Advanced Micro Devices Inc (NASDAQ: AMD), commonly known as AMD, has become a familiar name in the tech industry, known for its relentless pursuit of innovation and market share. As the curtain rises on Q3 2023 and projections for the year’s end, investors and tech enthusiasts are presented with an electrifying narrative of growth prospects, even as they navigate the challenging near-term risks.

Here are the five key takeaways from AMD’s latest financial disclosure that paint a picture of a company at a pivotal moment in its storied journey.

1. Better than expected Q3 but a cautious Q4 ahead

AMD’s Q3 2023 results were slightly ahead of expectations, with revenues and non-GAAP earnings per share hitting US$5.8 billion and US$0.70, respectively. However, the forecast for the Q4 2023 is less rosy, with anticipated revenues at US$6.1 billion falling short of the $6.4 billion consensus.

2. PC market rebounds, data centres and AI accelerate

The PC market, which is seeing a recovery, coupled with AMD’s increased CPU market share, has led to robust growth within its Data Center segment in the second half of 2023. Significantly, AMD projects over US$2 billion in AI GPU revenues for the next year, a figure that notably surpasses earlier predictions of less than US$1 billion.

3. Headwinds in gaming and embedded sectors

AMD is not immune to cyclical downturns as its Embedded and Gaming Console businesses are experiencing greater pressures than initially forecasted. The Embedded segment, in particular, is predicted to continue this downward trend well into H1 2024.

4. Strong long-term prospects despite short-term hurdles

Despite lowering earnings estimates for 2024 and setting a cautious tone for 2025, AMD’s long-term outlook remains optimistic. With potential server CPU share gains and a significant foothold in the burgeoning AI accelerator market, AMD’s forward-looking narrative is one of resilience and growth.

5. Valuation justified by future growth

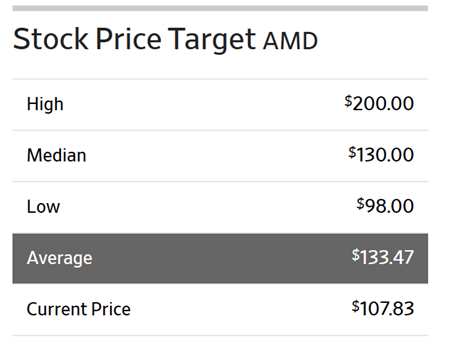

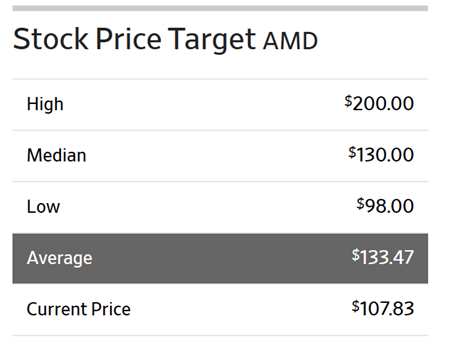

Currently valued at approximately 27 times its projected 2024 earnings, AMD’s valuation is considered justified, given the company’s prospects for sustained growth and margin expansion. This has led to a strong buy recommendation by Wall Street with an average target price of US$133.47, representing a potential increase of 23.8%.

Source: Wall Street Journal

Embrace the future of AI with AMD

As AMD navigates the ebb and flow of market demands and global economic shifts, its underlying strength in innovation, particularly in the AI sector, solidifies its potential for long-term growth. The call to action for investors is clear: with an anticipated 10-20% capture of the $100 billion+ AI accelerator market and continued server share gains, AMD presents a compelling opportunity. While the near-term challenges persist, AMD offers an attractive proposition for investors looking to tap on the AI growth story.

Disclaimer: ProsperUs Head of Content & Investment Lead Billy Toh doesn’t own shares of any companies mentioned.