Apple to Slow Hiring: 3 Key Takeaways for Investors

July 21, 2022

Earlier this week, iPhone giant Apple Inc (NASDAQ: AAPL) announced that it plans to slow hiring and spending growth next year in some divisions.

This would be done in order to cope with a potential economic slowdown. As a result, Apple becomes the latest tech company to hit the brakes on hiring.

According to the Bloomberg report, the decisions stem from a move to be more cautious during uncertain times.

Other tech companies that have been reported to slow hiring include Google’s parent company, Alphabet Inc (NASDAQ: GOOG), Amazon.com Inc (NASDAQ: AMZN), Facebook’s parent company, Meta Platforms Inc (NASDAQ: META) and Snap Inc (NYSE: SNAP).

Some tech companies such as Microsoft Corporation (NASDAQ: MSFT), Tesla Inc (NASDAQ: TSLA) and Meta have even gone as far as to cut jobs.

What does it all mean? Here are three key takeaways for investors from the deceleration in hiring by tech companies like Apple.

1. Recession risk is a real concern

The risk of a recession is front and centre for most of these corporate leaders as they plan ahead for expansion in 2023.

This is mainly due to persistent inflation, monetary policy tightening by the US Federal Reserve (Fed), the prolonged impact of the COVID-19 pandemic on the global supply chain as well as the Russia-Ukraine war.

Higher interest rates and economic growth concerns may delay the expansion by some of the tech players.

When the Fed raises interest rates too aggressively, this will lead to higher cost of borrowings, potentially impacting corporate expansion and hiring decisions.

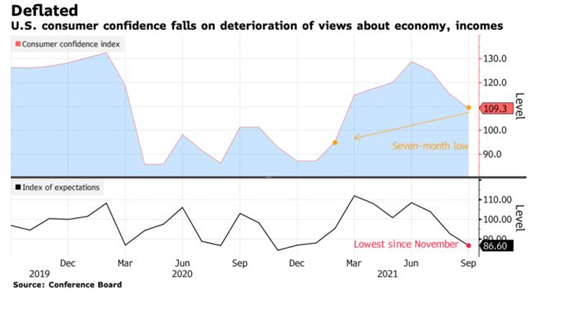

On the consumer front, we have seen downward movements in consumer expectations. This suggests the increase in likelihood of a recession in the world’s biggest economy.

On a positive note, the US labour market remains strong despite the wage growth pressure.

2. Normalised growth for tech players

One of the major impacts from the COVID-19 pandemic over the last two years is the shift towards digitalisation.

This has benefitted the tech companies, leading to an acceleration in growth.

Semiconductor players, software developers, social media company and cloud computing service providers; all of them have recorded multiple-fold increases in their earnings.

The strong earnings have driven share prices of tech companies higher over the last two years as well.

In order to meet the growing demand, tech players have also accelerated their expansion plans.

While the shift towards digitalisation will continue in the post-COVID era, the persistent inflationary pressure will put some of these plans on hold.

This means that investors should expect to see more moderate growth ahead, which would be a slowdown from the turbo-charged growth phase during the pandemic.

3. Wage inflation pressure could continue

Microsoft President, Brad Smith, told Reuters in an interview recently that US companies are facing a “new era” in which fewer people enter the workforce.

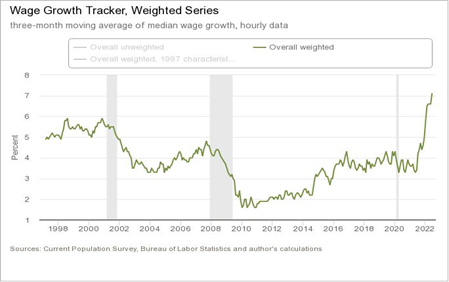

US Department of Labour data from June showed employers (broadly) have continued to raise wages to hire workers.

The data below shows that the three-month moving average of median wage growth has surpassed the 7% level.

Despite the sharp increase in wages, labour force participation has actually declined for the second time in three months, to 62.2%.

This is similar to the level where we started 2022.

Slowdown is not the end for technology companies

It has been a bad year for tech companies. Year-to-date, the NASDAQ Composite Index has fallen by 25.1%.

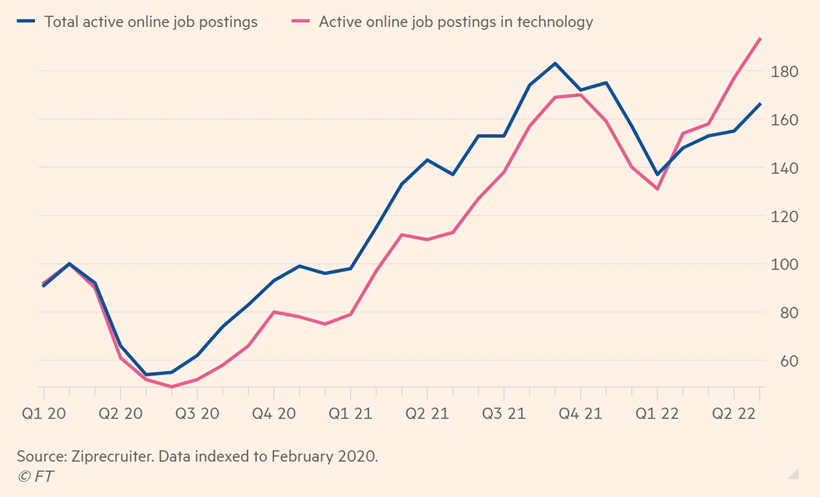

However, a slowdown in growth is not the end for tech players. In fact, active online jobs postings for the US tech sector still outpaces the wider market.

While the tech sector’s mantra of “growth at all costs” has transformed into something much more sensible, I believe it allows long-term investors to buy into some of these tech players that have a strong track record.

Instead of looking for super-fast growth, investors will start to adjust expectations towards a more realistic and sustainable growth target.

Given the decline in the share prices, I believe investors are already adjusting the premium and growth expectations going forward.

Disclaimer: ProsperUs Investment Coach Billy Toh doesn’t own shares of any companies mentioned.

Billy Toh

Billy is deeply committed to making investment accessible and understandable to everyone, a principle that drives his engagement with the capital markets and his long-term investment strategies. He is currently the Head of Content & Investment Lead for Prosperus and a SGX Academy Trainer. His extensive experience spans roles as an economist at RHB Investment Bank, focusing on the Thailand and Philippines markets, and as a financial journalist at The Edge Malaysia. Additionally, his background includes valuable time spent in an asset management firm. Outside of finance, Billy enjoys meaningful conversations over coffee, keeps fit as a fitness enthusiast, and has a keen interest in technology.