Why This Insurtech Stock Could be a 10-Bagger

March 11, 2021

The legendary investor Peter Lynch, who managed the Magellan Fund at Fidelity, coined the term “multibagger”.

It refers to a stock that gives you a return of more than 100% and is based upon the game of baseball, referencing the bases that measure success.

Coming out of his book “One Up on Wall Street”, the iconic number from the multibagger universe is the 10-bagger – essentially an investment that goes up 10 times what you paid for it.

That’s the holy grail for investors, isn’t it? Obviously, identifying and finding them is the hard part.

With that, here’s one stock operating in the insurance/technology (insurtech) space that I think could be a potential 10-bagger over the long term.

Online insurance for the young

Insurance is one of the most staid industries around. Until recently, it seemed to be immune to innovation.

However, one company that is trying to upend the traditional model of doing things is Lemonade Inc (NYSE: LMND), an online insurance platform that is serving home renters and home owners.

More recently, Lemonade has also expanded into pet insurance and life insurance while also broadening its suite of products to Germany, the Netherlands and France.

Uniquely, powered by an Artificial Intelligence (AI) chatbot named “Maya”, Lemonade policy holders’ claims can be settled in a matter of seconds.

It’s no surprise that the company has seen a surge in customers, having recently crossed the one million customer threshold late last year.

It took Lemonade a little over four years to reach that landmark. For context, traditional insurance powerhouses such as Geico took 28 years to reach a million while State Farm took 22 years. That’s the power of technology.

The home owners and renters insurance market in the US is still big (with a total addressable market of over US$110 billion) but the true prize for Lemonade would be even a small sliver of the term life insurance market in the US, which is worth over US$700 billion.

Multibagger potential

While Lemonade is still in its early days of growth, the company’s track record so far has been impressive. Recently it released its fourth-quarter and full-year results for 2020.

At the end of 2020, its in-force premium (IFP) jumped 89% year-on-year to US$213 million while its premium per customer rose 20% year-on-year to hit US$213.

That highlights how Lemonade is becoming more efficient at its “land and expand” model of growing its business. Essentially, the insurer uses a “gateway product”, in this case renters insurance, to sign up new customers.

It then stays with that customer throughout their insurance journey. It will then appropriately cross-sell and upsells those customers a whole host of other products such as home insurance, pet insurance and, now, life insurance.

This optionality (as well as the fact that users love its platform) is one of the key reasons why I think Lemonade could be a winner over the long term.

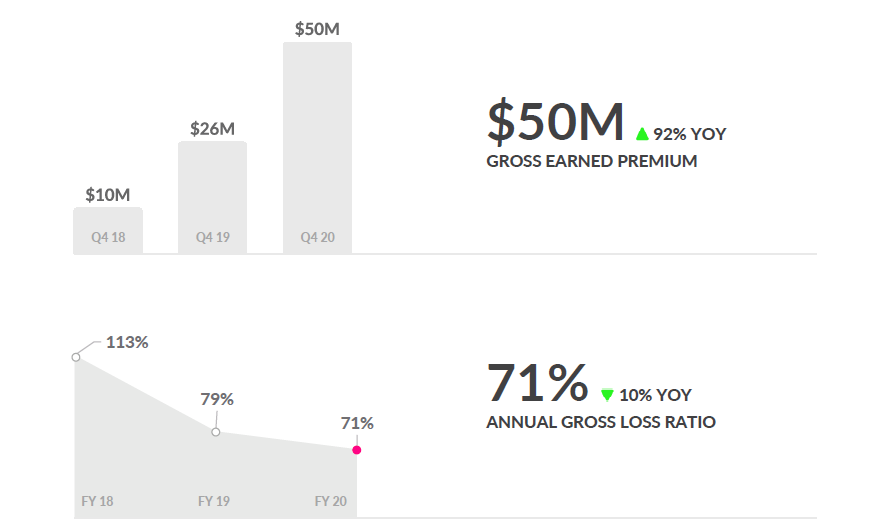

What’s more, its gross loss ratio – an insurance ratio measuring losses versus premiums – has been on a consistent downtrend. In 2020, it hit 71% (see below) while in FY 2017 it was up at 161%.

Meanwhile, its gross earned premium in the latest quarter was up 92% year-on-year to US$50 million.

Source: Lemonade Q4 2020 shareholder letter

Source: Lemonade Q4 2020 shareholder letter

Patience over the long term

It’s important that investors remember that this is a long-term story of a potential disruptor in a market that has been traditionally opposed to change.

Yet in 2020, many companies went up six- or seven-fold. That was not “normal” and shouldn’t be expected going forward.

For 10-baggers to play out, the business has to keep growing and succeeding over time. Take Tesla Inc (NASDAQ:TSLA), the poster child of multibagger gains.

Tesla stock is a 150-bagger over the past decade. Yet for a large part of that period, there were many lows and large periods when the share price underperformed the broader market.

Owning and investing in disruptors can be a case of waiting to see how the business plays out and performs.

In Lemonade’s case, its runway for growth in the insurance industry is clearly long and I believe it could be a huge success in future if it keeps executing on its vision to make insurance easier for everyone.

Disclaimer: ProsperUs Head of Content Tim Phillips owns shares of Lemonade Inc.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.