As the aviation industry continues its recovery from the global pandemic, Singapore’s flagship airline carrier – Singapore Airlines Ltd (SGX: C6L) – has emerged as a major beneficiary.

Year-to-date (YTD), Singapore Airlines shares, or SIA shares, have gained by 4.7%. This was better than the Straits Times Index’s (STI) return of 2.1% YTD.

In my previous article on the 5 hot investment themes in Singapore amid market volatility, I mentioned that SIA is one of the key beneficiaries of the return of Chinese tourists.

The return to air travel will maintain earnings momentum for SIA, even as the cost of operations surge amid the inflationary environment and higher fuel costs.

Here are some highlights of recent developments, all of which strengthen my view on the resilient earnings outlook for SIA.

SIA and Scoot’s passenger traffic jump by more than three times

In March, SIA and Scoot Pte Ltd (Scoot) carried a combined 2.7 million passengers, a 14.1% increase from February 2023 and three times more than March 2022.

Scoot is a Singapore low-cost airline and a wholly-owned subsidiary of SIA.

Scoot alone carried 947,600 passengers, a 638.6% jump from the previous year, while SIA transported 1,773,900 passengers, marking a 132% yearly increase.

The group’s passenger capacity in March rose by 10.9% compared to February 2023 and reached 79% of pre-pandemic levels (taking January 2020 as the comparison).

The group’s passenger load factor (PLF), a measure of how full flights are, reached 89.0% – a 2.4% monthly increase and a 34.5% yearly increase.

SIA’s PLF was 87.9%, and Scoot’s PLF hit a record high of 92.8%.

SIA’s passenger traffic recovery outpaced regional competition

SIA experienced a significant rebound in passenger traffic in 2022, with the group’s (including Scoot) passenger capacity reaching 80% of pre-pandemic levels in March 2023, a considerable increase from 38% in January 2022.

In contrast, competitors in the region only achieved 64.3% international capacity during the same period, largely due to their higher reliance on Chinese traffic and greater resource limitations.

SIA’s superior performance is expected to continue in the near future, supported by strong forward booking data and the group’s progress in restoring flights to China.

The airline aims to achieve 80-90% of its pre-pandemic capacity to China by October 2023, up from the current 25-30%.

Better management of labour shortages

In comparison with its peers, SIA has a better management of issues involving labour shortages, particularly among pilots.

This will allow the airline to expand its capacity in the short term as compared to its peers.

With strong demand and ability to restore its capacity to pre-pandemic levels, SIA’s passenger traffic is expected to normalise to pre-COVID levels by the end of this year.

This is likely to be ahead by one to two quarters as compared to its regional peers.

Strong pricing power

Aside from that, SIA has strong pricing power with the reopening of the economy and international borders.

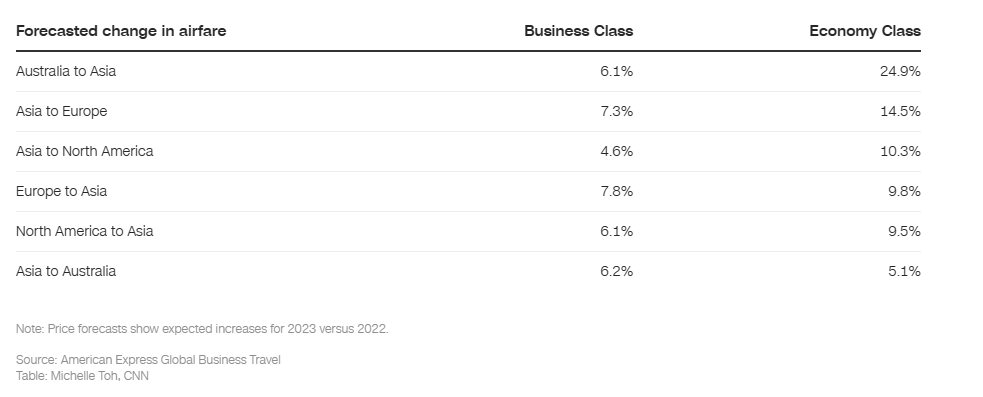

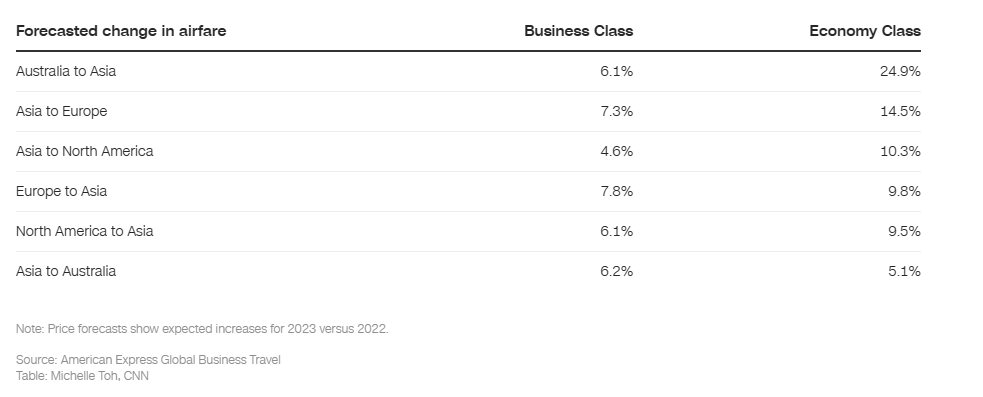

According to American Express Global Business Travel, intercontinental flight tickers are projected to get even more expensive as airline capacity remains low.

SIA is also focusing more on its non-stop flights as compared to layover flights and the former are priced at a premium.

With an increase in passenger yield expected during the summer until the end of this year, SIA’s earnings should remain elevated.

SIA’s earnings momentum sustainable, driven by China

Changi Airport’s passenger traffic saw a sharp rebound in 2022, which has benefitted SIA.

Looking ahead, air passenger traffic in Asia Pacific will continue to recover, especially with the reopening in China.

Singapore is expected to maintain its lead over its regional peers, mainly due to its efforts to restore flights to China.

While the current macroeconomic environment and persistent inflationary environment could affect travel plans, the constructive recovery in the region and promising forward booking data and travel data points to a sustainable earnings momentum for SIA.

Disclaimer: ProsperUs Investment Coach Billy Toh doesn’t own shares of any companies mentioned.