Target Corporation (NYSE: TGT) has been on a roll as the retailer again reported a strong set of earnings. Should long-term investors buy?

Tim’s take:

In the past, “Tar-jay” has been a colloquial moniker used in jest to describe Target – mainly in order to make it sound more upscale than it actually is.

The retailer’s stores offer everything from groceries and essentials to clothing and electronics. Target has been a mainstay of the American retailing scene for decades.

Joking aside, Target’s core market has been performing ridiculously well. Its latest set of earnings were no laughing matter.

Revenue jumped 21.3% year-on-year in the third quarter to US$22.36 billion while earnings per share (EPS) was US$2.79 – up a whopping 105.1% year-on-year.

Perhaps most encouragingly, amid the Covid-19 pandemic and likely further lockdowns across the US, Target’s digital sales rocketed 155% year-on-year.

Comparable sales were also impressive with Target posting 20.7% year-on-year growth on that metric.

Throughout this year, the company has managed to consistently beat on expectations given the company’s strong execution. A lot of this has come down to its digital strategy.

Focus on the Target experience

In the US, department stores on the whole have been awful investments. The share prices of the likes of Macy’s Inc (NYSE: M) and Nordstrom Inc (NYSE: JWN) have cratered in recent years as consumers become more discerning on where they spend their money.

However, Target has bucked this trend by focusing on building out its own stable of branded goods that have met consumers’ demands – from affordable clothing to grocery offerings that department stores lack.

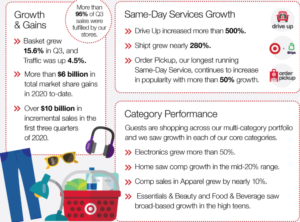

Yet perhaps one of the biggest reasons Target has been able to succeed has been its extraordinary omnichannel experience. The retailer has worked hard to build out its delivery capabilities and expand pick-up options. As the third-quarter numbers show, these are starting to bear fruit (see below).

Source: Target Q3 2020 earnings infographic

Target’s recent tie-up with Ulta Beauty Inc (NASDAQ: ULTA), a chain of beauty stores, will see the latter set up shop in Target stores.

Although most likely not a large contributor to the bottom line, having Ulta within its stable of brands will further strengthen Target’s already-robust product offering to consumers.

With further lockdowns imminent in the US, and people looking to spend during the holiday season, Target looks well-positioned to keep delivering the goods.

Disclaimer: ProsperUs Head of Content doesn’t own shares of any companies mentioned.