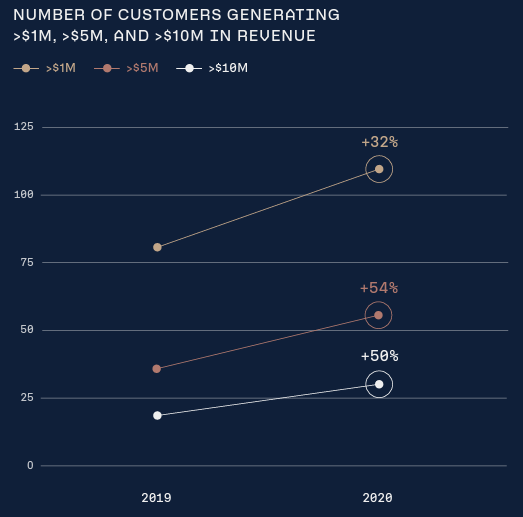

This is clearly paying off and showing up in the numbers. The numbers of customers generating over US$1 million, US$5 million and US$10 million in revenue are growing at an impressive clip (see below).

Source: Palantir Technologies Q4 2020 earnings presentation

Loss making and ethical concerns

As with many growth companies out there, Palantir remains unprofitable despite its huge revenue growth numbers.

In 2020, the company’s operating cash flow was negative US$297 million as it continues to invest in the growth of its business.

The opportunity ahead of Palantir is large but certain investors have also been wary over its ties to the US government and military projects.

For investors who don’t wish to put money into companies that are linked to governments or any clandestine projects, this might be a concern for them to consider before buying its shares.

However, with Palantir’s share price sitting about 50% off its all-time high, this could be an opportunity for long-term investors to add to an under-the-radar high-growth company.

Disclaimer: ProsperUs Head of Content Tim Phillips doesn’t own shares of any companies mentioned.